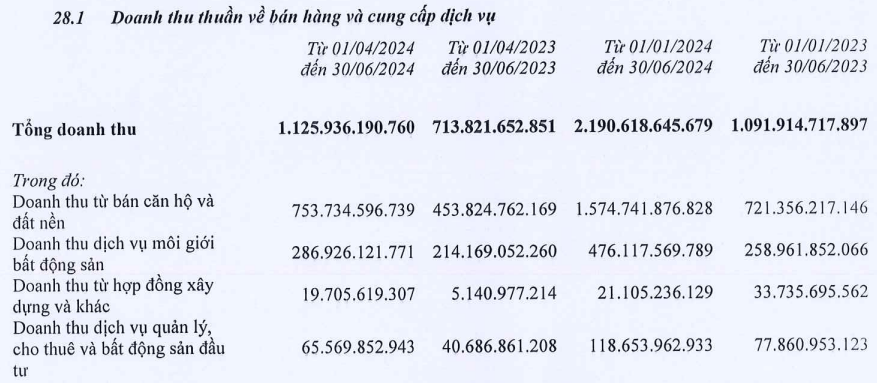

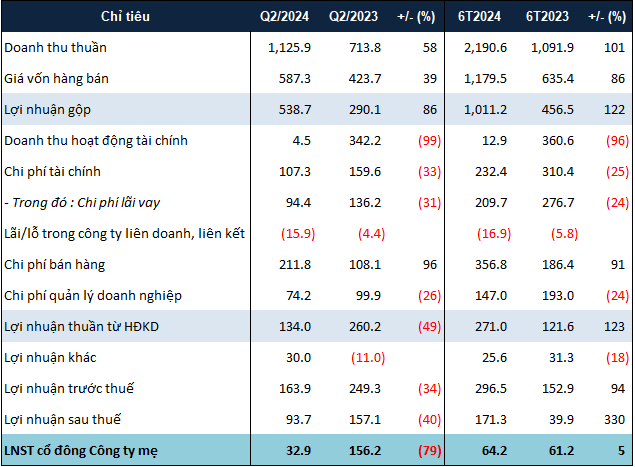

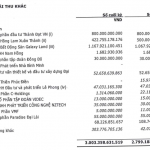

Specifically, DXG’s revenue for the period was nearly VND 1,126 billion, up 58% over the same period last year. Of this, revenue from apartment and land sales increased 66% to nearly VND 754 billion. Meanwhile, revenue from real estate brokerage activities amounted to VND 287 billion, a 34% increase.

|

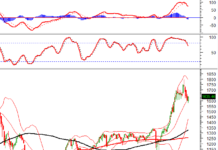

DXG’s Q2 2024 Revenue Structure

Source: DXG

|

However, DXG’s financial activities recorded only VND 5 billion in revenue, compared to over VND 342 billion in the same period last year. This discrepancy is due to the fact that in Q2 2023, DXG received nearly VND 316 billion in profit from investment liquidation, while no such amount was recorded in the recent period.

On the other hand, selling expenses increased by 96% to VND 212 billion. The company attributed this increase in expenses to the intensified business activities during the period.

Conversely, the company reduced its interest expenses and management expenses by 31% and 26%, respectively, to VND 94 billion and VND 74 billion. Additionally, DXG recorded other income of VND 30 billion, compared to a loss of VND 11 billion in the same period last year.

Despite these positive aspects, the decline in financial revenue and the significant increase in selling expenses led to a 79% decrease in DXG’s net profit for Q2 2024, amounting to nearly VND 34 billion.

|

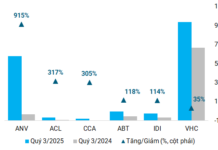

PAP’s business results for Q2 and the first 6 months of 2024. Unit: Billion VND

Source: VietstockFinance

|

Thanks to the results of Q1, DXG still achieved growth in net profit for the first six months of 2024, with over VND 64 billion, a 5% increase. Compared to the plan of VND 226 billion set for 2024, this profit represents only a little over 28% completion.

On the balance sheet, DXG’s total assets as of June 30, 2024, were nearly VND 29 trillion, almost unchanged from the beginning of the year. Notably, the company’s cash holdings exceeded VND 1.1 trillion, triple the amount from the previous year-end.

Ha Le

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.