Services

BCG Energy, established in 2017, is the energy subsidiary of Bamboo Capital Group (HoSE: BCG). On July 31, BCG Energy will officially trade 730 million shares on the UPCoM exchange under the ticker symbol BGE, with a reference price of VND 15,600 per share.

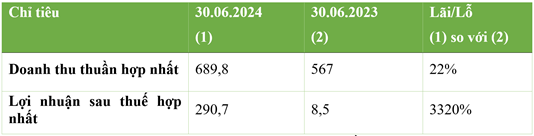

In the first half of 2024, BCG Energy recorded a consolidated net revenue of VND 689.8 billion, a 22% increase compared to the same period in 2023. This growth was mainly driven by the commercial operation of the Phu My Phase 2 Power Plant with a capacity of 114 MW since June 2023. In addition, solar power projects with a total capacity of 594.4 MW have been successfully operated, including BCG Long An 1 (40.6 MW), BCG Long An 2 (100.5 MW), BCG Phu My (330 MW), and BCG Vinh Long (49.3 MW). Roof-top solar projects with a total capacity of 74 MW also achieved good operational efficiency.

Phu My Phase 2 Solar Power Plant with a capacity of 114 MW has contributed significantly to the revenue growth of BCG Energy in the first half of 2024

|

For the full year 2024, the company’s revenue is expected to continue growing due to the completion of procedures for the commercial operation recognition of the Krong Pa 2 Solar Power Project with a capacity of 21 MW/49 MW in Gia Lai, along with contributions from ongoing roof-top solar projects.

The semi-annual 2024 financial statements show that BCG Energy’s consolidated after-tax profit reached VND 290.7 billion, a 33-fold increase compared to the same period in 2023. This impressive growth was mainly driven by cost-saving efficiency, especially the significant reduction in interest expenses. With these results, BCG Energy has achieved 59% of its 2024 profit plan.

Revenue and Profit for the first half of 2024 – Unit: Billion VND

|

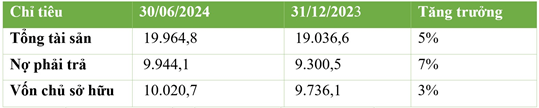

As of June 30, 2024, BCG Energy’s consolidated total assets reached VND 19,964.8 billion, a 5% increase compared to the beginning of the year. This growth was mainly due to new investments, notably the investment in the Tam Sinh Nghia Waste-to-Energy Power Plant in Thai My, Cu Chi district, Ho Chi Minh City.

Consolidated Balance Sheet Indicators – Unit: Billion VND

|

Total liabilities also increased to VND 9,944.1 billion, equivalent to a 7% growth. This increase was mainly due to liabilities related to the purchase of BCG Energy’s shares from Tam Sinh Nghia Investment and Development Joint Stock Company by former shareholders.

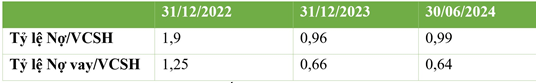

Debt-to-Equity Ratio in the Consolidated Report

|

BCG Energy’s debt-to-equity ratio has improved significantly and remained stable over the years, with a ratio of 1.9 as of December 31, 2022, decreasing to 0.96 as of December 31, 2023, and reaching 0.99 as of June 30, 2024. At the same time, the debt-to-equity ratio has shown a clear downward trend, with a ratio of 1.25 as of December 31, 2022, decreasing to 0.66 as of December 31, 2023, and further declining to 0.64 as of June 30, 2024. This improvement not only enhances the company’s financial strength but also helps minimize risks arising from economic and market fluctuations. Strong financial capabilities also enhance the ability to meet capital requirements for M&A activities to expand the project portfolio.

The semi-annual financial statements of the BCG Energy parent company recorded a decrease in revenue and profit compared to the same period in 2023. This was due to the fact that in the first half of 2024, the company did not receive financial revenue in the form of dividends from its subsidiaries. With the strong revenue growth from renewable energy projects and the expected efficient operation of these projects in the future, the dividends received by the parent company are expected to continue growing, bringing significant returns to shareholders.

BCG Energy’s success can be attributed to three core competencies: project development, management, and operation capabilities; M&A capabilities for potential projects and successful post-M&A restructuring; and capital mobilization capabilities for project implementation. In addition to building relationships with large credit institutions and banks, BCG Energy also focuses on collaborating with international partners. In February 2024, BCG Energy signed a cooperation agreement with SUS Vietnam Holding Pte. Ltd. for the implementation of projects of Tam Sinh Nghia Investment and Development Joint Stock Company. Successfully attracting foreign investors with strong financial capabilities and experience in implementing waste-to-energy projects not only ensures the company’s success in entering a new field but also promises to bring new financial resources.

Perspective of Tam Sinh Nghia Waste-to-Energy Power Plant constructed by BCG Energy in Cu Chi, Ho Chi Minh City

|

Looking ahead, BCG Energy’s revenue and profit are expected to continue their strong growth trajectory, thanks to a portfolio of ongoing projects with a total capacity of 229 MW and future projects with a capacity of up to 670 MW. The company aims to reach a total capacity of 2 GW by 2026 while diversifying its investment portfolio in renewable energy with low investment costs and an average IRR of 10% to 14%.

BCG Energy has a strong track record in domestic and international capital mobilization, enabling the company to meet capital requirements during the initial project implementation phase and to refinance at reasonable costs when projects become operational. The listing on the UPCoM exchange is a significant step in BCG Energy’s development journey, facilitating capital mobilization for new energy projects.

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.