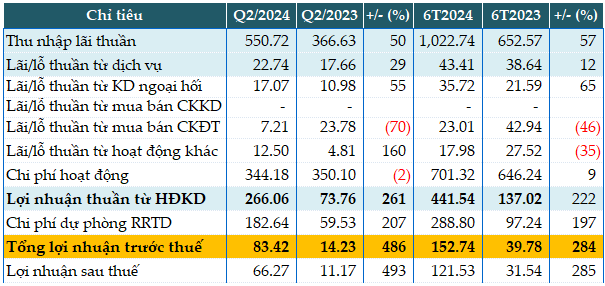

Net interest income increased by 50% year-on-year to nearly VND 551 billion, as interest expenses decreased by 35%. Income from services rose by 29% to nearly VND 23 billion. Profits from foreign exchange trading increased by 55%, earning over VND 17 billion, due to exchange rate fluctuations and higher foreign currency trading volumes.

The bank also managed to reduce operating expenses by 2%, to VND 344 billion. As a result, net profit from business operations exceeded VND 266 billion, a 3.6-fold increase compared to the same period last year. During the quarter, the bank set aside nearly VND 183 billion in credit risk provisions, resulting in a pre-tax profit of over VND 83 billion, almost six times higher than the previous year.

For the first six months of the year, BVBank’s net profit from business operations reached nearly VND 442 billion (a 3.2-fold increase). After allocating nearly VND 289 billion for risk provisions, the bank’s pre-tax profit stood at nearly VND 153 billion, 3.8 times higher than the same period last year.

Compared to the full-year target of VND 200 billion in pre-tax profit, BVBank has achieved nearly 77% of its goal by the end of the second quarter.

|

BVBank’s Q2 2024 Financial Results in VND billions

Source: VietstockFinance

|

As of June 30, 2024, BVBank’s total assets amounted to nearly VND 90,490 billion, a 3% increase from the beginning of the year. Deposits from economic organizations and individuals exceeded VND 63,500 billion, including VND 57,487 billion in customer deposits, a 1% rise.

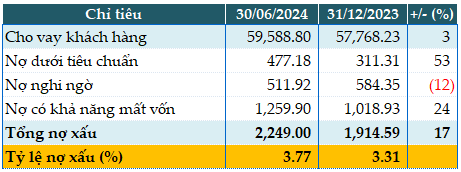

BVBank noted that the first quarter of 2024 presented challenges due in part to the broader market conditions. In the second quarter, lending activities showed improvement with the introduction of attractive interest rate packages and competitive customer engagement policies, resulting in total loans of nearly VND 59,589 billion, a 3% increase from the start of the year.

|

BVB’s Loan Quality as of June 30, 2024, in VND billions

Source: VietstockFinance

|

The bank’s total non-performing loans as of the end of the second quarter stood at VND 2,249 billion, a 17% increase from the beginning of the year. On a positive note, there was an improvement in doubtful debts. Consequently, the non-performing loan ratio increased from 3.31% at the beginning of the year to 3.77%.

Han Dong

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.