Ho Chi Minh City Securities Exchange (HOSE) announced that F&N Dairy Investment Pte. Ltd., owned by Thai billionaire Charoen Sirivadhanabhakdi, has registered to purchase nearly 20.9 million VNM shares of Vietnam Dairy Products Joint Stock Company (Vinamilk) for investment purposes.

The transaction will be carried out through matched orders and order matching on the trading floor. The expected transaction period is from August 2 to August 30.

If the transaction is successful, the company’s ownership in Vinamilk will increase from 17.69% to 18.69%, holding 390.6 million VNM shares.

In the market, VNM shares have fluctuated around the price range of VND 66,000 – 70,000 per share since the beginning of the year. Based on the closing price of VND 67,700 per share on July 30, the estimated value of this lot of shares is over VND 1,400 billion.

Notably, since the beginning of the year, the company of the Thai billionaire has registered to buy the same amount of VNM shares five times, but has not been able to purchase any shares due to unfavorable market conditions.

VNM share price movement in the past 3 months. Source: Fireant

Similarly, Platinum Victory Pte. Ltd. (headquartered in Singapore) also registered to buy nearly 20.9 million VNM shares five times but was unsuccessful.

It is known that both entities are related to Vinamilk’s internal shareholders. Specifically, F&N Dairy Investment PTE. LTD is related to Mr. Lee Meng Tat and Michael Chye Hin Fah, both of whom are members of Vinamilk’s Board of Directors.

Platinum Victory Pte. Ltd. (Singapore) is related to Mr. Alain Xavier Cany, a member of Vinamilk’s Board of Directors.

On the other hand, SCIC One-Member Limited Liability Company (SIC), an organization related to Ms. Dang Thi Thu Ha, a non-executive member of the Board of Directors, and Mr. Le Thanh Liem, a member of the Board of Directors, Chief Financial Officer, and Chief Accountant of Vinamilk, has successfully purchased 1.45 million VNM shares, equivalent to 0.069% of the charter capital, since the beginning of the year.

Currently, the State Capital Investment Corporation is Vinamilk’s largest shareholder, holding 36% (equivalent to 752.4 million shares).

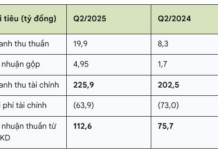

Regarding Vinamilk’s business performance, the company’s consolidated financial statements for the first quarter of 2024 recorded a slight increase in net revenue to VND 14,112 billion compared to the same period last year, and after-tax profit of VND 2,206 billion, an increase of more than VND 300 billion compared to the first quarter of 2023.

The value of Vinamilk’s cash and cash equivalents stood at VND 1,788 billion, a decrease of 38.5% compared to the beginning of 2024.

The main reason for this decrease is the significant decline in cash equivalents (short-term investments) by VND 900 billion, from VND 1,886 billion to VND 998 billion, and a reduction in cash balance of more than VND 600 billion, from VND 1,545 billion to VND 943 billion.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.

Attracting talented individuals is challenging, but retaining them is even more difficult.

Not only is it about salary and benefits, but employees nowadays also have increasing desires for their working environment. Among them, what used to be considered as “additional perks” such as comprehensive healthcare programs, learning and development opportunities, and an environment to explore new things… are now being prioritized.