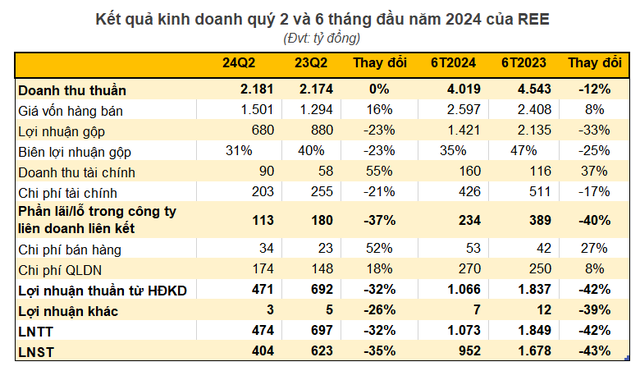

REE Joint Stock Company (REE: HoSE) has announced its second-quarter 2024 financial results, with consolidated net revenue reaching over VND 2,181 billion, almost unchanged from the same period last year. However, a 16% increase in cost of goods sold led to a 23% decline in gross profit, amounting to nearly VND 680 billion. The gross profit margin also narrowed to 31%.

In the revenue breakdown for the second quarter of 2024, the electricity and water infrastructure segment contributed nearly VND 918 billion, a 20% decrease compared to the second quarter of 2023. In contrast, the real estate and refrigeration engineering segments posted respective revenues of VND 330 billion and VND 935 billion, representing year-over-year growth of 25% and 21%.

Additionally, financial revenue surged by 55% to VND 90 billion, while financial expenses amounted to nearly VND 203 billion, a 21% decrease from the previous year, mainly due to reduced interest expenses.

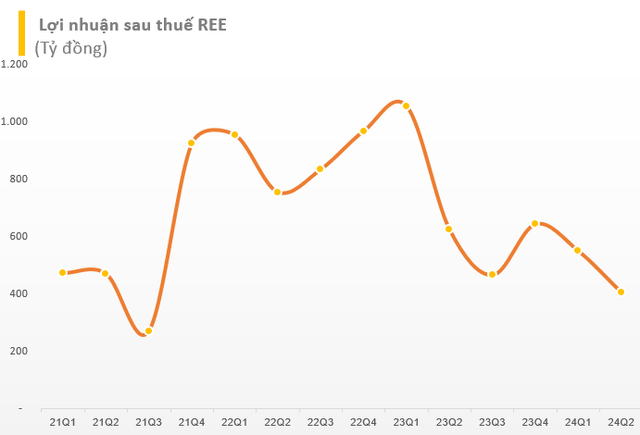

After accounting for various expenses, REE reported a 35% year-over-year decline in net profit to nearly VND 404 billion, the lowest in 11 quarters since the third quarter of 2021. Net profit attributable to the parent company’s shareholders decreased by 27% to VND 355 billion. EPS stood at VND 755, compared to VND 1,040 in the same period last year.

According to REE, the 27% year-over-year decline in consolidated net profit attributable to the parent company’s shareholders in the second quarter of 2024 was due to a VND 134 billion decrease in the electricity segment compared to the same period last year. This was mainly attributed to significantly lower profits from member companies and associates in the hydropower group, including Vinh Son – Song Hinh Hydropower Joint Stock Company, Thac Mo Hydropower Joint Stock Company, Thac Ba Hydropower Joint Stock Company, and Central Hydropower Joint Stock Company.

For the first half of 2024, REE recorded net revenue of VND 4,019 billion and net profit of VND 952 billion, representing decreases of 12% and 43%, respectively, compared to the same period last year. For the full year 2024, REE’s Board of Directors has set revenue and net profit targets of VND 10,588 billion and VND 2,409 billion, respectively. With the results from the first half, REE has achieved 38% of its revenue target and 40% of its net profit target.

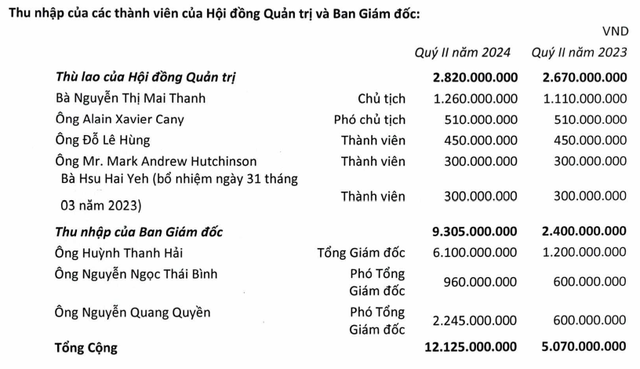

In the second quarter of 2024, the income statement of the Board of Directors recorded nearly VND 3 billion, of which the Chairman of the Board, Ms. Nguyen Thi Mai Thanh, received VND 1.26 billion. Notably, the income of the Board of Directors increased significantly from VND 2.4 billion in the same period last year to over VND 9 billion. REE paid Mr. Huynh Thanh Hai, the former General Director, more than VND 6 billion for the second quarter of 2024 (compared to VND 1.2 billion in the same period last year), equivalent to over VND 2 billion per month. On July 1, 2024, Mr. Huynh Thanh Hai stepped down from his position as General Director, and Mr. Le Nguyen Minh Quang was appointed as his successor.

Q2/2024 Financial Statement of REE

Benefiting from the La Nina Phenomenon

On a positive note, REE’s business performance is expected to improve in the coming months. According to a recent report by KBSV Securities, the hydropower sector is entering a recovery phase in the second quarter of 2024, benefiting from favorable weather conditions. The more pronounced La Nina weather pattern in the remaining months of 2024 will be advantageous for hydropower plants as increased rainfall will replenish reservoir water levels, allowing for higher electricity generation.

The increased mobilization of hydropower during the peak electricity consumption season will enable these plants to maintain high transmission capacity over an extended period, benefiting from the nature of hydropower, which typically involves longer startup times and higher turbine startup costs compared to other thermal power plants.

Moreover, the average selling price of electricity will be sustained by the high and stable prices in the competitive market, offsetting the reduced contribution of hydropower in this market. In the long term, REE’s power generation capacity in the hydropower segment will continue to strengthen, with the latest addition being the Tra Khuc 2 Hydropower Project, expected to add 30MW of capacity and commence operations in 2028.

Meanwhile, the transition to the La Nina weather phase will bring higher rainfall, supporting electricity generation from hydropower. Although coal-fired power generation growth will be lower in the second half compared to the first half of the year, it will still exhibit positive year-over-year growth due to its stable power generation capacity, maintaining its high proportion in the total electricity output.

Regarding the renewable energy segment, KBSV Securities believes that the second half of 2024 will continue to be a favorable period due to: (1) higher wind speeds in the regions where the two wind power plants are located compared to the same period last year, and (2) low-interest rate environment supporting reduced borrowing costs for the plants.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.