The Ho Chi Minh City Stock Exchange (HoSE) has recently announced the mandatory delisting of shares of Hoa Binh Construction Group Joint Stock Company (code: HBC) after receiving the company’s separate and consolidated audited financial statements for the year 2023.

According to the 2023 consolidated audited financial statements, the company’s undistributed post-tax profits as of December 31, 2023, were negative VND 3,240 billion, exceeding its paid-up capital of VND 2,741 billion.

Referring to Point e, Clause 1, Article 120 of Decree No. 155/2020/ND-CP dated December 31, 2020: “1. Shares of a public company shall be subject to mandatory delisting upon the occurrence of one of the following cases: e) The business has been making losses for three consecutive years or the total accumulated losses exceed the paid-up capital or owner’s equity is negative in the latest audited financial statements before the time of consideration.”.

Based on Official Letter No. 4615/UBCK-PTTT dated July 24, 2024, from the State Securities Commission of Vietnam (SSC) regarding the consideration of mandatory delisting of shares, HoSE announces that HBC shares fall under the mandatory delisting case and will proceed with the delisting of these shares as per regulations.

In the market, HBC shares are trading near long-term lows at VND 7,250 per share, down 8% since the beginning of the year. The market capitalization stands at approximately VND 2,500 billion, only one-fifth of its peak in October 2017.

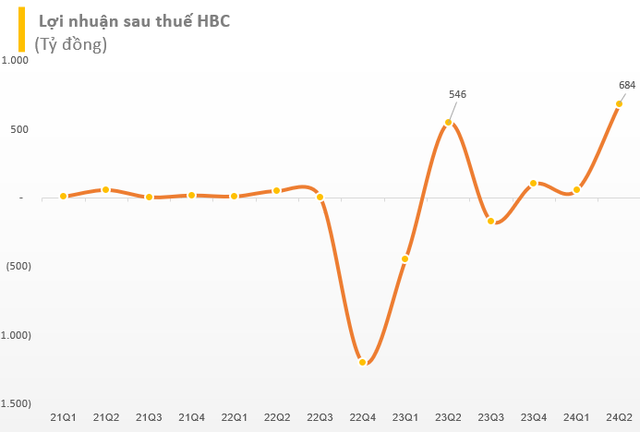

For the second quarter of 2024, Hoa Binh Construction Group recorded consolidated net revenue of nearly VND 2,160 billion, a slight decrease of 5% compared to the same period last year. The cost of goods sold increased by 10% to over VND 2,060 billion, resulting in a significant 74% decline in gross profit compared to the second quarter of the previous year, amounting to nearly VND 100 billion.

However, the company reported a post-tax profit of VND 684 billion, a substantial improvement compared to the loss of VND 268 billion in the same period last year, thanks to a reversal of provisions of over VND 220 billion and a surge in other income of VND 515 billion. The after-tax profit attributable to the parent company’s shareholders was over VND 682 billion, the highest in the company’s operating history.

For the first six months of 2024, the company recorded consolidated net revenue of VND 3,811 billion, a 10% decrease compared to the same period in 2023. Post-tax profit surged to VND 741 billion, while in the same period last year, the company incurred a loss of VND 713 billion. With these results, the company has exceeded 71% of its profit target for the full year 2024.

As of June 30, 2024, Hoa Binh Construction Group’s total assets amounted to VND 15,632 billion, an increase of VND 380 billion from the beginning of the year. Short-term receivables accounted for VND 11,220 billion, representing 72% of total assets. The company had nearly VND 311 billion in cash and cash equivalents as of the end of the second quarter.

On the capital side, the company still recorded accumulated losses of VND 2,498 billion as of the second quarter of 2024. Owners’ equity stood at VND 1,567 billion, a significant improvement from VND 93 billion at the beginning of the year. Financial borrowings were recorded at VND 4,485 billion, nearly three times the owners’ equity.