Vietnam’s stock market witnessed a relatively positive start to the week on July 29, with the VN-Index recording gains throughout the trading session. However, liquidity took a significant hit, as the total trading value across all three exchanges fell to approximately VND 13,000 billion.

The VN-Index closed 4.49 points higher at 1,246.6 points. Foreign trading was a downside, as they net sold with a value of VND 316 billion on the entire market.

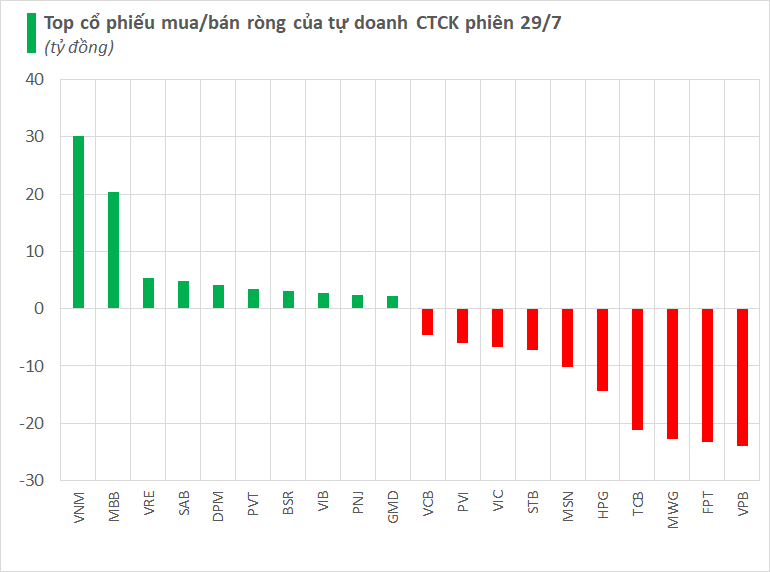

Securities companies net sold VND 110 billion on the entire market.

On the HoSE, securities companies net sold VND 102 billion, including VND 62 billion on the matching order channel and VND 40 billion on the negotiated transaction channel.

Specifically, securities companies net sold the most in the FPT and VPB stocks, with respective values of VND 23 billion and VND 24 billion. The MWG and TCB stocks were also net sold, with respective values of VND 23 billion and VND 21 billion. This was followed by HPG, which was net sold at around VND 14 billion. Other stocks that were net sold in this session included STB, MSN, VIC, and others.

In contrast, securities companies net bought the most in VNM, with a value of VND 30 billion. MBB and VRE were also net bought at VND 20 billion and VND 5 billion, respectively. Additionally, stocks such as SAB, DPM, PVT, and others were net bought on July 29.

On the HNX, securities companies net sold VND 6 billion, with PVI being net sold at nearly VND 6 billion and TNG at VND 2 billion. Conversely, PVS was net bought at over VND 2 billion.

On UPCoM, securities companies net sold VND 2 billion, where they net bought nearly VND 3 billion in BSR but net sold nearly VND 5 billion in ACV.