Vietnamese stocks witnessed a bearish trend last week (July 22-26), with the VN-Index plunging during the first two trading sessions and testing the 1,220-point level before a recovery was mounted thanks to returning buying interest. However, the benchmark index still closed the week at 1,242 points, down 22.67 points (-1.79%) from the previous week.

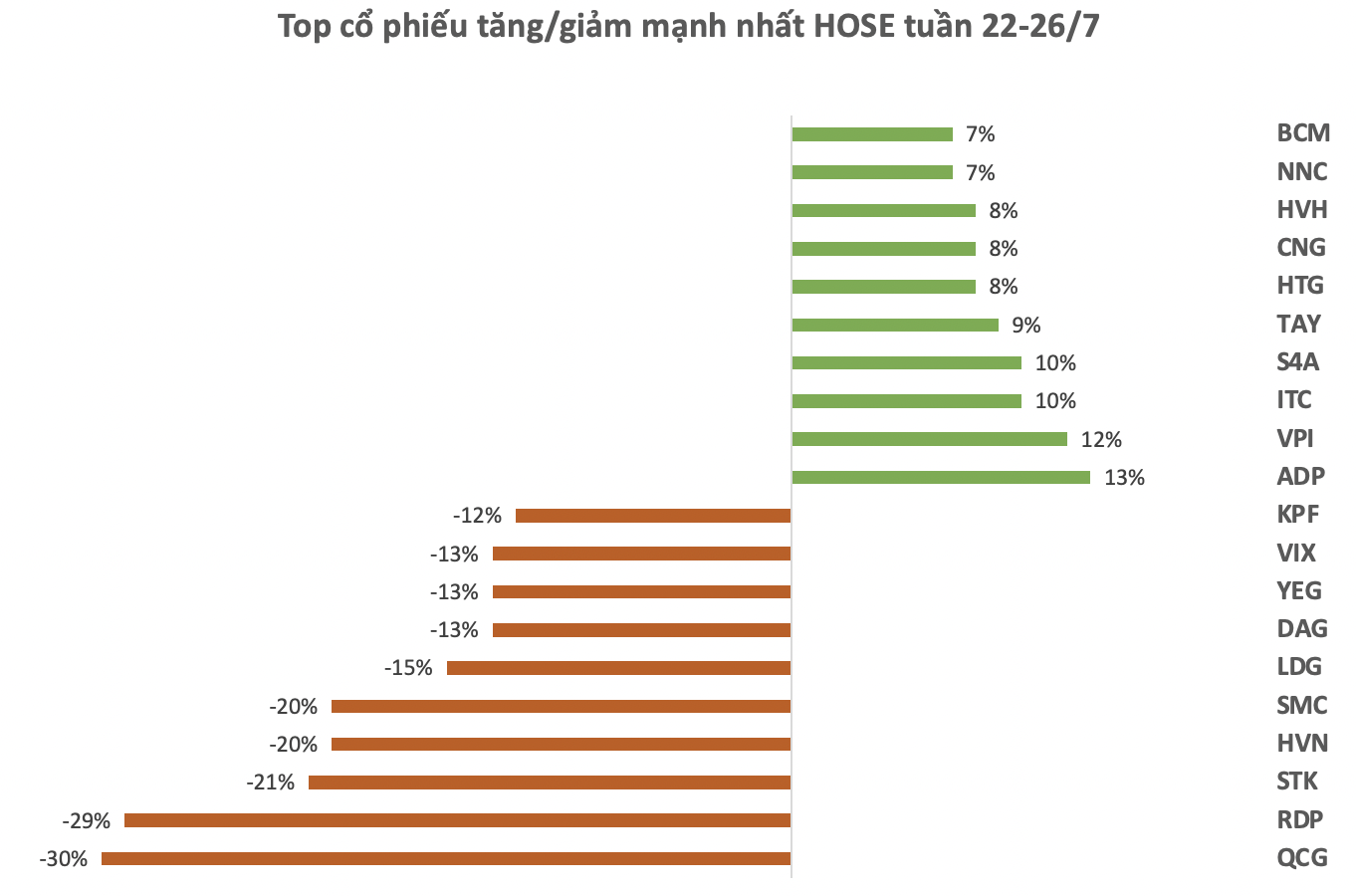

On the Ho Chi Minh Stock Exchange (HoSE), ADP shares topped the list of biggest gainers, surging 13% to VND32,900 per share despite facing corrective pressure on July 24. However, trading volume was modest, with only a few tens of thousands of shares matched during the week.

The rally in ADP shares came after the company paid the first dividend for 2024 in cash at a rate of 8% on July 18. With 23 million shares in circulation, ADP has paid nearly VND18 billion in dividends for this period.

,

BCM shares also had a breakthrough week, surging over 7% to VND72,500 per share, marking a four-month high. As a result, its market capitalization reached the VND75 trillion threshold. The upward momentum in BCM shares can be attributed to the Prime Minister’s decision to approve the reduction of state capital in Becamex IDC from 95.44% to 65% by the end of 2025. This paves the way for the state shareholder to divest and reduce its ownership in Becamex IDC.

On the other hand, QCG, RDP, STK, and HVN faced profit-taking pressure, declining over 20% during the week.

Notably, QCG witnessed the sharpest decline on HoSE following allegations of leadership involvement in violations related to the 39-39B Ben Van Don project. The land plot in question is state-owned and was previously managed by the Vietnam Rubber Industry Group, Ba Ria Rubber Company, and Dong Nai Rubber Company.

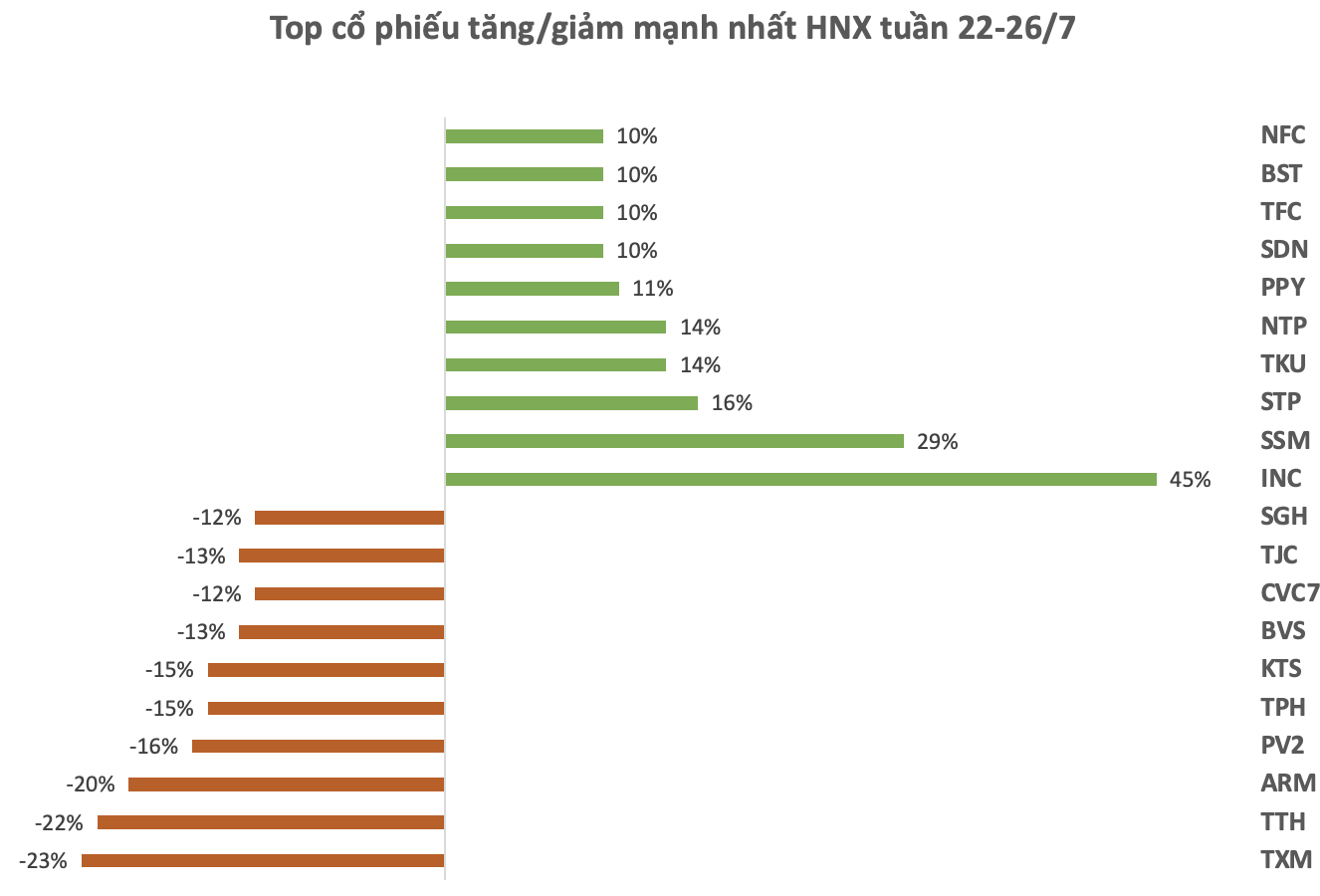

On the Hanoi Stock Exchange (HNX), the gainers were mostly small-cap and low-liquidity stocks such as INC, SSM, STP, and TKU.

Notably, NTP had a positive week, climbing to a new historical peak at VND61,500 per share. This momentum was supported by impressive financial results. The plastic company announced its Q2/2024 financial statements, reporting a 37% year-on-year surge in net revenue to VND1,680 billion. After deducting expenses, Nhua Tien Phong posted a post-tax profit of VND238 billion, up 86% from Q2/2023. This also marked the company’s highest-ever quarterly profit.

On the downside, TXM, TTH, and ARM faced profit-taking pressure, declining over 20% during the week.

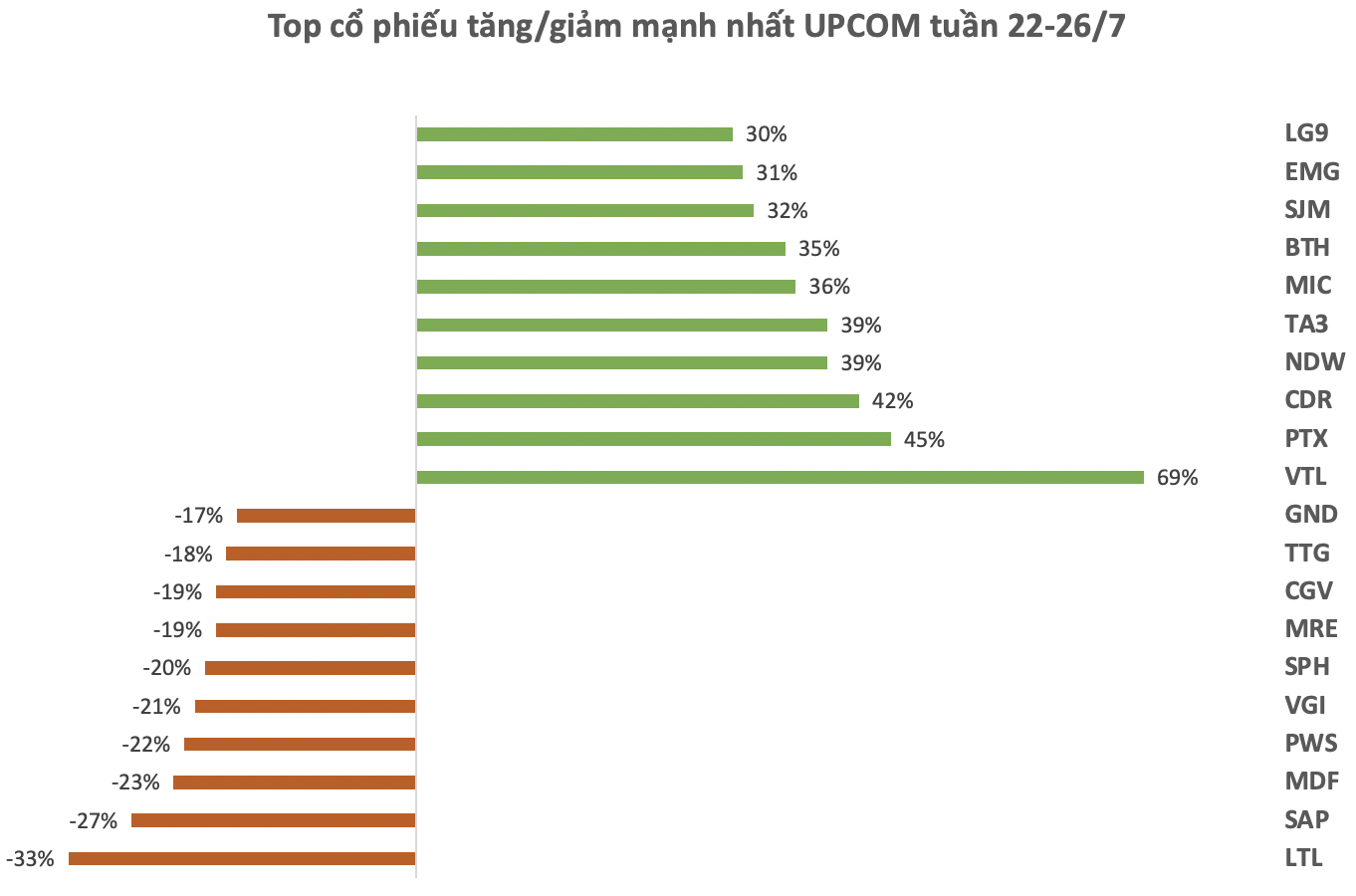

On the Unlisted Public Company Market (UPCOM), VTL continued its upward rally, hitting the weekly ceiling in all sessions, pushing its share price to VND8,100. Overall, the stock still recorded a nearly 69% gain for the week. Despite the strong performance, trading volume remained modest, with only a few thousand to a few tens of thousands of shares traded.

In contrast, several stocks on UPCOM recorded declines ranging from 17% to 33% during the week.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.