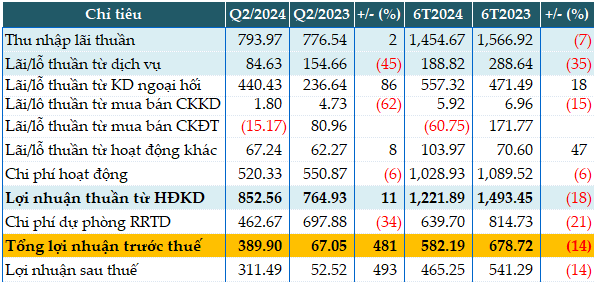

ABB’s second-quarter performance showed a profit of nearly VND 794 billion in net interest income, a 2% increase from the previous year. A notable highlight was the 86% surge in profits from foreign exchange trading, amounting to over VND 440 billion. However, other non-interest income sources witnessed declines, including a 45% drop in service income and a 62% fall in profits from securities trading.

The bank successfully reduced operating expenses by 6%, bringing them down to VND 520 billion. Consequently, the net profit from business operations climbed by 11% to VND 853 billion.

ABB’s prudent approach to risk management is evident in the 34% reduction in credit risk provisions, with only VND 463 billion set aside. This strategic move resulted in a substantial pre-tax profit of nearly VND 390 billion, an impressive 5.8 times higher than the previous year.

For the first six months of the year, the bank’s pre-tax profit stood at over VND 582 billion, a 14% decrease from the same period last year. With a target of VND 1,000 billion in pre-tax profit for the full year, ABB has accomplished 58% of its goal in the first two quarters.

|

ABB’s Q2 2024 Financial Results in billions of VND

Source: VietstockFinance

|

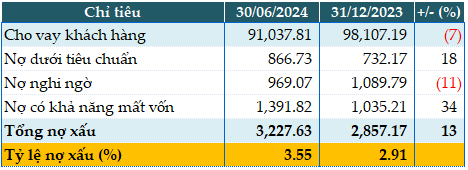

As of the end of the second quarter, ABB’s total assets stood at VND 152,145 billion, a 6% decrease from the beginning of the year. Customer lending and deposits also witnessed reductions, with customer loans decreasing by 7% to VND 91,037 billion and customer deposits falling by 15% to VND 85,515 billion.

The bank’s non-performing loan ratio as of June 30, 2024, was 3.55%, an increase from the 2.91% recorded at the start of the year. The total non-performing loans amounted to nearly VND 3,228 billion, a 13% rise compared to the beginning of 2024.

|

ABB’s Loan Quality as of June 30, 2024, in billions of VND

Source: VietstockFinance

|

Hàn Đông