|

Q2 2024 Business Targets of OIL

Source: VietstockFinance

|

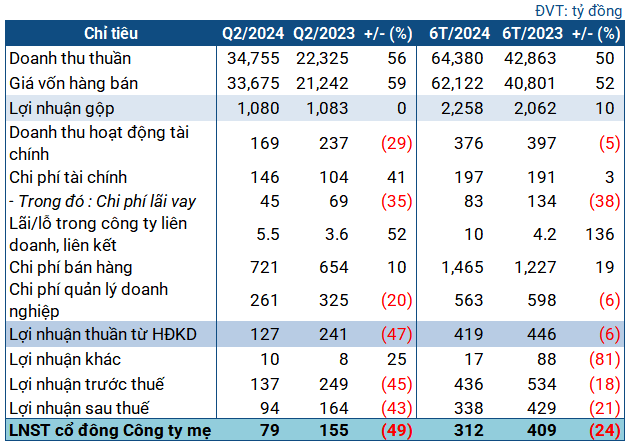

In Q2 2024, OIL‘s revenue surged 56% to nearly VND 34.8 thousand billion. However, cost of goods sold also increased significantly by 59%, to nearly VND 33.7 thousand billion. As a result, gross profit remained flat, reaching VND 1,080 billion.

Financial income for the period declined by 29% to VND 169 billion, while financial expenses increased by 41% to VND 146 billion. In addition, selling expenses remained high at VND 721 billion, a 10% increase. Finally, the Enterprise recorded a net profit of VND 79 billion, a 49% drop.

In their explanation, OIL stated that the frequency of base price adjustments was reduced from 10 days/time in Q2 2023 to 7 days/time in Q2 2024. Therefore, despite the downward trend in global oil prices similar to the same period last year, the pace of retail price reduction this period was faster, significantly narrowing the gross profit.

Additionally, the USD/VND exchange rate in Q2 2024 was higher compared to the same period last year, resulting in increased financial expenses due to foreign exchange losses. Consequently, the Enterprise’s profit declined.

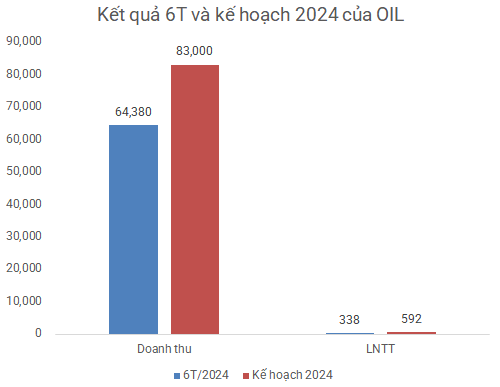

For the first half of the year, OIL still recorded high revenue of nearly VND 64.4 thousand billion, a 50% increase compared to the previous year; net profit reached VND 312 billion, a 24% decrease. Compared to the plan approved by the 2024 General Meeting of Shareholders, the Enterprise achieved nearly 78% of the revenue plan and over 57% of the annual after-tax profit target.

Source: VietstockFinance

|

As of the end of Q2, OIL‘s total assets slightly decreased from the beginning of the year to nearly VND 37.6 thousand billion, with nearly VND 32 thousand billion in short-term assets, a 4% decrease. Cash and cash equivalents decreased by 9%, recording nearly VND 13.9 thousand billion. Inventories increased by 17%, to nearly VND 4.9 thousand billion.

On the capital side, most of the liabilities were short-term, amounting to nearly VND 25.6 thousand billion, a 6% decrease. Both the quick and current ratios were above 1.

In terms of borrowings, the majority were short-term loans totaling VND 7.3 thousand billion, a slight increase from the beginning of the year. Additionally, OIL had nearly VND 90 billion in long-term debt. The Enterprise did not provide detailed explanations for these loan amounts.