2024 Apartment Consumption Expected to be the Highest in 4 Years

According to the OneHousing Market Research and Customer Insight Center, in the first half of 2024, the Hanoi market recorded more than 52,000 transactions, of which apartments (both primary and secondary) accounted for 54%.

New supply sources, the number of transactions, and unit prices are all on the rise, indicating that the Hanoi market has moved past the recovery phase and entered a period of strong growth. Specifically, Hanoi’s primary supply in Q2/2024 increased for the fifth consecutive quarter, reaching 8,400 units, up 97% from the previous quarter and up 340% year-on-year. Favorable macroeconomic factors and the consecutive launch of new projects have driven the Q2 supply to its highest level since 2020.

Apartment transactions increased in both quantity and selling prices. Specifically, compared to Q1/2024, the number of transactions in Q2/2024 increased by 49%, and the average unit price increased by 21%.

OneHousing’s research shows that in the period of 2024 – 2025, the Hanoi apartment market will introduce and consume approximately 22,000-23,000 apartments annually. The supply and consumption in Hanoi during this period are forecasted to surpass the figures from 2020-2022 and will be the highest in the past four years.

The new apartment supply in Q2 mainly came from the luxury and high-end segments, accounting for 97% of the total market. The absence of new affordable housing projects and the minimal presence of mid-range options (~3%) indicate a shift in the market dynamic, with luxury and high-end segments dominating the supply landscape.

Future supply is expected to largely originate from the eastern and western regions of Hanoi, where new subdivisions and projects are being developed on a large scale.

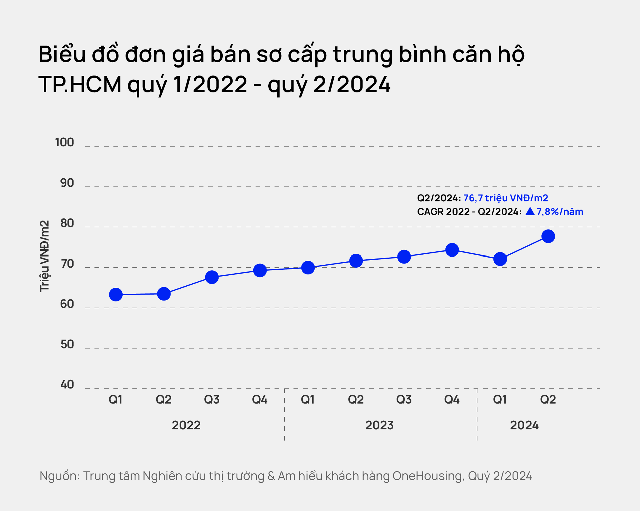

Ho Chi Minh City’s Apartment Prices Hit a Record High in Q2

Lagging slightly behind Hanoi’s market, Ho Chi Minh City’s apartment market is anticipated to enter a recovery phase in the period of 2024 – 2025, with supply and consumption forecasted to surpass the figures from 2023.

Specifically, in the first half of 2024, Ho Chi Minh City recorded a 132.5% increase in new apartment supply in Q2 compared to the previous quarter. Experts predict that in 2024 – 2025, the Ho Chi Minh City market will recover with an annual supply of 8,000 – 10,000 units.

The luxury segment is leading the city’s apartment market in the first half of 2024, accounting for 54% of new supply, with most new projects located in the eastern region.

Notably, the average primary selling price in Ho Chi Minh City in Q2/2024 reached a record high of VND 76.7 million/sqm, a 6% increase compared to the same period last year. Despite the high prices, consumption in Q2/2024 still increased by 7.3% year-on-year to 1,600 units, surpassing the new supply (~1,200 units). The consumption of luxury and high-end apartments accounted for 80% of the total.

Mr. Tran Minh Tien, Director of the OneHousing Market Research and Customer Insight Center, believes that the positive macroeconomic indicators and the upcoming enactment of the three amended Real Estate Laws will lay the foundation for the continued growth of the apartment market in Hanoi and Ho Chi Minh City in the second half of 2024 and beyond.

Regarding the Hanoi market, the Q2 figures demonstrate a robust recovery in the apartment sector after five consecutive quarters of growth, signaling the beginning of a new growth phase. Meanwhile, the Ho Chi Minh City real estate market is expected to enter a recovery phase in 2024-2025 as legal issues surrounding projects are gradually resolved and new apartment supply increases compared to 2023. The luxury and high-end segments will dominate new apartment supply in both markets. Well-planned large-scale urban areas and reputable developers with strong financial capabilities will have the opportunity to lead the market in the coming years.