|

PetroVietnam Southwest’s Business Targets in Q2 2024

Source: VietstockFinance

|

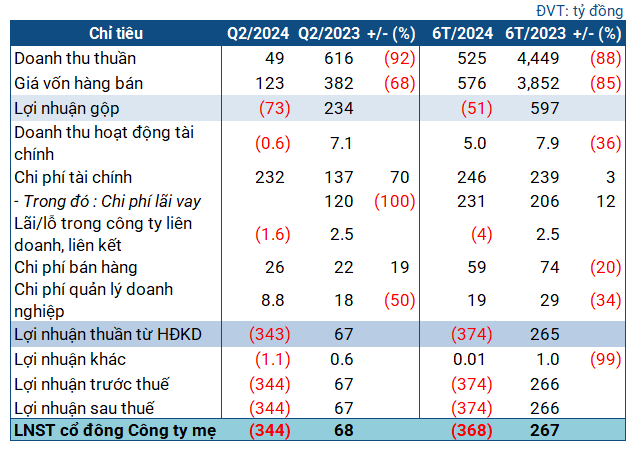

In the second quarter, the Western fuel giant continued to experience a sharp drop in revenue compared to the same period last year, reaching only VND 49 billion (-92%). While the cost of goods sold decreased, it still amounted to over VND 100 billion. As a result, the company incurred a gross loss of VND 73 billion (compared to a gross profit of VND 234 billion in the same period last year).

Financial revenue for the period was negative, while financial expenses surged to VND 232 billion, a 70% increase year-on-year, further widening the company’s loss. Consequently, PetroVietnam Southwest recorded a net loss of VND 344 billion for the quarter (compared to a net profit of VND 68 billion in the same period last year). This also marks the heaviest quarterly loss for the company since 2018.

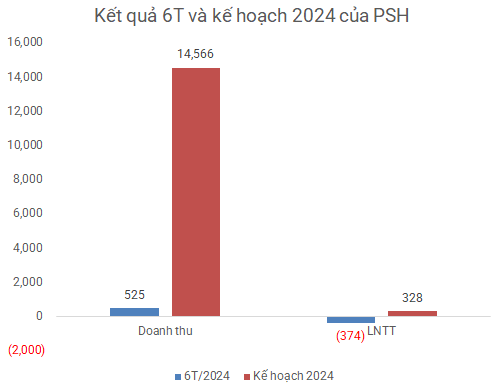

Coupled with the lackluster performance in the first quarter, the half-year business picture looks gloomy. In the first six months, the company achieved VND 525 billion in net revenue, an 88% decrease year-on-year; and incurred a net loss of VND 368 billion (compared to a net profit of VND 267 billion in the previous year). At the 2024 Annual General Meeting, PetroVietnam Southwest ambitiously set a target of nearly VND 328 billion in after-tax profit, seven times higher than the previous year. However, with these results, the company needs to put in considerable effort to achieve its goals.

Source: VietstockFinance

|

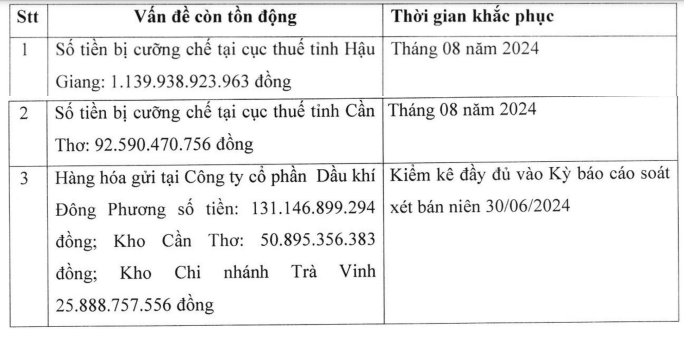

One of the main reasons for the company’s losses lies in tax complications. In late 2023, PetroVietnam Southwest received enforcement notices from the Tax Departments of Hau Giang and Can Tho provinces, totaling over VND 1,200 billion. As of July 2024, the company still owes nearly VND 1,140 billion in taxes in Hau Giang and almost VND 93 billion in Can Tho. Despite the Ministry of Finance’s intervention and the granted extension for payment, this situation has negatively impacted the company’s business operations and contributed to the classification of PSH stock as “warned” (due to the audited 2023 financial statements expressing an exception opinion).

However, PetroVietnam Southwest has outlined a plan to address this issue. On June 27, 2024, the company signed a credit contract with Acuity Funding, a financial partner, to secure funding for project development within and outside Hau Giang province. The funding package is worth approximately $720 million, with the first phase involving a disbursement of $290 million to settle debts and supplement working capital.

“The 20-year credit funding from Acuity Funding will greatly assist in restructuring the payment of tax debts, bond debts, and providing working capital to address the current challenges,” PetroVietnam Southwest explained.

According to the company’s updates, the loan procedures require the completion of certain documents, and the disbursement is expected to take place in the middle of Q3 2024. The two tax debts in Hau Giang and Can Tho will be resolved by August 2024. Additionally, the goods stored at Eastern Petroleum Joint Stock Company (worth VND 131 billion), Can Tho warehouse (VND 51 billion), and Tra Vinh warehouse (nearly VND 26 billion) were fully inventoried in the semi-annual reviewed financial statements for 2024.

|

As per the plan, the tax debt of over VND 1,200 billion will be resolved this August

Source: PetroVietnam Southwest

|

At the end of June, the company’s total assets decreased slightly from the beginning of the year to over VND 10,800 billion, with more than VND 6,000 billion in short-term assets. The majority of this comprises inventory, valued at nearly VND 4,700 billion, which remained unchanged from the beginning of the year. Cash holdings significantly declined to just over VND 5.6 billion (compared to VND 24 billion at the start of the year).

On the capital side, short-term debt accounts for the lion’s share of the company’s liabilities, totaling nearly VND 7,800 billion, a 16% increase. Short-term borrowings amount to over VND 5,500 billion, an 18% rise, and comprise bank loans. The company also has over VND 1,400 billion in long-term debt, including nearly VND 757 billion in bond debt and the remainder in bank loans.

Over 2,200 businesses owe nearly 1,000 billion VND in taxes exposed in Hanoi

The Tax Department has announced its intention to enhance the dissemination of tax policies and laws to taxpayers, as well as implement enforcement measures to improve compliance and voluntary tax payment, and prevent tax debt.

Real estate companies face customs clearance halt due to tax debts

Several real estate businesses, including Danh Khôi Group, Golden Hill Investment Corporation, Trường Thịnh Phát Real Estate Construction Investment Corporation, and Danh Khôi Holdings Investment Corporation, have been suspended by local customs authorities due to outstanding tax debts amounting to billions of Vietnamese dong.