The final trading session of July witnessed significant volatility in the stock prices of three veteran businesses based in Gia Lai, including Hoang Anh Gia Lai Joint Stock Company (HAG), Quoc Cuong Gia Lai Joint Stock Company (QCG), and Duc Long Gia Lai Group Joint Stock Company (DLG).

In the morning session, QCG and DLG simultaneously surged to the maximum allowable limit of nearly 7%, with millions of buy orders at the ceiling price. However, the upward momentum narrowed in the afternoon session. As a result, DLG closed at the ceiling price of VND 1,730 per share, while QCG gained 1.5% to VND 7,350 per share.

Meanwhile, HAG also performed well in the morning session, but selling pressure pushed the share price back to the reference threshold of VND 12,150 per share, with improved liquidity of more than 9 million traded shares.

Nevertheless, the increase was not significant as these stocks had undergone a strong correction phase previously. Compared to the beginning of 2024, QCG lost 27%, DLG decreased by more than 29%, and HAG declined by nearly 11% over the past seven months.

Hoang Anh Gia Lai, Quoc Cuong Gia Lai, and Duc Long Gia Lai are decades-old companies that started as small wood workshops in Gia Lai Province. They eventually achieved success and left their mark during a golden era. At that time, their stock prices also surged, propelling the company owners to the list of the richest people on the Vietnamese stock market. However, these businesses have since faced numerous challenges, and their financial performance has visibly deteriorated in recent years, even falling into debt.

Recently, all three enterprises revealed their financial statements for the first half of the year, and they all reported profits. However, a closer look at each company reveals significant differences in their operational performance.

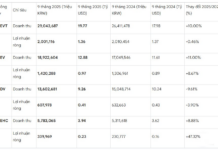

Regarding Hoang Anh Gia Lai, in the first six months of 2024, the company generated VND 2,759 billion in revenue, a 12% decrease compared to the same period last year. In contrast, after-tax profit reached VND 507 billion, a 32% increase.

This positive signal follows several robust measures taken by the company, known as Bầu Đức, to improve its cash flow. Looking back, the company, led by entrepreneur Đoàn Nguyên Đức (Bầu Đức), initially focused on real estate but gradually expanded into hydropower, football, and agriculture. However, as many of these ventures did not pan out, the company was burdened with massive debt, reaching VND 27,000 billion in the 2015-2016 period.

Subsequently, the company had to abandon several business areas and sell off subsidiaries. In 2022, Bầu Đức declared that Hoang Anh Gia Lai had escaped from the brink of death. The profit in the first half of 2024 helped HAGL reduce its accumulated loss as of June 30, 2024, to VND 904 billion, with debt exceeding VND 7,000 billion, a reduction of nearly VND 900 billion in six months.

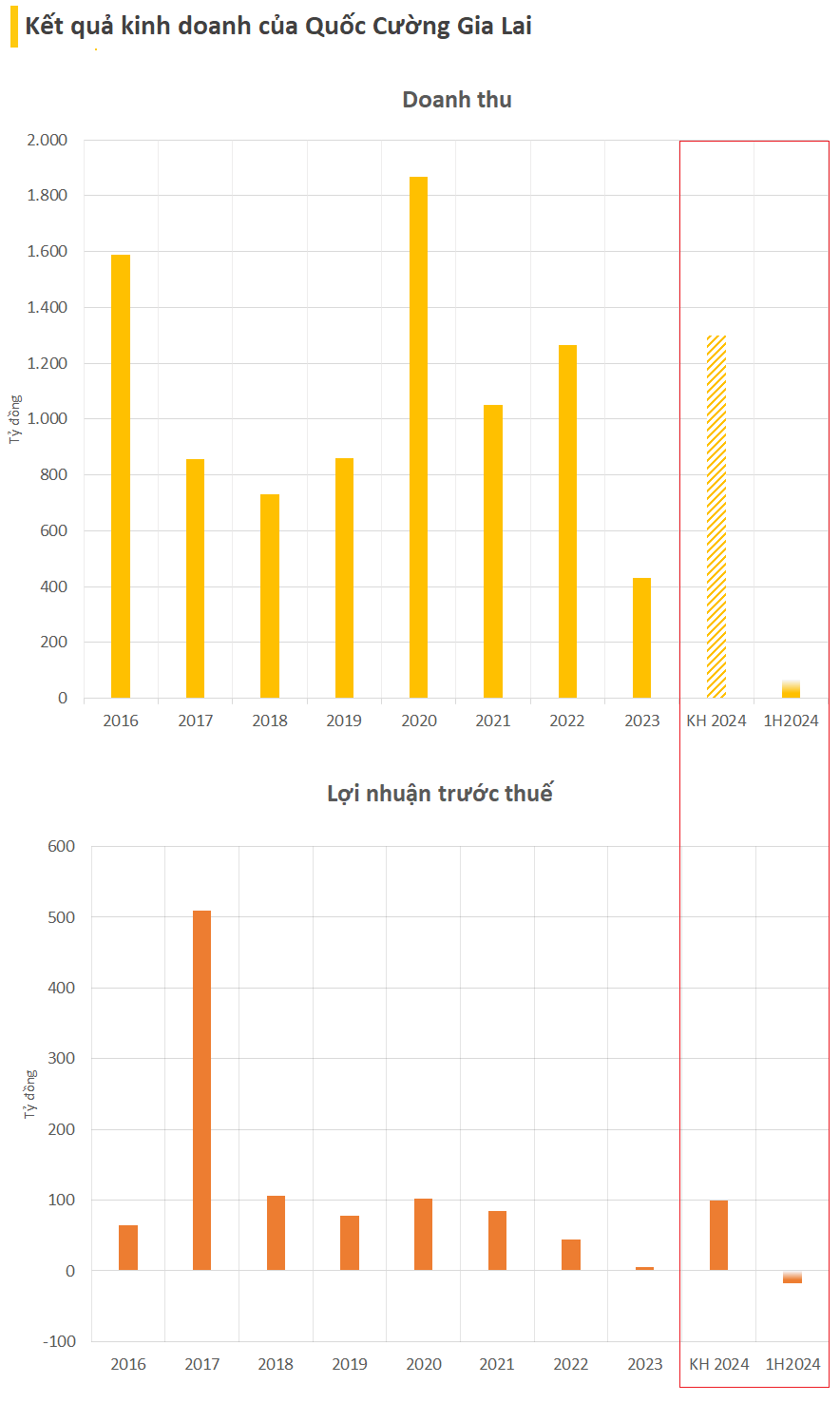

While Hoang Anh Gia Lai is making a good recovery after a downward spiral, Quoc Cuong Gia Lai is facing even more challenging circumstances. The most significant development is the arrest and detention of Ms. Nguyễn Thị Như Loan, CEO of QCG, on July 19, in connection with an investigation into the violation of regulations on the management and use of state assets, resulting in waste and losses. This case is part of an investigation into the Vietnam Rubber Industry Group, Dong Nai Rubber Company, Ba Ria Rubber Company, the Ministry of Natural Resources and Environment, and related units.

Her son, Mr. Nguyễn Quốc Cường, also known as “Cường Đô la,” has officially taken over as the CEO and legal representative of the company.

The company’s performance continues to decline, with QCG reporting its heaviest loss in 12 years in the second quarter of 2024, amounting to VND 17 billion. In the first six months of the year, the company’s revenue plummeted by 69% to VND 65 billion. After-tax losses were also recorded at nearly VND 17 billion, compared to a loss of nearly VND 14 billion in the same period last year.

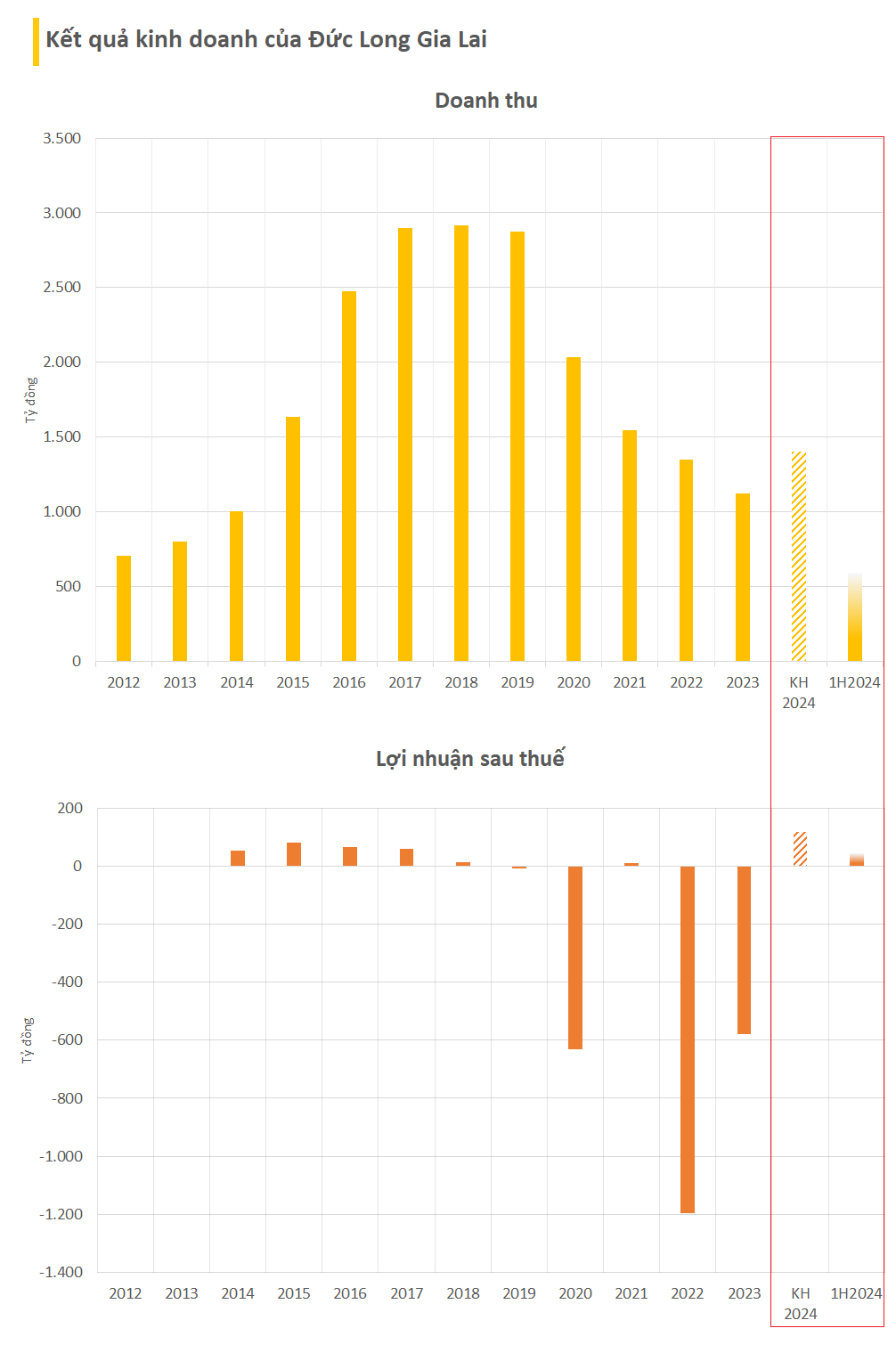

Turning to the Duc Long Gia Lai Group, its foray into numerous fields with little success has led to a continuous decline. The company reported losses for two consecutive years in 2022 and 2023. If it fails to turn a profit in 2024, it will face delisting in the following year.

The company has also faced bankruptcy petitions from partners on two occasions. In July 2023, after Lilama 45.3 filed a petition for bankruptcy proceedings, Duc Long Gia Lai requested the Da Nang Court of Appeals to review the decision, leading to the cancellation of the bankruptcy proceedings by the Gia Lai Provincial Court. Most recently, Lilama 45.3 resubmitted the petition, and the Gia Lai Provincial Court has accepted it.

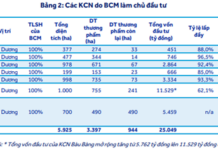

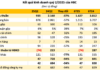

For 2024, Duc Long Gia Lai set a target of VND 1,400 billion in revenue (a 25% increase compared to the previous year) and VND 120 billion in after-tax profit (compared to a loss of nearly VND 579 billion in 2023). In the first six months, DLG earned a profit of nearly VND 10 billion, completing only 8% of its annual target. As of June 30, 2024, the accumulated loss was nearly VND 2,635 billion.

Most recently, DLG surprised the market by announcing its withdrawal from Mass Noble Investments Limited (Mass Noble) – a US company specializing in ANSEN electronic component production, after nine years of ownership. The component segment contributed a large proportion of DLG’s revenue; in 2023, revenue from this segment was VND 573 billion, along with VND 449 billion from the BOT sector, supporting the conglomerate.