Liquidity in the market decreased compared to the previous trading session, with the VN-Index matching volume reaching over 657 million shares, equivalent to a value of more than 15.6 trillion VND; HNX-Index reached over 56 million shares, equivalent to a value of more than 1 trillion VND.

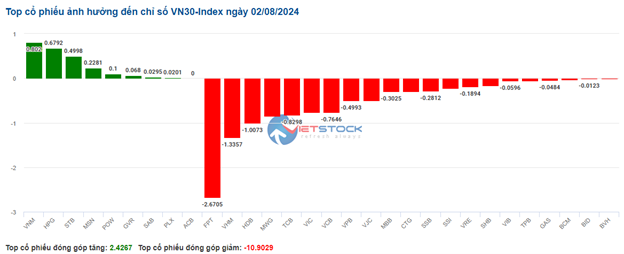

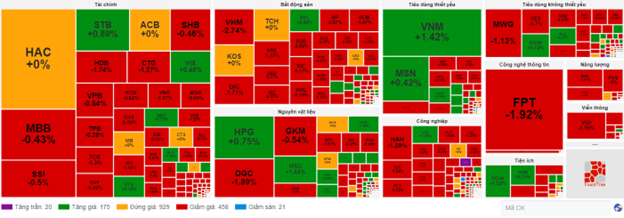

In the afternoon session, with the efforts of buyers, the index gradually recovered, and the winning side managed to maintain the green to the end of the session. In terms of impact, BID, GVR, TCB, and HPG were the most positive influences on the VN-Index, with an increase of more than 4 points. On the other hand, VCB, FPT, VHM, and LPB had the most negative impacts, taking away more than 3.9 points from the overall index.

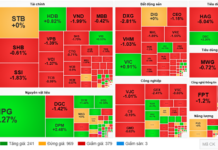

| Top 10 stocks impacting the VN-Index on August 2, 2024 |

The HNX-Index also had a positive performance, influenced by the gains in KSV (+9.83%), MBS (+6.09%), IDC (+2.1%), VCS (+3.13%), among others.

|

Source: VietstockFinance

|

The materials sector was the top gainer, rising 2.14%, led by HPG (+2.06%), GVR (+3.03%), DGC (+1.04%), and VGC (+1.27%). This was followed by the non-essential consumer goods sector and the industrial sector, which increased by 1.53% and 1.5%, respectively. On the other hand, the information technology sector witnessed the sharpest decline of -1.1%, dragged down by FPT (-1.28%), CMT (-1.4%), and VTB (-2.75%).

In terms of foreign trading activities, foreign investors net bought over 466 billion VND on the HOSE exchange, focusing on VNM (281.43 billion), DGC (58.8 billion), MSN (51.37 billion), and SSI (42.33 billion). On the HNX exchange, they net bought over 38 billion VND, mainly in IDC (12.96 billion), MBS (9.68 billion), SHS (5.37 billion), and VGS (3.66 billion).

| Foreign Trading Activities |

Morning Session: Negative Sentiment Prevails

Lacking market demand, the market continued its downward trend after a sharp decline in the previous session. By the morning close, the VN-Index temporarily retreated to 1,213.75 points, a decrease of 1.08%. Similarly, the HNX-Index dropped by 1.03%, settling at 226.86 points. Sellers dominated the market, with 525 declining stocks versus 166 advancing stocks. Foreign investors resumed net buying on the HOSE exchange, with a net purchase value of nearly 63 billion VND, focusing on VNM stocks.

The trading volume of the VN-Index in the morning session remained unchanged from the previous session, reaching over 280 million units, equivalent to a value of more than 6.4 trillion VND. The HNX-Index recorded a trading volume of over 24 million units, with a value of over 424 billion VND.

In terms of impact, VCB was the most negative influence, causing the VN-Index to lose more than 2 points. This was followed by CTG, VHM, and FPT, which dragged the index down by more than 3 points. Conversely, VNM, GVR, and POW were the few bright spots in the sea of red, contributing to a gain of about 0.6 points for the VN-Index.

Selling pressure prevailed across all sectors. Notably, the telecommunications sector continued to be the worst performer, plunging by 7.55%. Stocks like VGI (-10.2%), FOX (-1.61%), CTR (-3.08%), and others remained on a downward spiral.

The energy sector followed suit, declining by 2.59%, mainly influenced by oil and gas stocks, including BSR (-3.1%), PVS (-1.5%), PVD (-2.51%), and others.

The materials and essential consumer goods sectors were the two industries that showed relative resilience, recording only a slight decline of 0.04%. This stability was mainly attributed to the gains in large-cap stocks such as VNM (+0.85%), HPG (+0.19%), GVR (0.64%), and others.

Foreign investors’ net buying was a positive signal amid the market turmoil, with a net purchase value of nearly 63 billion VND on the HOSE exchange, focusing on VNM stocks (over 150 billion VND). On the HNX exchange, they also net bought over 15 billion VND, mainly in SHS stocks.

10:40 AM: Widespread Selling Pressure Persists, VN-Index Reaches Lowest Valuation in 6 Months

The trading sentiment remained cautious following the previous session’s sharp decline, causing the major indices to fluctuate below the reference level. As of 10:30 AM, the VN-Index dropped by 8.52 points, hovering around 1,218 points, while the HNX-Index lost 1.34 points, trading around 227 points.

Stocks like FPT, VHM, HDB, and MWG negatively impacted the VN30-Index, deducting 2.67 points, 1.34 points, 1 point, and 0.85 points, respectively. Conversely, VNM, HPG, STB, and MSN helped the VN30 recoup over 2 points.

Source: VietstockFinance

|

Notably, the market’s PE ratio has decreased from 14.36 times in March 2024 to 12.91 times as of now, reaching its lowest level in the past six months. This indicates investors’ pessimistic outlook despite the positive profit growth reported by most companies in the second quarter of 2024, which has helped bring the market valuation to a more reasonable level.

Source: VietstockFinance

|

The essential consumer goods sector continued to be the focus, maintaining its recovery momentum this week and being one of the few sectors to stay in the green, with a current increase of 0.25%. Notably, VNM rose by 1.56%, MSN gained 0.84%, and HAG climbed by 0.85%.

Additionally, from a technical perspective, VNM stock continued its upward trajectory after successfully breaking through the medium-term downward trendline, accompanied by a significant increase in trading volume, surpassing the 20-session average. At present, the MACD indicator is trending upward and is above the zero level, providing a buy signal. This upward momentum is further reinforced by the net buying activities of foreign investors for the past nine consecutive sessions.

Source: VietstockFinance

|

Meanwhile, the telecommunications services sector continued to face headwinds, recording losses for three consecutive sessions, erasing the gains made during the first two sessions of the week. Specifically, FOX declined by 1.07%, CTR fell by 2.67%, FOC dropped by 3.18%, and notably, VGI witnessed a significant decline of 7.15%, extending its downward trend. Since its peak of 112,900 on July 11, 2024, this stock has lost more than 49% of its market capitalization, and the downward pressure shows no signs of abating.

Compared to the opening, sellers continued to dominate the market. There were 458 declining stocks versus 175 advancing stocks.

Source: VietstockFinance

|

Opening: Broad-Based Declines, VN-Index Loses Over 6 Points

The morning session began on a negative note, with most sectors trading in the red. Notably, the VN30 index was the most significant drag on the market, with the majority of its constituent stocks falling.

Large-cap stocks were the main culprits behind the market’s decline, with VIC, VCB, FPT, and TCB leading the downturn. On the other hand, the gains in VNM, STB, and MSN were relatively weak and failed to offset the losses.

The telecommunications services sector bore the brunt of the selling pressure, plunging by 7.09%. Specifically, stocks like VGI, CTR, ELC, FOX, MFS, and others were all in negative territory.

The information technology sector also witnessed a similar fate, with prominent stocks like FPT falling by 1.44%, CMG declining by 0.78%, ITD dropping by 0.75%, and CMT slipping by 0.7%.