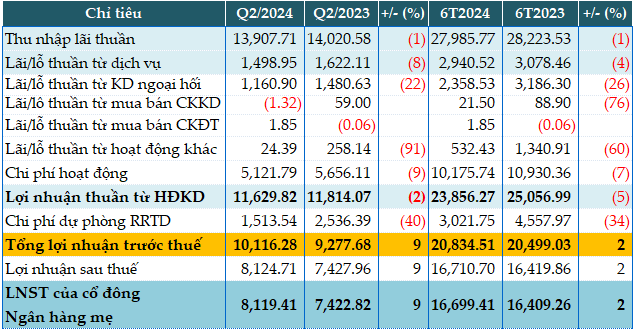

In Q2 alone, VCB experienced a setback across the board compared to the same period last year. The main revenue stream decreased by 1%, with interest income reaching 13,908 billion VND.

Non-interest income streams also witnessed declines, including service income (-8%), foreign exchange trading income (-22%), other business activities (-91%), and losses in proprietary trading…

Consequently, the net profit from business operations decreased by 2%, settling at 11,629 billion VND. Thanks to a 40% reduction in credit risk provisions, amounting to 1,513 billion VND, VCB posted a 9% increase in pre-tax profit, totaling 10,116 billion VND, compared to the previous year.

For the first six months of the year, VCB‘s pre-tax profit neared 20,835 billion VND, a modest 2% increase year-on-year, attributable to a 34% decrease in provisions (3,021 billion VND).

|

VCB’s Q2/2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

The Bank’s total assets as of the end of Q2 exceeded 1.9 million billion VND, marking a 4% increase from the beginning of the year. Within this, funds deposited with the SBV decreased by 38% (35,735 billion VND), while lending to customers increased by 8% (nearly 1.37 million billion VND)…

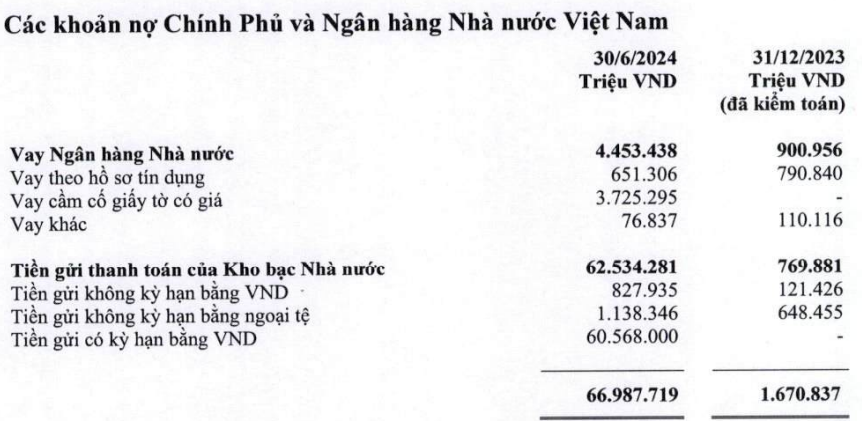

On the funding side, customer deposits decreased by 2% compared to the start of the year, amounting to over 1.37 million billion VND. Notably, payment deposits from the State Treasury surged to 62,534 billion VND, a significant increase from the beginning of the year, which stood at just over 900 billion VND.

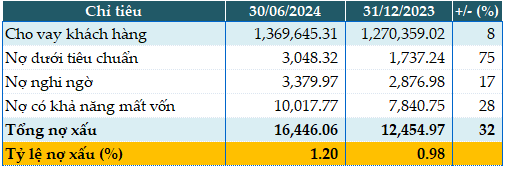

VCB‘s loan quality also took a step back compared to the start of the year. As of June 30, 2024, total non-performing loans (NPLs) increased by 32% to 16,446 billion VND. The NPL ratio rose from 0.98% to 1.2% during this period.

|

VCB’s Loan Quality as of June 30, 2024. Unit: Billion VND

Source: VietstockFinance

|