Strong and sustainable credit growth, industry-leading ROE

As of June 30, 2024, HDBank reported a 13% year-to-date credit growth, channeling credit towards high-growth sectors such as agriculture, rural areas, SMEs, supply chain finance, green credit, and tourism. This was coupled with a high and sustainable credit growth, ensuring capital adequacy and low non-performing loan ratios. The bank’s CAR ratio under Basel II reached 13.9%, while the consolidated non-performing loan ratio, including consumer finance as per the State Bank’s Circular No. 11, stood at only 1.59%.

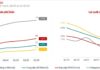

For the first half of 2024, HDBank recorded a total income of VND 16,045 billion, a 32.9% increase year-on-year. Profit before tax reached VND 8,165 billion, a 48.9% surge compared to the previous year, attributable to enhanced operational efficiency and the successful implementation of HDBank’s digital transformation initiatives. The bank’s return on equity (ROE) was 26.1%, and its return on assets (ROA) stood at 2.1%, both higher than the previous year.

Continuing its tradition of prioritizing shareholder interests through consistent and high dividend payouts, HDBank distributed dividends of up to 30% this year. The bank has already completed a 10% cash dividend payout and is in the process of executing a 20% stock dividend distribution in the third quarter.

As of June 30, 2024, HDBank’s total assets exceeded VND 624 trillion, marking a 29% increase year-on-year. Capital mobilization reached over VND 552 trillion, with digital banking deposits accounting for nearly VND 40 trillion, a fivefold increase compared to the previous year.

New strides in digital and green banking

In the first half of 2024, HDBank made significant progress in its journey towards comprehensive ESG strategy implementation. The bank became the first in Vietnam to publish a sustainability report, adhering to international standards. Through this report, HDBank demonstrated its commitment to sustainable development principles and its aspiration to become a Net Zero Bank by 2050. HDBank also established a Sustainability Committee under the Board of Directors to oversee and direct the comprehensive integration of ESG standards into the bank’s operations.

HDBank accelerated its efforts to “green” its operations and environment-friendly initiatives, alongside its digital transformation journey and the development of modern digital banking solutions. The bank actively explored the application of artificial intelligence (AI) technologies. As a result, the number of new customers acquired through digital channels was 2.5 times higher than the previous year. Additionally, 94% of customer transactions were conducted through digital channels, and the volume of e-banking transactions increased by 130% year-on-year.

Beyond introducing new products and cashless payment solutions, HDBank completed the early adoption of biometric facial recognition technology as per Decision No. 2345/QD-NHNN, enhancing transaction security and customer data protection. Previously, HDBank launched the “HDBank Nong Thon” app dedicated to modern, efficient, and sustainable agricultural and rural development.

HDBank’s impressive business performance, coupled with its advancements in digitalization and green initiatives, garnered recognition from renowned global organizations. On July 4, the bank was honored with two prestigious awards, “Retail Bank of the Year” and “Best Payment and Digital Banking Initiative, Vietnam,” by Asian Banking & Finance (ABF) magazine, alongside other prominent financial institutions in Asia.

Prior to this, HDBank was recognized as the “Best Bank for Sustainable Finance” by The Asset magazine and ranked among the TOP 500 largest enterprises in Southeast Asia by the esteemed Fortune magazine.

Alongside its business and sustainability endeavors, HDBank actively contributes to a brighter future for Vietnam, especially in the fields of education, healthcare, culture, and sports. Notable initiatives include the bank’s long-standing support for the HDBank National Futsal Championship, the HDBank Futsal for Students tournament, and the HDBank International Chess Tournament.

With the very positive results in the first half of the year and the effective application of new initiatives, HDBank is well-positioned to continue its growth trajectory in 2024.