HAGL Agrico (HNG) has recently outlined measures and a roadmap to address its controlled stock situation.

A look back at their financial performance for the first half of 2024 reveals a 47% decrease in revenue, with a net loss of 370 billion dong, bringing the cumulative loss as of June 30, 2024, to 8,472 billion dong.

To reduce this cumulative loss, HNG plans to cultivate 1,533 hectares of bananas, tend to and exploit 6,328 hectares of rubber trees, and invest in cattle sheds, pastures, and the import of 5,800 cows. They estimate a revenue of 694 billion dong and a pre-tax loss of 120 billion dong from these initiatives.

Additionally, the Government of Laos has approved HNG’s large-scale agro-industrial project in Attapeu and Sekong provinces, involving fruit tree cultivation and cattle farming across 27,384 hectares. With a total investment of 18,090 billion dong, the project is expected to generate a revenue of 13,500 billion dong and a profit of 2,450 billion dong by 2028.

HNG’s current strategy focuses on large-scale organic agriculture, industrial management, mechanization, biotechnology, and digitalization. They have set four main goals: first, to invest in a comprehensive master plan for transportation, irrigation, and power infrastructure, as well as on-land developments and flood protection measures; second, to engage in large-scale specialized cultivation of bananas and pineapples for fresh fruit supply, along with fruit processing plants, and the cultivation of mangoes, pomelos, and durians, combined with semi-intensive cattle breeding; third, to establish a closed-loop agro-livestock production model that ensures biosecurity and disease control; and finally, to continue converting inefficient rubber plantations into banana, pineapple, and fruit tree farms integrated with cattle farming.

HNG expresses confidence in the sustainability and profitability of this strategy, believing it will lead to a reduction in cumulative losses in the shortest possible time.

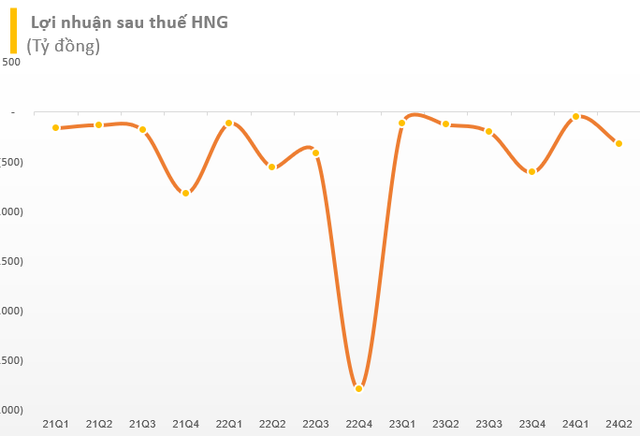

Previously, HNG stock was placed under control on April 12, 2023, due to negative financial results in 2021 and 2022. On July 27, HOSE announced the delisting of HNG due to three consecutive years of losses—nearly 1,120 billion dong in 2021, 3,580 billion dong in 2022, and approximately 1,100 billion dong in 2023.

As of June 2024, the company’s cumulative loss of nearly 8,472 billion dong has reduced owner’s equity to 2,387 billion dong, while total liabilities have increased by over 11% to more than 13,162 billion dong, mainly due to loans exceeding 9,100 billion dong. The largest debt is owed to Agricultural Truong Hai Joint Stock Company (6,082 billion dong), followed by Hoang Anh Gia Lai Joint Stock Company (over 1,123 billion dong), with the remaining debt held by banks (over 1,160 billion dong).

For the second quarter of 2024, HAGL Agrico reported a net loss of nearly 323 billion dong, compared to a loss of 135 billion dong in the same period last year. This extends the company’s streak of consecutive quarterly losses to 14. The parent company recorded a net loss of 323 billion dong. In the first six months of the year, HAGL Agrico achieved 21% of its revenue target, with a net loss of 370 billion dong on revenue of 147 billion dong, a 47% decrease from the previous year.

For 2024, HAGL Agrico aims for a revenue of 694 billion dong, a 14.5% increase from 2023, and expects a net loss of 120 billion dong for the year.