Illustrative image

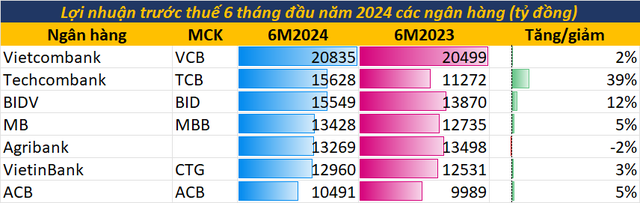

As of now, 29 banks (including 27 listed banks and Agribank, BaoViet Bank) have announced their second-quarter financial reports. Of these, seven banks recorded pre-tax profits of over VND 10 trillion each: Vietcombank, Techcombank, BIDV, MB, Agribank, VietinBank, and ACB. The total profits of these seven banks amounted to more than VND 102 trillion, accounting for nearly 2/3 of the profits of the 29 banks that have published their business results and equivalent to about 60% of the industry’s total profits.

Among them, Vietcombank continues to lead the industry with a record pre-tax profit of VND 20,835 billion in the first half of the year, up 2% over the same period last year. This “giant” regained its growth momentum in the second quarter after recording two consecutive quarters of profit decline. This is also the third consecutive quarter that Vietcombank has achieved pre-tax profits of over VND 10 trillion.

In the first half of the year, most of Vietcombank’s key revenue sources declined compared to the same period in 2023. The growth driver of Vietcombank‘s profit came from the reduction in credit risk provision expenses. Specifically, the bank’s provision expenses decreased by nearly 34% compared to the same period in 2022 to VND 3,021 billion.

With a growth rate of up to 39% over the same period last year, Techcombank has risen to the second position in the industry in terms of profit size, with more than VND 15,628 billion, and has achieved nearly 58% of its full-year plan (VND 27,100 billion).

The main profit growth driver for Techcombank in the first half came from net interest income, as this key revenue source reached over VND 18 trillion, up 40.2% over the previous year. This result was driven by high credit growth and improved net interest margin (NIM). In addition, non-interest income also grew well, helping Techcombank become one of the banks with the best profit growth in the first half.

In a recent meeting with investors, Techcombank CEO Jens Lottner forecast that full-year profit would be “in the middle” of the target approved by the AGM and twice the first-half profit (VND 31,200 billion), but we will have to wait until the third quarter of 2024 for a clearer picture.

“Profit will exceed the target, but it will not double the first-half result,” he said.

As the fastest-growing bank in the Big4 group, BIDV reported pre-tax profits of over VND 15,549 billion in the first half. In Q2 alone, the bank’s pre-tax profit reached VND 8,159 billion, up 17.4% over the same period last year and marking BIDV’s highest-ever quarterly profit.

In the first half, BIDV’s main sources of income all grew compared to the same period in 2023, especially non-interest income. This was accompanied by effective management of operating expenses and credit risk provision expenses, enabling BIDV to achieve more positive business results than other banks in the state-owned group.

In addition, BIDV’s total assets in the first half grew by 9.6%, reaching a record high in the banking industry of over VND 2.5 quadrillion. This will be an important basis for the bank to continue its profit growth momentum in the second half.

At MB, the bank also recorded a record high profit in Q2, with more than VND 7,600 billion. This result helped MB enter the “club” of trillion-dong profit-making banks for the third consecutive year.

In the context of narrowing interest income, MB focused on increasing non-interest income from services, foreign exchange, and securities trading activities. This helped the bank’s total operating income grow by more than 11% in the first half. Combined with tight cost control, MB was able to maintain its profit growth momentum.

Ranking fifth on the list of the most profitable banks, Agribank ended the first half with a pre-tax profit of VND 13,269 billion, down 1.7% over the same period last year.

In the first half of 2024, both net interest income and non-interest income of Agribank increased compared to the same period last year. Net interest income reached VND 30,282 billion, up 3.8%, thanks to a faster decline in interest expenses than interest income.

Meanwhile, Agribank’s non-interest income in the first half reached VND 7,862 billion, up 24.1% over the same period last year, mainly due to positive results in foreign exchange, services, and other business activities.

However, the significant increase in operating expenses and credit risk provisions caused a profit decline for this “giant,” making it the only state-owned bank to record a decrease in profit in the first half.

For VietinBank, the first-half profit reached VND 12,960 billion, up 3.4% over the same period in 2023. This is the fourth consecutive year that the bank has achieved a half-year profit of over VND 10 trillion.

The growth driver for VietinBank’s profit was net interest income, as this important source of revenue increased by 20% over the same period in 2023 and exceeded VND 30 trillion, second only to Agribank in the banking industry. However, due to the decline in many non-interest income sources, along with the increase in operating expenses and credit risk provisions, VietinBank’s profit growth was modest at just over 3% compared to the previous year.

At ACB, for the first six months of 2024, the consolidated pre-tax profit reached over VND 10,500 billion, up 5%. In Q2/2024 alone, the pre-tax profit was VND 5,600 billion, up 16% over the same period, thanks to strong growth in scale, improved service fees, and tight cost control.

In the first half, ACB’s credit growth reached 12.8%, twice the industry average and the highest growth rate in nearly a decade. The strong credit growth helped ACB’s interest income increase by 11% over the same period. Income from service activities also achieved high growth of 13%, mainly from core products such as card fees and international payments.

The strong growth in scale, improved service fees, and tight cost control helped ACB record a half-year profit of over VND 10 trillion for the first time.

An HR member of the Big4 team with higher salary and bonus than the Chairman and CEO

Vietcombank, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, has recently released its financial report for the fourth quarter of 2023. In this report, the bank has disclosed the figures for the salaries, wages, and bonuses of the executives within the Board of Directors and the Executive Board.