Illustrative image

The Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has simultaneously reduced deposit interest rates by 0.1 – 0.3% per year for all terms, bringing the highest deposit interest rate below 5% per year.

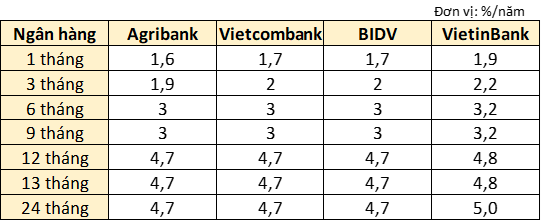

Specifically, the deposit interest rate for terms of 1 – 2 months decreased from 1.9% per year to 1.7% per year; for terms of 3 – 5 months decreased from 2.2% per year to 2% per year; for terms of 6 – 9 months decreased from 3.2% per year to 3% per year; for terms of 12 – 18 months decreased from 4.8% per year to 4.7% per year; for terms of 24 – 36 months decreased from 5% per year to 4.8% per year.

Before BIDV, two banks in the Big4 group, Agribank and Vietcombank, have also reduced deposit interest rates below this level.

Since March 15, the Agricultural Bank of Vietnam (Agribank) has adjusted and reduced interest rates for many terms.

Specifically, the deposit interest rate for a 1-month term decreased from 1.7% per year to 1.6% per year; for terms of 3 – 5 months decreased from 2% per year to 1.9% per year;

For terms of 6 – 11 months, the interest rate remains at 3% per year. Meanwhile, the interest rates for the 12-month and 13-month terms decreased by 0.1 percentage points, from 4.8% per year to 4.7% per year; for the 24-month term decreased from 4.9% per year to 4.7% per year.

Previously, Vietcombank had also reduced deposit interest rates below 5% per year since the beginning of January 2023. Currently, the interest rates for deposits under 1 month at Vietcombank are 0.2% per year; for terms of 1 – 2 months, the interest rate is 1.7% per year; for a 3-month term, the interest rate is 2% per year; for 6 and 9-month terms, the same interest rate of 3% per year;

The most preferential interest rate offered by Vietcombank for individual customers is 4.7% per year, for terms of 12 months and above.

Therefore, the deposit interest rate table of Agribank, Vietcombank, and BIDV is currently quite similar. Meanwhile, VietinBank is the bank with the highest deposit interest rate among the Big4 group, slightly higher than the others by 0.1 – 0.3% per year, depending on the term.

Specifically, deposits with terms of 1 month to less than 3 months at VietinBank have an interest rate of 1.9% per year; from 3 months to less than 6 months, the interest rate is 2.2% per year;

VietinBank applies an interest rate of 3.2% per year for terms of 6 months to less than 12 months; Individual customers will receive an interest rate of 4.8% per year when depositing for terms of 12 months to less than 24 months;

The highest deposit interest rate currently offered by VietinBank for individual customers is 5% per year, for terms of 24 months and above. This is also the highest deposit interest rate among the Big4 group.

Source: Compiled by Quoc Thuy

In March, the trend of reducing deposit interest rates from most banks continues to be maintained, and some private banks such as ACB, Sacombank, VPBank, and Techcombank are maintaining interest rates significantly lower than state-owned banks. However, some joint stock banks have begun to increase deposit interest rates, mainly in short terms of less than 5 months, to attract more deposits after Tết Nguyên Đán.

According to experts, despite the significant reduction in deposit interest rates, the amount of money deposited in the banking system is still at a record high level. Furthermore, due to weak credit demand for production and consumption of goods, most banks are not eager to increase deposit interest rates. However, it is predicted that credit growth will recover in the second quarter, which will reduce the abundant liquidity of the banking system and have the potential to push up deposit interest rates.

In a recently published analysis report, MB Securities (MBS) believes that the prime interest rate may bottom out in the first quarter and it is unlikely to decrease further mainly due to the tendency of credit demand to rise in 2024.

“We forecast that the 12-month deposit interest rate of major commercial joint-stock banks may increase by 25 – 50 basis points, returning to a level of 5.25% – 5.5% in 2024,” MBS said.

Rong Viet Securities (VDSC) also believes that the opposite adjustments on deposit interest rates by some banks in February, along with the increasing trend of interbank interest rates, may imply a scenario of gradually increasing deposit interest rates starting from the second quarter of 2024, earlier than the previous expectations of the analysis group that deposit interest rates may increase from the second half of 2024.