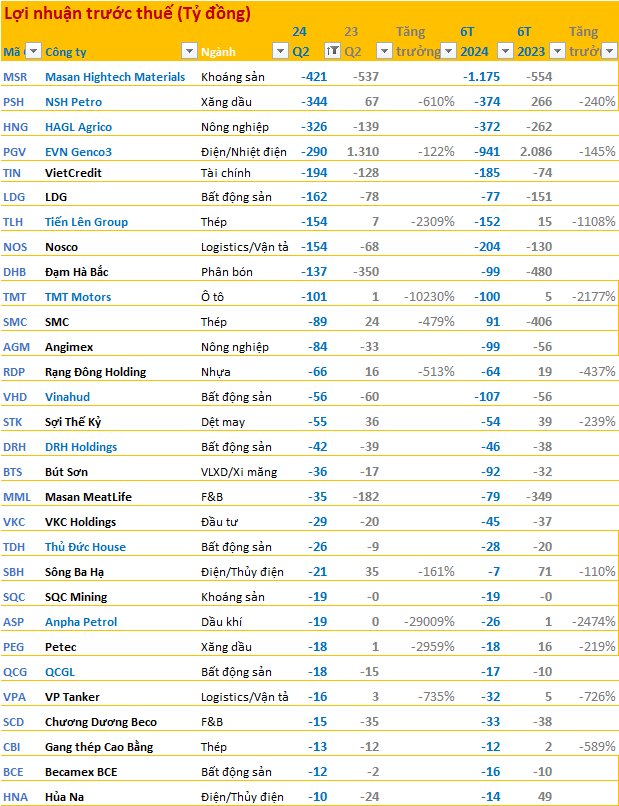

As of August 1st, almost all enterprises listed on the stock exchange have announced their second-quarter financial statements for 2024. As is customary, during this earnings season, alongside companies announcing positive results and substantial profits, there are also those that report losses.

According to statistics, there were a total of 10 businesses on the stock market that reported losses exceeding 100 billion VND, but there were no losses in the trillions as in previous quarters. For the most part, these companies have been grappling with prominent issues for several quarters, so reporting losses has become a ‘habit’. However, there were also some surprises.

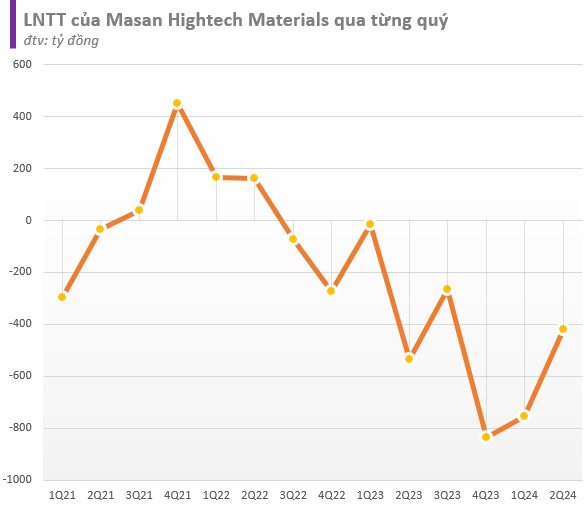

The company with the largest loss in the second quarter of 2024 was Masan Hightech Materials (MSR). Specifically, in the past quarter, the company recorded revenue of 3,652 billion VND, up 3.5% compared to the same period last year. However, revenue growth could not offset expenses, especially high financial costs, resulting in a pre-tax loss of 421 billion VND.

This company has consistently reported losses since the second quarter of 2022. In the first six months of the year, Masan Hightech Materials generated 6,741 billion VND in revenue, an almost 8% decrease compared to the same period last year. After deducting expenses, the company lost 1,175 billion VND.

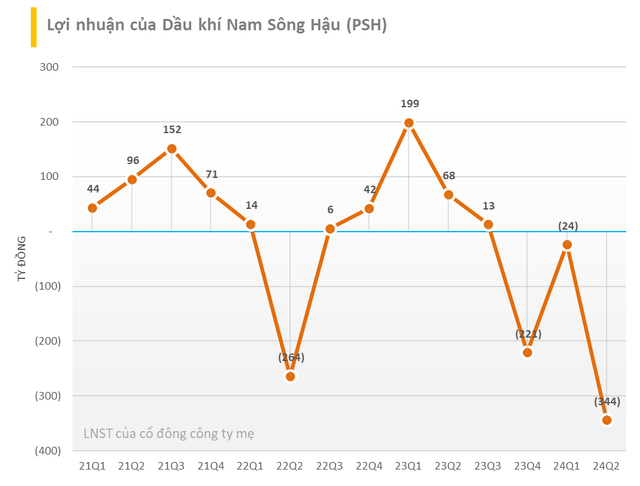

The second-largest loss-making enterprise on this list is NSH Petro (PSH), owned by tycoon Mai Van Huy. Specifically, in the past quarter, this petroleum company only earned a ‘meager’ billion VND in revenue, an 88% decrease compared to the same period last year. Selling below cost, coupled with increased expenses, resulted in a loss of more than 344 billion VND for the company.

This is the third consecutive quarter that the company has reported losses. In reality, NSH Petro has been embroiled in tax debt controversies since the end of 2023. Additionally, the company’s leaders have been implicated in a securities manipulation case involving PSH shares, including Mr. Mai Huu Phuc, the son of Mr. Mai Van Huy.

Among these loss-making enterprises, we can mention several names that have been mired in controversies recently, hindering their production and business activities, such as LDG, Quoc Cuong Gia Lai, Angimex, and Thu Duc House. Additionally, there are companies that have been consistently reporting losses, including HAGL Agrico, Nosco, and Chuong Duong Beco…

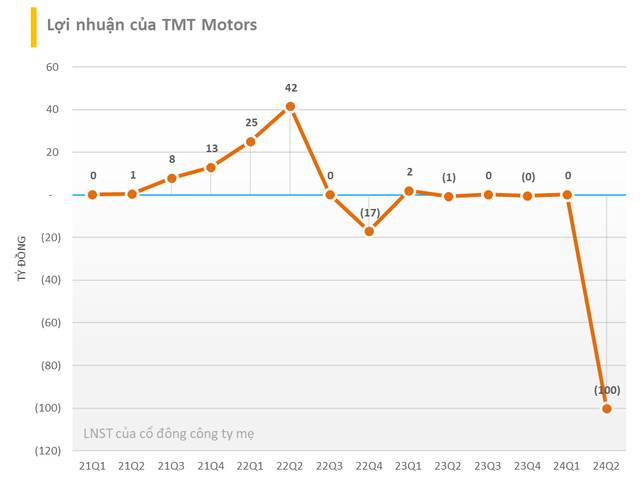

A surprising loss-making case is that of TMT Motors (TMT). According to the second-quarter financial statements for 2024, the company’s net revenue was 814 billion VND, unchanged from the same period last year. An 11% increase in cost of goods sold resulted in a gross loss of 49 billion VND, while in the same period last year, there was a gross profit of 52 billion VND.

After deducting expenses, the company reported a pre-tax loss of 101 billion VND, compared to a profit of over 1 billion VND in the same period last year. This was also the quarter with the heaviest loss in the company’s operating history.

According to explanations from the enterprise, the main reason for the decline in net profit was the challenging economic situation in 2024, with significant decreases in real estate and public investment, and the rising threat of inflation. These factors led to a sharp drop in car sales, despite continuous price reductions by automobile manufacturers and distributors like TMT to clear inventory.

TMT Motors gained attention by entering the electric vehicle market through the production, assembly, and distribution of the Wuling Hongguang MiniEV in Vietnam. It is worth noting that the Wuling Mini EV is a well-known small-sized electric car model in China, having held the title of “the world’s best-selling small electric car” for four consecutive years, from 2020 to 2023.

Despite its affordable price, the sales performance of the TMT Motor’s electric car fell short of expectations. Last year, the company only sold a mere 591 units of the Wuling HongGuang MiniEV, equivalent to 11% of its initial sales target of 5,525 vehicles.