Market liquidity increased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 417 million shares, equivalent to a value of more than 10.1 trillion VND. The HNX-Index reached over 32 million shares, equivalent to a value of more than 658 billion VND.

The VN-Index opened the afternoon session with a tug-of-war between buyers and sellers but buying pressure returned and continued to rise, helping the index recover well by the end of the session. In terms of impact, MSN, FPT, BCM, and CTG were the codes with the most positive impact on the VN-Index, with an increase of more than 3.6 points. On the contrary, LPB, VRE, NVL, and FRT were the codes with the most negative impact, taking away more than 1 point from the overall index.

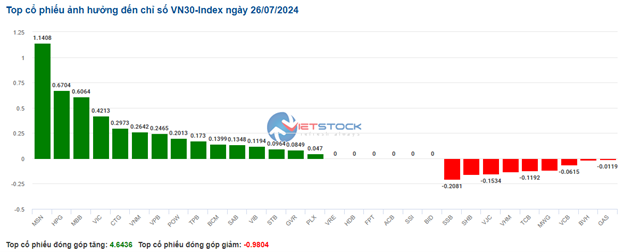

| Top 10 stocks with the strongest impact on the VN-Index on July 26, 2024 |

The HNX-Index also had a positive performance, with the index being positively impacted by the codes PVS (+1.95%), PVI (+2.91%), KSV (+3.71%), and IDC (+1.23%), among others.

|

Source: VietstockFinance

|

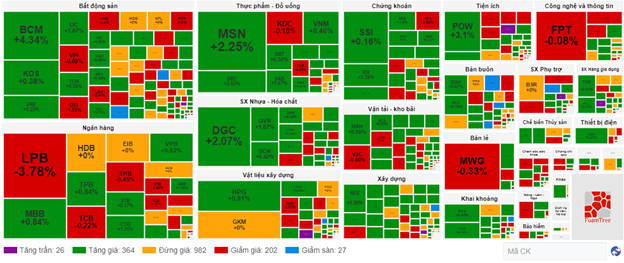

The consulting and support services sector was the group with the strongest increase, up 3.61%, mainly driven by the codes TV2 (+5.17%), TV4 (+0.71%), KPF (+2.33%), and TV3 (+0.82%). This was followed by the information and technology sector and the trading sector, with increases of 2.56% and 2.24%, respectively. On the other hand, the retail sector saw the biggest decline in the market, down -0.43%, mainly due to the codes FRT (-1.69%) and HAX (-0.32%).

In terms of foreign trading, foreigners net bought more than 327 billion VND on the HOSE exchange, focusing on the codes KDC (398.07 billion), VCB (107.24 billion), BID (70.82 billion), and MSN (66.92 billion). On the HNX exchange, foreigners net sold more than 35 billion VND, focusing on the code PVS (23.29 billion), SHS (5.06 billion), LAS (3.88 billion), and VCS (3.01 billion).

| Foreigners’ net buying and selling activities |

Morning Session: Maintaining the Green

At the end of the morning session, investor sentiment improved, with the main indices unanimously rising. The VN-Index temporarily stood at 1,237.02 points, up 3.83 points, or 0.31%; the HNX-Index also increased by 0.14% to 235.59 points. Buyers regained the upper hand after a series of suppressed days, with 379 stocks rising and 258 falling. The VN30 basket followed suit, trading positively with 20 gainers and 8 losers.

However, the trading volume of the VN-Index in the morning session remained low, reaching just over 174 million units, equivalent to a value of more than 4 trillion VND. The HNX-Index recorded a trading volume of nearly 15 million units, with a value of over 278 billion VND.

The green color spread across most stock groups. The consulting and support services group temporarily led the market, rising 3.46%, mainly contributed by TV2 (4.86%), KPF (+1.16%), and INC, which hit the daily limit up of 9.73%. This was followed by the agriculture, forestry, and fisheries sector, as well as the wholesale and food and beverage sectors, which traded positively with an increase of more than 1% in the morning session.

On the other hand, retail was the group that saw the strongest selling in the morning session, falling 0.69%. This was mainly due to the two large caps in the sector, MWG (-0.49%) and FRT (-1.51%). However, PNJ went against the industry trend, gaining 0.63%.

The accommodation, food and beverage services, electrical equipment, and information technology sectors also failed to recover by the end of the morning session, with red dominating. The downside in the morning session came from foreign investors, who continued to net sell more than 168 billion VND on the HOSE exchange, with SSI being the most net-sold stock, with a value of nearly 38 billion VND. On the HNX exchange, foreigners net sold nearly 27 billion VND, focusing on selling the PVS stock, with a value of nearly 18 billion VND.

10:35 a.m.: Buyers Take the Upper Hand

As of 10:30 a.m., the VN-Index had gained more than 3.38 points, trading around 1,236 points. The HNX-Index rose slightly by 0.87 points, trading around 236 points.

The breadth of stocks in the VN30 basket was slightly positive, with 22 gainers and 14 losers. Among them, MSN, HPG, MBB, and VIC were the main drivers of the VN30-Index, contributing 1.14 points, 0.67 points, 0.61 points, and 0.42 points, respectively. In contrast, SSB, SHB, VJC, and VHM continued to face selling pressure but the declines were not significant.

Source: VietstockFinance

|

Contributing to the current recovery momentum was the real estate group, with a trading value of more than 430 billion VND and a matched volume of over 19 million units as of 10:30 a.m. Although the increase was modest at 0.51%, it was the group with the highest trading value in the market. Currently, the performance of this group is quite mixed, with green mainly seen in VIC (+0.84%), BCM (+4.49%), NLG (+0.72%)… Conversely, VHM (-0.4%), KBC (-1.08%), PDR (-0.25%), DIG (-0.82%)… are still facing selling pressure but the declines are not significant.

The plastics and chemicals production sector rebounded with an impressive increase of 1.49%. Specifically, the main drivers of this group were GVR (+1.67%), DGC (+1.89%), DCM (+0.7%), DPM (+1%), and others.

On the positive side, the food and beverage sector continued to perform well. Buying pressure was mainly focused on the three giants of the industry, VNM (+0.46%), MSN (+2.11%), and SAB (+1.67%)… However, a large proportion of codes such as BHN, VCF, ANV, IDI… remained unchanged, while a few codes such as KDC (-0.18%), BAF (-0.81%), CMX (-0.15%)… were in the red, but the declines were not significant.

Compared to the beginning of the session, buyers had a clear advantage. There were 364 gainers and 202 losers.

Source: VietstockFinance

|

Opening: Maintaining a slight gain

At the start of the July 26 session, as of 9:40 a.m., the VN-Index had gained more than 1 point to 1,234.75 points. The HNX-Index also edged higher to 236.07 points.

Green dominated most industry groups, with some large-cap stocks posting strong gains from the beginning of the session, such as BCM up 2.6%, POW up 2.33%, SAB up 2.04%, and GVR up 1.36%.

Large-cap stocks such as GVR, SAB, and BCM were leading the market, contributing a total increase of nearly 1.5 points. On the contrary, LPB, TCB, and MWG were the codes with the most negative impact on the market, but the decline was less than 0.7 points.

The plastics and chemicals production sector continued to maintain stable growth from the beginning of the session, with stocks such as GVR up 1.36%, DPM up 0.86%, DCM up 0.84%, AAA up 0.44%, NTP up 1.64%, PHR up 1.07%, and others.