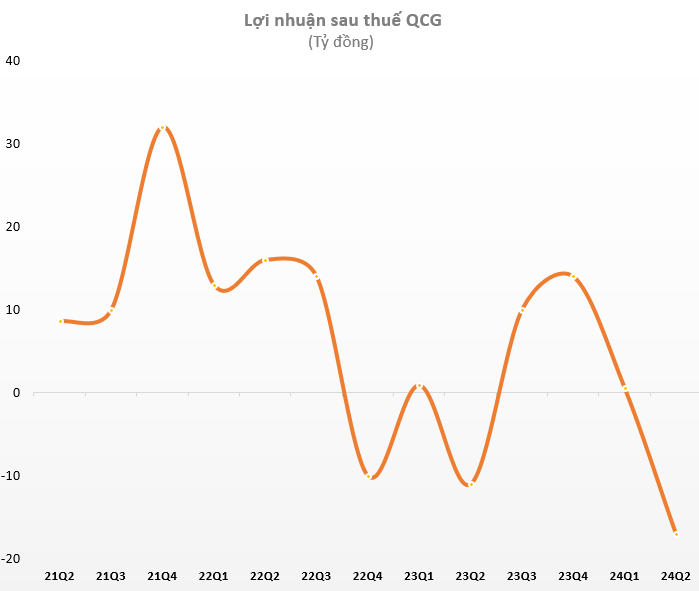

Quoc Cuong Gia Lai Joint Stock Company (QCG) has released its second-quarter 2024 financial report, revealing a 41% year-on-year decline in revenue to 26 billion VND. With selling expenses reaching 32 billion VND, the company incurred a gross loss of nearly 6 billion VND, contrasting a profit of over 5 billion VND in the previous year’s quarter.

Despite significant cost-cutting measures, Quoc Cuong Gia Lai reported a post-tax loss of 17 billion VND, widening from a loss of 14.5 billion VND in the same period last year. This quarter’s loss marks the most substantial loss for the real estate company in the past 12 years.

For the first six months of the year, the company’s revenue plummeted by 69% to 65 billion VND, with a post-tax loss of nearly 17 billion VND compared to a loss of nearly 14 billion VND in the same period last year.

As of June 30, the company’s assets stood at 9,375 billion VND, including 28 billion VND in cash. Inventories made up a significant portion of the asset structure, accounting for 75% of total assets, or 7,028 billion VND. Notable projects within this inventory include the Phuoc Kien Residential Area, Lavida, Central Premium, and Marina Danang.

This financial report marks the first signed by Mr. Nguyen Quoc Cuong, also known as “Cuong Dollar” (born in 1982), in his new role as CEO of QCG, succeeding his mother, Ms. Nguyen Thi Nhu Loan, who is currently under temporary detention regarding the 39-39B Ben Van Don project in District 4, Ho Chi Minh City.

Addressing shareholder inquiries during the second Annual General Meeting on July 30, Mr. Cuong shared the company’s plan to raise nearly 3,000 billion VND to repay Van Thinh Phat. Firstly, they have approved the divestment from three hydropower plants, expecting to bring in approximately 1,000 billion VND. Secondly, they aim to handle inventories and pre-sales to generate another 1,000 billion VND. Lastly, they will sell the Marina Danang project.

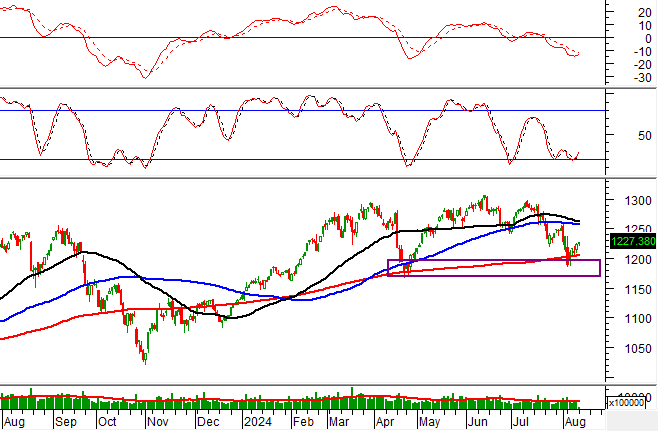

In the stock market, after a series of consecutive floor price falls, QCG shares have made a remarkable rebound with three consecutive ceiling price rises, reaching a market price of 7,740 VND per share. Trading volume has also surged, with millions of matched orders per session. However, looking further back, the share price is still at its lowest level in the past 14 months.

Regarding the recent surge in QCG’s share price, Mr. Cuong attributed it to shareholders recognizing the company’s potential and the deep price drop following the incident. According to CEO Nguyen Quoc Cuong, Quoc Cuong Gia Lai’s silver lining is its short-term debt of only about 4,900-5,000 billion VND, while owner’s equity exceeds 9,000 billion VND. Annual interest expenses on the debt are less than 300 billion VND.

“Debt is not and has never been a pressure for Quoc Cuong Gia Lai, so our financial situation is quite good and not worrying. Therefore, I hope that shareholders will continue to accompany, believe, and stand side by side even after this. In addition, Quoc Cuong Gia Lai is holding many good land funds with liquidity and feasibility for development in the coming time. The absence of significant short-term debt repayment pressure is a positive sign,” Mr. Cuong shared at the Annual General Meeting.