Illustration

Oil at 8-Month Low

Oil prices fell on Friday to their lowest level since January 2024 after data showed the US economy created fewer jobs than expected in July. Weak economic data from China further pressured the oil market.

Brent crude oil futures settled down $2.71, or 3.41%, at $76.81 a barrel. West Texas Intermediate (WTI) crude oil futures fell $2.79, or 3.66%, to $73.52 per barrel.

US job growth in July was much slower than expected, and the unemployment rate rose to 4.3%, raising concerns about a possible economic recession.

Meanwhile, economic data from China, the world’s top oil importer, and surveys showed manufacturing activity across Asia, Europe, and the US weakening, increasing the risk of a sluggish global economic recovery, which pressured the oil market.

Gold Falls

Gold bullion prices slipped on Friday as profit-taking emerged after prices rose over 1% earlier in the session on hopes of a US rate cut following data that showed the US economy created fewer jobs than expected in July.

Spot gold fell 0.5% to $2,432.19 per ounce, and US gold futures for December delivery settled down 0.4% at $2,476.98.

However, gold prices rose 1.8% for the week, underpinned by safe-haven buying as tensions in the Middle East escalated and expectations of a US rate cut.

In Asia, India’s gold price premium over official domestic prices narrowed to $6 an ounce this week from last week’s $20 as buying frenzy eased. Gold in India currently hovers around 70,100 rupees per 10 grams, after hitting a four-month low of 67,400 rupees earlier this week.

Iron Ore Rises

Iron ore prices on the Dalian exchange rose on Friday but posted weekly losses.

The September iron ore contract on the Dalian Commodity Exchange (DCE) ended daytime trading up 2.16% at 779 yuan ($108.09) per ton.

Singapore’s September iron ore contract rose 1.41% to $104.10 per ton. For the week, DCE iron ore fell 0.13%, while Singapore’s contract rose 0.69%.

Nineteen steelmakers across China have voluntarily maintained equipment maintenance from late July to late August to cut output, leading to a total production reduction of 1.98 million tons of construction steel.

Copper Edges Higher

Copper prices edged higher on Friday, supported by growing expectations of a Fed rate cut and slightly higher physical demand in China, although investors remained cautious amid weak economic data.

Three-month copper on the London Metal Exchange (LME) ended the session up 0.3% at $9,082 a ton.

Weaker-than-expected US jobs data pushed the dollar lower, making dollar-priced commodities cheaper for buyers using other currencies.

Despite recent weak data from Chinese factories, the top metal consumer, there has been evidence of some physical copper buying in the market.

Rubber Climbs

Rubber prices on the Japanese market rose on Friday, driven by concerns over supply-side disruptions.

The rubber contract for January delivery on the Osaka Exchange (OSE) ended the session up 4 yen, or 1.28%, at 315.3 yen ($2.81) per kg. However, the contract still fell 0.76% for the week.

The rubber contract for January delivery on the Shanghai Futures Exchange (SHFE) rose 150 yuan to 15,680 yuan ($2,175.84) per ton.

Thailand’s meteorological agency has warned of heavy to very heavy rainfall, which could cause flash floods from August 2 to 5.

Indian Rice at 6-Week High; Thai and Vietnamese Rice Steady

Indian 5% broken rice prices rose to $543-$551 per ton, compared to $540-$547 per ton last week. Thai 5% broken rice was quoted at $570-$575 per ton, unchanged from last week, while Vietnamese 5% broken rice was at $560 per ton, up from $550-$560 per ton last week.

Corn, Wheat, and Soybeans Climb

Soybean and grain prices on the Chicago Board of Trade (CBOT) rose on Friday. Despite the gains, corn and soybeans remained near four-year lows and posted weekly losses on forecasts of cool, wet weather in the US corn belt, improving supply prospects.

Soybean futures ended up 1.28% at $10.29-1/2 per bushel, corn rose 1.38% to $4.04 per bushel, and wheat gained 0.99% to $5.37-1/4 per bushel.

Coffee Falls

September robusta coffee futures fell 0.2% to $4,218 per ton. Prices dropped 2% for the week, pressured by rising conillon (robusta) coffee supplies from Brazil, offsetting lower exports from Vietnam.

The progress of the 2024/25 coffee harvest in Brazil has reached about 87% as of Monday last week, according to consulting firm Safras & Mercado.

September arabica coffee rose 1% to $2,2945 per lb.

Data released by the National Coffee Institute (ICAFE) on Thursday showed that Costa Rica’s coffee exports in July rose 16.4% from the same month last year.

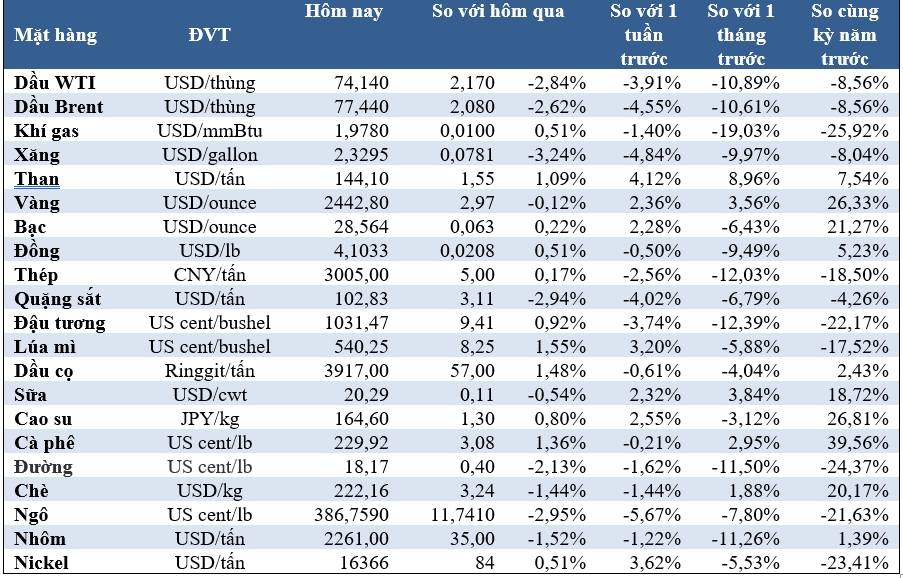

Prices of Key Commodities on August 3: