Illustrative Image

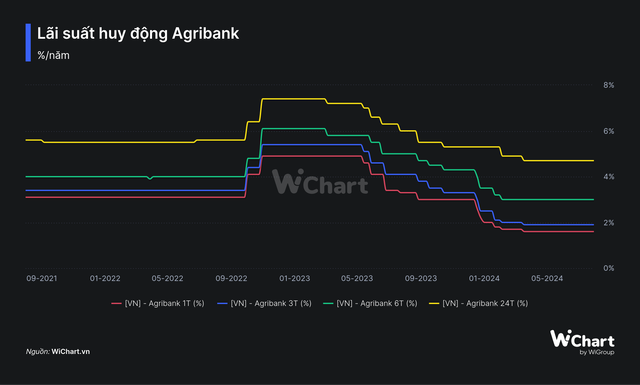

Agribank has recently announced an adjustment to its deposit interest rates for individual customers, with rates for 1-2 month terms increasing by 0.1% per year to 1.7% per year. Rates for 3-5 month terms have also seen a similar increase, now standing at 2.0% per year.

Meanwhile, the bank has maintained interest rates for 6-11 month terms at 3.0% per year. Agribank has also kept rates unchanged for 12-18 month terms at 4.7% per year, but has increased rates for 24-month and longer terms by 0.1% to 4.8% per year.

This is the first time in four and a half months that the bank has made adjustments to its deposit rates, and the first time since November 2022 that Agribank has raised interest rates.

Agribank’s Latest Personal Deposit Interest Rates

Agribank is the latest major bank in the Big 4 group to increase deposit interest rates in recent weeks. Previously, from July 22, the Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) also raised online deposit interest rates for long-term maturities.

Specifically, BIDV increased interest rates for 24-36 month online deposits by 0.1% per year to 4.9% per year, while maintaining rates for other maturities.

With two of the largest deposit-holding banks in the system raising their interest rates, the overall deposit interest rate landscape is expected to follow suit in the near future.

Agribank has consistently lowered deposit rates since the end of 2022, reaching historic lows in March 2024.

After hitting these lows, deposit rates began to climb again in late March, with widespread increases seen in April, May, and June. This trend continued into July, with around 20 banks adjusting their rates upwards, including NCB, Eximbank, SeABank, VIB, BaoViet Bank, Saigonbank, VietBank, MB, BVBank, KienLong Bank, VPBank, PVCombank, PGBank, Sacombank, BIDV, ABBank, Bac A Bank, SHB, ACB, and Cake by VPBank. Many of these banks have increased their deposit rates two to three times.

Analysts attribute this rise in deposit rates to several factors. Firstly, low deposit growth from individuals and businesses in the early months of the year, coupled with a recovering credit growth, has prompted banks to offer higher rates to attract more deposits and maintain liquidity. Additionally, interventions by the State Bank of Vietnam (SBV) through open market operations and foreign currency sales have impacted the Vietnamese Dong liquidity of banks.

Experts from Rong Viet Securities Company (VDSC) suggest that the rise in deposit rates is in line with expectations given the fluctuations in exchange rate expectations and interest rate policies.

Indeed, since the beginning of the second quarter, VND interest rates have been on an upward trajectory, with mid-year rates increasing by 0.5% to 1% for various maturities. Interbank money market rates have also climbed, and the State Bank’s intervention rates, such as the open market operation (OMO) rate and the rate for issuing bills, have been adjusted higher.

However, despite these increases, deposit rates remain lower than pre-pandemic levels. VDSC predicts that VND interest rates in the second half of the year could continue to rise slightly, by 0.25% to 0.75%.

KB Vietnam Securities Co. (KBSV) shares a similar outlook, anticipating a further increase of 50 basis points in deposit rates from now until the end of the year, reaching levels similar to the COVID-19 lows in 2020-2021.

According to KBSV experts, the following key factors will influence deposit rates for the remainder of the year:

Firstly, exchange rates in the third quarter of 2024 are expected to fluctuate, although the risk of a sharp increase has diminished. The State Bank will likely maintain its policy of keeping interbank interest rates sufficiently high to discourage carry trade, while also selling USD to meet the needs of businesses as imports are projected to continue rising. These actions will directly impact system liquidity and drive up deposit rates in the formal banking sector, particularly for small and medium-sized private joint-stock commercial banks with less flexible sources of funds and those experiencing strong credit growth.

Secondly, the expected recovery in credit demand will lead to an increased need for capital mobilization, pushing deposit rates higher towards the end of the year. Specifically, credit growth is forecast to rebound more noticeably in the second half of 2024, driven by a warming economy and key factors such as: (i) a significant increase in import turnover in recent months, indicating positive prospects for production and export activities; (ii) the impact of monetary and fiscal policy measures stimulating domestic demand; and (iii) a revival in the real estate market. In fact, credit growth in the second quarter of 2024 already showed signs of improvement, reaching 6% as of June 30 (with a 4.6% increase in the second quarter alone), mainly driven by real estate and infrastructure development lending.

Along with the upward trend in deposit rates, experts also predict that lending rates have bottomed out and are expected to remain stable or see a slight increase by the end of the year. Lending rates have indeed decreased significantly compared to the peak at the end of 2022, in line with the government and SBV’s policy to support economic development. However, with the rise in funding costs, KBSV analysts believe that lending rates have reached their lowest point and are likely to stabilize or see a minor increase by year-end.

Nevertheless, KBSV points out that the extent of this increase will vary across banks. State-owned banks, with their role in supporting the economy, are expected to maintain relatively low lending rates, while private banks may raise rates to adjust for higher funding costs. Additionally, non-performing loans remain a concern as banks’ buffers have been significantly reduced, and the expiration of Circular 02 at the end of 2024 could lead to a change in the risk classification of many customers, necessitating adjustments in lending rates to account for higher customer risk.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

New currency exchange service: Rare small denominations

The demand for exchanging small denominations of money increases during the Lunar New Year, but the availability of small bills is limited. The familiar “money exchange kiosks” are also gradually disappearing from this service.