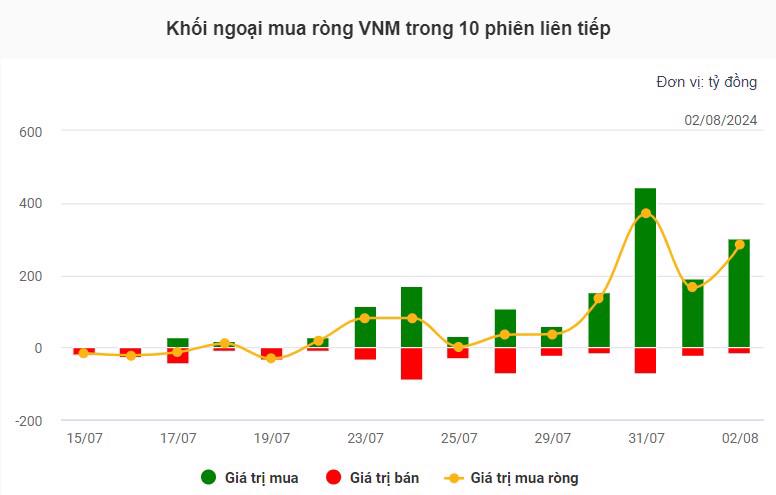

Foreign investors have been showing positive sentiment towards VNM on the stock market. On August 2, VNM remained the stock with the strongest net buying in both volume and value, with VND 330 billion, equivalent to more than 2.8 million units. Previously, on July 31, foreign investors net bought VND 370 billion, marking the strongest net buying session for VNM since the beginning of 2024.

The buying streak in VNM has lasted for 10 consecutive sessions, with a total net buying value of approximately VND 1,254 billion.

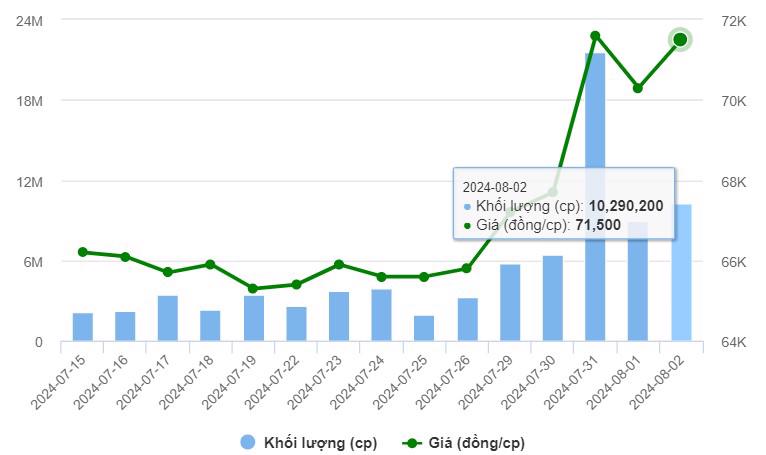

Along with the positive sentiment from foreign investors, VNM’s share price has also performed well in the stock market. Since July 22, the giant in the industry has seen a 9% increase in its share price, surpassing the VND 70,000/share mark and closing the session on August 2 at VND 71,500 per share.

In addition to the share price and trading volume from foreign investors, VNM’s liquidity in recent sessions has also surged. The most notable was the session on July 31, with a record trading volume of nearly 21.6 million shares, equivalent to a value of more than VND 1,500 billion. This brought the average liquidity in the past year to more than 2.9 million units per session. In this historic session, foreign investors purchased nearly 6.3 million VNM shares through matching transactions, equivalent to a value of nearly VND 443 billion, marking one of the largest direct buying and selling transactions.

On August 2, 10.3 million VNM shares were traded, with a value of VND 731 billion.

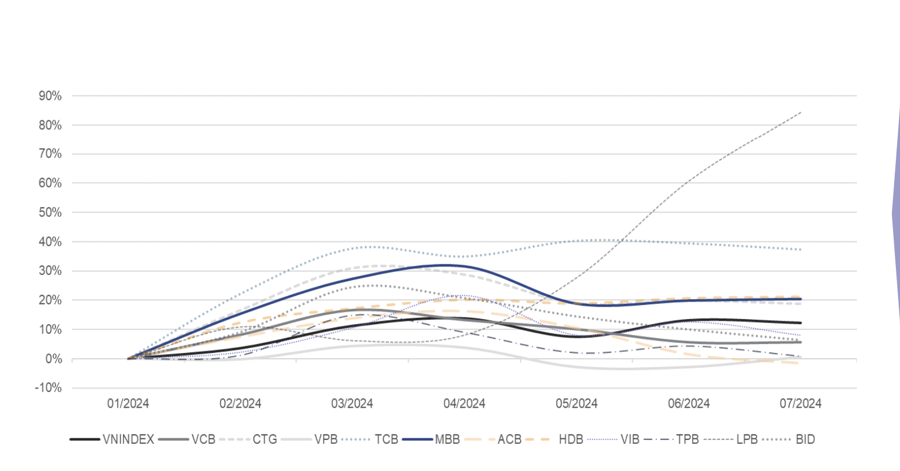

The net buying by foreign investors, along with the increase in liquidity and share price, is supported by VNM’s positive financial results. Vinamilk had an outstanding second quarter, with record-high consolidated revenue. More importantly, the company achieved growth in all segments, including domestic, export, and member units at home and abroad.

According to the Q2/2024 consolidated financial statements, VNM’s net revenue reached VND 16,655 billion, surpassing the previous record of VND 16,194 billion in Q3/2021 to become the quarter with the highest revenue. This quarter also marked the company’s highest growth rate since the beginning of 2022, with a 9.5% increase year-on-year. Net profit reached VND 2,671 billion, up 21%.

These results were supported by the company’s domestic and overseas business activities, which grew by 5.8% and 29.9%, respectively, compared to the same period last year.

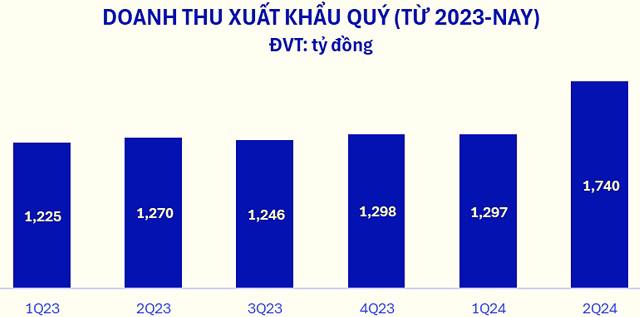

Overseas markets contributed 18.5% to the consolidated revenue in Q2/2024. Export revenue reached VND 1,740 billion, a 37% increase year-on-year. Continuous product innovation and strong relationships with partners in key export markets have been the foundation for Vinamilk’s export growth.

In addition to strengthening its presence in traditional markets, Vinamilk is exploring new opportunities by supplying to global chains. This strategy is expanding Vinamilk’s reach in the Oceania region and further into Africa and South America.

Moving forward, Vinamilk will focus on emerging markets, leveraging free trade agreements, and building strategic partnerships. In the second quarter, Vinamilk continued to promote trade promotion activities and international business connections. Its sustainable development strategy is also being leveraged as a competitive advantage in exports to create a new wave of growth.

With its overseas branches in Cambodia and the US, the company’s revenue in Q2/2024 reached VND 1,384 billion, a 21.8% increase year-on-year.

“With encouraging results in the first half of 2024, we are confident in achieving our full-year targets and believe that Vinamilk will continue to be a bright spot in the market, delivering sustainable value to investors,” shared Ms. Mai Kieu Lien with investors.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.