The VN-Index saw no improvement in trading volume compared to the previous session, reaching nearly 281 million units, equivalent to a value of nearly VND 6.6 trillion in the morning session. The HNX-Index recorded a trading volume of over 25 million units, with a value of over VND 507 billion.

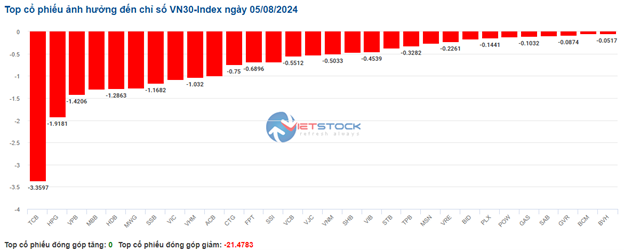

In terms of impact, the 10 codes that had the most negative influence on the VN-Index caused the index to drop by nearly 11 points, led by banking stocks, including TCB, BID, VCB, and CTG. On the other hand, the 10 codes with the most positive influence only helped the index increase by 0.3 points, including EIB, SVC, BSI, FTS, etc.

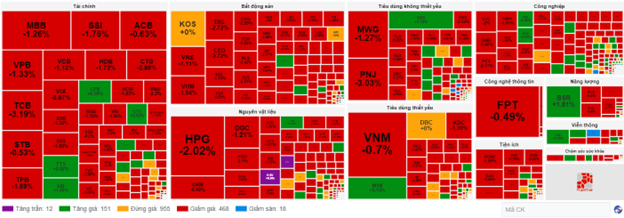

Most sectors were dominated by red. Among them, the real estate group was the most significant “burden,” falling by 2.46%. Most of the stocks in this group are facing strong selling pressure, typically the trio of VIC, VHM, and VRE, which decreased by 2.62%, 2.64%, and 2.23%, respectively. In addition, BCM fell by 2.76%, KDH by 2%, and NVL by 2.17%…

This was followed by the materials sector, which also traded negatively, falling by 2.19%. The main influence came from large-cap stocks HPG (-2.57%), GVR (-3.25%), DGC (-2.43%), and VGC (-4.11%), among others. The banking sector suffered a similar fate, declining by 1.89%. The “king stocks” were all in the red, such as VCB (-1.01%), BID (-1.99%), CTG (-2.85%), and TCB (-3.4%). EIB was the only bright spot in this group, trading positively with a gain of 1.94%.

Conversely, telecommunications was the only group to remain in the green, rising by 0.94%. However, this figure was largely due to VGI, the largest capitalization stock in the group, which increased by 2.44%. Most of the remaining stocks in this sector could not escape the negative downward trend, such as FOX (-3.23%), CTR (-2.98%), and ELC (-3.21%), to name a few.

Foreign investors net sold nearly VND 444 billion on the HOSE exchange, focusing their selling on stocks like HPG, FPT, TCB, and SSI… On the HNX exchange, foreign investors also net sold over VND 17 billion, focusing their sales on the PVS stock.

10:40 am: Red dominates the market as real estate and financial sectors become “burdens”

After creating a price reduction gap (gap down) from the opening, the market continued to fluctuate below the reference level, causing the main indices to sink into the red. As of 10:30 am, the VN-Index fell by 16.03 points, trading around the 1,220-point level. The HNX-Index decreased by 2.42 points, trading around 229 points.

The codes in the VN30 basket were all painted red as they faced strong selling pressure, resulting in a loss of more than 21 points from the overall index. Notably, four banking codes, TCB, HPG, VPB, and MBB, witnessed decreases of 3.36 points, 1.92 points, 1.42 points, and 1.3 points, respectively.

Source: VietstockFinance

|

Capital continued to flow out of the real estate sector, causing most stocks in this industry to decline sharply. Specifically, VHM fell by 1.81%, VRE by 1.11%, DIG by 2.93%, and CEO by 3.4%…

Next was the financial sector, which also turned red as the leading securities and banking codes, such as SSI, VND, VIX, MBB, TCB, VPB, etc., witnessed decreases. In contrast, only a few codes remained in the green, including FTS, which increased by 1.48%, EIB by 1.11%, and LPB by 0.35%…

Regarding the FTS code, from a technical perspective during the morning session of August 5, 2024, this stock continued to rise while forming a Piercing Pattern candlestick pattern. The trading volume is expected to surpass the 20-day average by the end of the session. Additionally, the Stochastic Oscillator indicator has signaled a buy and risen out of the oversold region after a bullish divergence appeared in this area, further supporting the FTS recovery scenario in the upcoming sessions.

Source: https://stockchart.vietstock.vn/

|

Compared to the beginning of the session, sellers continued to dominate the market. There were 468 declining codes and only 151 advancing codes.

Source: VietstockFinance

|

Opening: Broad-based declines, VN-Index loses more than 15 points at the start

The morning session began on a negative note, with most sectors dominated by red. Notably, the VN30 index had the most negative impact as most of the stocks in this group declined.

Numerous VN30 stocks witnessed sharp declines, such as SSB (-2.43%), POW (-1.45%), TCB (-3.19%), VIC (-2.62%), CTG (-2.85%), SSI (-2.08%), VIB (-2.37%), HDB (-3.45%), and GVR (-1.08%).

The real estate sector also had a significant negative impact, with stocks such as VHM falling by 2.36%, NVL by 1.74%, VRE by 1.39%, VIC by 2.62%, HDG by 2.55%, DXG by 1.91%, and NLG by 3.04%…

This was followed by the non-essential consumer goods sector, where most of the leading stocks sank into the red, including MWG, which fell by 1.75%, PNJ by 1.62%, FRT by 2.47%, TNG by 2.79%, DGW by 1.73%, and PLX by 2.53%, among others.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.