Illustration Photo

Vietnam boasts a range of top-tier export commodities, including rice, coffee, cashews, phones, textiles, and, notably, footwear, which consistently brings in billions of USD in revenue each month.

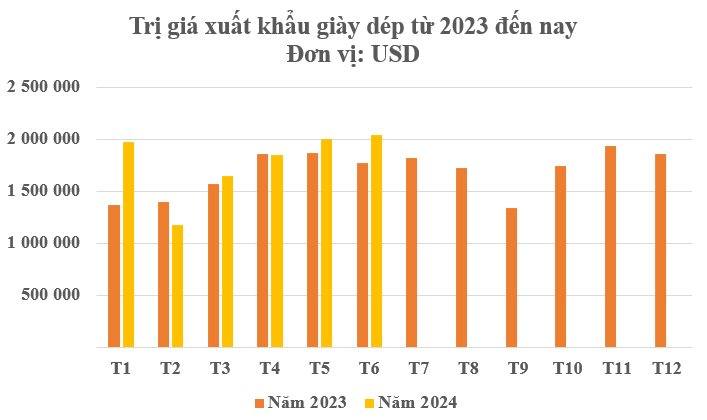

According to preliminary statistics from the General Department of Vietnam Customs, footwear exports in June 2024 surpassed $2 billion, a 1.8% increase from the previous month. Cumulatively, in the first six months of the year, footwear exports generated over $10.7 billion, an 8.8% rise compared to the same period last year.

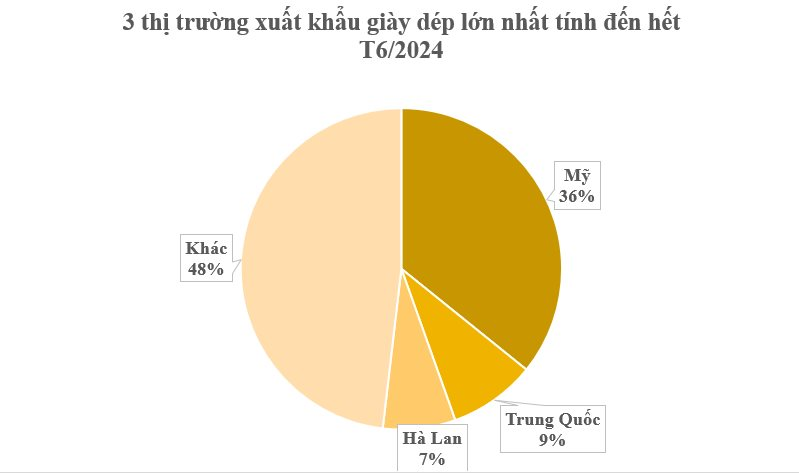

The three largest export markets for Vietnam are the United States, China, and the Netherlands. Exports to the largest market, the US, reached $3.8 million, a 15% increase compared to the same period in 2023.

China comes in second, with over $900 million, an 8.6% increase, while the Netherlands is the third-largest importer, with more than $782 million, a significant 62% jump compared to the same period last year.

In terms of global market share, Vietnam currently ranks second in footwear exports, just behind China. Vietnamese footwear exports account for an estimated 10% of the global market and are present in 150 countries, including major markets like the US, EU, China, Japan, and the UK. Notably, in 2020, Vietnam was the world’s largest exporter of canvas shoes by value, surpassing China. Together with Italy, these three countries account for more than half of the global footwear market.

In 2023, footwear exports brought in more than $20.2 billion. This marks the 26th consecutive year (since 1998) that footwear exports have been among the billion-dollar groups, consistently maintaining their high trade value.

Currently, Vietnam has over 1,000 footwear factories, providing employment for approximately 1.5 million workers and contributing about 8% to the country’s GDP.

Notably, the Southwest and Central regions of Vietnam still have a large labor force, low labor costs, and vast expanses of vacant land. These factors present opportunities for Vietnamese businesses to continue their expansion and attract foreign investment into the country’s footwear industry.

According to the Ministry of Industry and Trade, to ensure the rapid and sustainable development of the leather, footwear, and handbag industry, the association should closely monitor the new Leather and Footwear Strategy and the EU’s trend towards circular footwear development. Additionally, they should study the policy adjustment experiences of countries with strengths and potential in this sector, such as China, India, and Bangladesh, and propose appropriate solutions to the relevant authorities. Furthermore, it is crucial to provide timely warnings, guidance, and information sharing to avoid a passive position regarding new policy adjustments and regulations from the EU and other global markets.

According to the “Strategy for the Development of Vietnam’s Textile, Garment, and Footwear Industries by 2030, with a Vision to 2035,” Vietnam aims to achieve footwear export turnover of $27-28 billion by 2025 and $38-39 billion by 2030.

Vietnam’s footwear exports are projected to grow at a rate of 10-12% annually during the 2022-2026 period. The country is also recognized as a reliable market for producing high-quality footwear products, particularly sports shoes for major brands.