The market witnessed a significant decline today, with 129 codes falling below the floor price.

Trading liquidity increased compared to the previous session, with the matched order volume of the VN-Index reaching over 942 million shares, equivalent to a value of more than 21.2 trillion VND. The HNX-Index recorded over 83 million trading volume, equivalent to a value of more than 1.5 trillion VND.

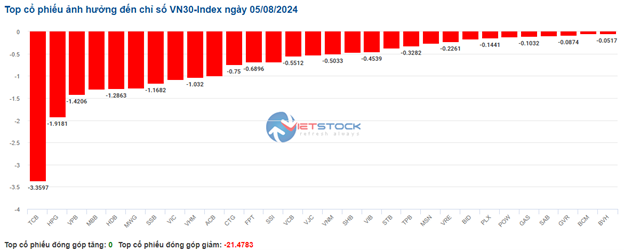

The VN-Index opened the afternoon session with continued selling pressure, causing the index to plunge and close in a pessimistic red. In terms of impact, VCB, BID, GVR, and TCB were the codes with the most negative influence, taking away more than 8.9 points from the index. On the other hand, HNA, SVC, EIB, and BSI had the most positive impact on the VN-Index, but the increase was not significant.

| Top 10 stocks affecting the VN-Index on August 5th |

The HNX-Index followed a similar trend, negatively impacted by codes such as PVS (-5.5%), SHS (-8.44%), MBS (-5.07%), and CEO (-8.84%), among others.

|

Source: VietstockFinance

|

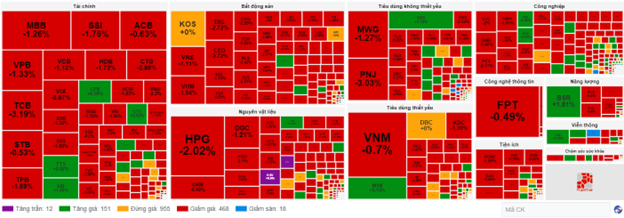

The materials sector witnessed the most significant decline in the market, falling by -5%, mainly due to codes such as HPG (-4.77%), HSG (-6.76%), DGC (-5.51%), DCM (-6.38%), and NKG (-6.88%). This was followed by the information technology and industrial sectors, which decreased by 3.89% and 3.71%, respectively.

In terms of foreign trading, they returned to net sell more than 820 billion VND on the HOSE exchange, focusing on codes such as HPG (232.06 billion), FPT (103.86 billion), MWG (86.48 billion), and STB (77.5 billion). On the HNX exchange, foreign investors net sold more than 11 billion VND, focusing on PVS (10.8 billion), SHS (5.56 billion), DHT (1.96 billion), and CEO (1.88 billion).

| Foreign Trading Net Buy-Sell Activity |

Morning Session: Foreigners Net Sell, VN-Index Returns to 1,200-Point Level

Unable to shake off the negative sentiment that engulfed global financial markets since last weekend, heavy selling pressure weighed down on large-cap stocks, causing the VN-Index to plunge further. By the morning close, the VN-Index had dropped significantly to 1,212.22 points (-1.97%), while the HNX-Index fell by 1.83% to 227.33 points. The VN30 basket was entirely dominated by sellers, with all 30 codes drowning in red.

The trading volume of the VN-Index remained unchanged from the previous session, reaching nearly 281 million units, equivalent to a value of almost 6.6 trillion VND in the morning session. The HNX-Index recorded a trading volume of over 25 million units, with a value of over 507 billion VND.

In terms of impact, the 10 codes with the most negative influence on the VN-Index caused the index to lose nearly 11 points, led mostly by banking stocks, including TCB, BID, VCB, and CTG. Conversely, the 10 codes with the most positive influence only helped the index gain slightly over 0.3 points, including EIB, SVC, BSI, FTS, etc.

Almost all sectors were engulfed in red. Among them, the real estate sector was the most significant “burden,” falling by 2.46%. Most stocks in this group faced intense selling pressure, notably the trio of VIC, VHM, and VRE, which declined by 2.62%, 2.64%, and 2.23%, respectively. Additionally, BCM fell by 2.76%, KDH by 2%, and NVL by 2.17%…

Following closely was the materials sector, which also traded negatively, decreasing by 2.19%. This was mainly influenced by large-cap stocks such as HPG (-2.57%), GVR (-3.25%), DGC (-2.43%), and VGC (-4.11%) … The banking sector suffered a similar fate, declining by 1.89%. The “king stocks” all turned red, including VCB (-1.01%), BID (-1.99%), CTG (-2.85%), TCB (-3.4%), … EIB was the only bright spot in this group, rising by 1.94%.

Conversely, telecommunications was the only sector to remain in the green, increasing by 0.94%. However, this was largely due to VGI, the sector’s largest cap stock, which rose by 2.44%. Most other stocks in the sector couldn’t escape the negative tide, with FOX falling by 3.23%, CTR by 2.98%, and ELC by 3.21%…

Foreigners net sold on the HOSE exchange with a value of nearly 444 billion VND, focusing their selling pressure mainly on HPG, FPT, TCB, and SSI stocks. On the HNX exchange, they also net sold more than 17 billion VND, focusing on PVS stock.

10:40 am: Red Dominates the Market as Real Estate and Financial Sectors Become “Burden”

After a gap-down opening, the market continued to fluctuate below the reference level, causing the main indices to sink into the red. As of 10:30 am, the VN-Index had lost 16.03 points, trading around the 1,220-point level. The HNX-Index fell by 2.42 points, hovering around 229 points.

Stocks in the VN30 basket were all painted red as intense selling pressure took away more than 21 points from the index. Notably, four banking codes, TCB, HPG, VPB, and MBB, fell by 3.36 points, 1.92 points, 1.42 points, and 1.3 points, respectively.

Source: VietstockFinance

|

Money continued to flow out of the real estate sector, causing most stocks in this industry to decline sharply. Specifically, VHM fell by 1.81%, VRE by 1.11%, DIG by 2.93%, and CEO by 3.4%…

Next was the financial sector, which also turned red as leading securities and banking codes such as SSI fell by 1.92%, VND by 2.3%, VIX by 2.7%, MBB by 1.89%, TCB by 2.98%, and VPB by 1.6%… Conversely, the green shade was only visible in a few codes, including FTS, which rose by 1.48%, EIB by 1.11%, and LPB by 0.35%…

Regarding FTS, from a technical perspective during the morning session of August 5, 2024, this stock continued its upward trajectory while forming a Piercing Pattern candlestick pattern. The trading volume was expected to surpass the 20-day average by the session’s end. Additionally, the Stochastic Oscillator indicator signaled a buy and emerged from the oversold region after a bullish divergence, further supporting the potential recovery of FTS in the upcoming sessions.

Source: https://stockchart.vietstock.vn/

|

Compared to the opening, sellers continued to hold the upper hand. There were 468 declining codes and only 151 advancing codes.

Source: VietstockFinance

|

Opening: Broad-Based Declines, VN-Index Loses Over 15 Points at the Start

The morning session began on a negative note, with most sectors drowning in red. Notably, the VN30 index had the most significant negative impact as almost all the stocks in this group fell.

Numerous VN30 stocks witnessed sharp declines, including SSB (-2.43%), POW (-1.45%), TCB (-3.19%), VIC (-2.62%), CTG (-2.85%), SSI (-2.08%), VIB (-2.37%), HDB (-3.45%), and GVR (-1.08%)…

The real estate sector also had a substantial negative impact, with stocks such as VHM falling by 2.36%, NVL by 1.74%, VRE by 1.39%, VIC by 2.62%, HDG by 2.55%, DXG by 1.91%, and NLG by 3.04%…

Following closely was the non-essential consumer goods sector, with leading stocks in this group sinking into the red. These included MWG, which fell by 1.75%, PNJ by 1.62%, FRT by 2.47%, TNG by 2.79%, DGW by 1.73%, and PLX by 2.53%…

Ly Hoa