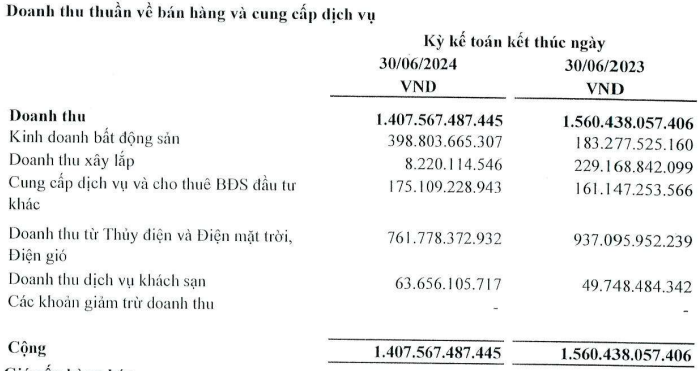

Specifically, HDG’s net revenue for the first six months of 2024 was nearly VND 1,408 billion, a 10% decrease year-on-year. The bright spot was the real estate business, which brought in nearly VND 399 billion in revenue, almost 2.2 times higher.

On the other hand, revenue from construction and renewable energy (hydropower, wind power, and solar power) decreased significantly by over 96% and nearly 19%, respectively, to just over VND 8 billion and nearly VND 762 billion.

|

HDG’s revenue structure in the first six months of 2024

Source: VietstockFinance

|

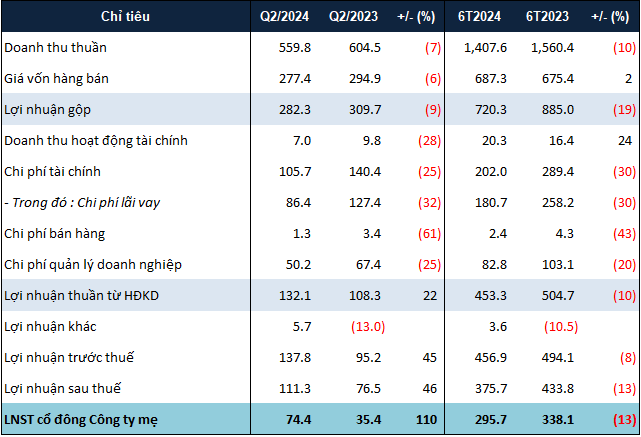

In the context of declining net revenue, HDG’s cost of goods sold increased slightly by 2%, causing gross profit to decrease by 19% to over VND 720 billion. Financial revenue increased by 24%, but the value was not enough to offset the decline in gross profit.

Meanwhile, HDG significantly reduced its expenses for the period, including interest expenses (30%), selling expenses (43%), and management expenses (20%). As a result, pre-tax profit decreased by only 8%, to nearly VND 457 billion.

However, after deducting corporate income tax and distributing profits to non-controlling shareholders, net income for the first half of the year decreased by 13% year-on-year to nearly VND 296 billion.

In the second quarter, HDG also significantly reduced its expenses, resulting in a net income of over VND 74 billion, twice as much as the same period last year. However, due to the decline in the first quarter, the company could not avoid negative results for the first six months.

|

HDG’s business results for the first six months of 2024 in VND billion

|

On the balance sheet, HDG’s total assets as of June 30, 2024, were nearly VND 14,100 billion, a 3% decrease from the beginning of the year. Inventories and short-term receivables decreased by 17% and 28%, respectively, to over VND 889 billion and nearly VND 1,200 billion. In contrast, cash balances and the value of traded securities (including bonds and deposit certificates) doubled and increased by 58%, to nearly VND 546 billion and over VND 609 billion, respectively.

On the other side of the balance sheet, payables decreased by 8% to over VND 6,600 billion. Borrowings decreased by 5% to nearly VND 5,200 billion. Notably, the company’s “rainy day fund” (comprised of advances from customers and unearned revenue) stood at just under VND 10 billion, a 97% decrease.

Ha Le

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.