At the Military Commercial Joint Stock Bank’s (MB, HOSE: MBB) Investor Conference held on the afternoon of August 5, 2024, alongside updates on business results, the Bank’s leadership also forecasted business prospects for the last six months of 2024.

Collateral assets of the four business groups are three times the lending scale

Ms. Pham Thi Trung Ha, MB’s Vice Chairman, stated that restructured debt according to Circular 02 (TT02) accounts for 0.59% of MB’s total loans and bonds. Deferred income is insignificant and does not impact the Bank’s profits. The scale of restructured debt as per TT02 is relatively small.

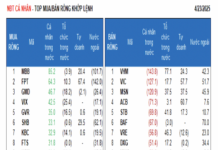

As of June 30, 2024, MB’s non-performing loans (NPLs) came from multiple clients, with the average NPL amount being relatively small, mainly from individual customers, accounting for about 80%, while the remaining 20% came from SMEs, spread across multiple customers.

Screen capture.

|

Mr. Luu Trung Thai, Chairman of MB’s Board of Directors, shared information about the outstanding debt of the four business groups that investors are concerned about.

Regarding the Trung Nam Group, MB’s outstanding debt has decreased by VND 2,000 billion this year, and the Bank only lends to three solar power projects. These projects are operating as scheduled, had good prices in the previous period, and the cash flow ensures debt repayment to MB. Therefore, MB does not classify these three projects of Trung Nam Group as non-performing and considers them independent with good performance and the ability to repay MB in the future.

Concerning Novaland, MB has reduced its exposure by VND 1,500 billion from last year to this year, contrary to investors’ concerns. MB only lends to three projects that are progressing well. The project in Novaland Phan Thiet is showing positive signs and has no legal issues, only undergoing land price determination. This is land valuation according to the new Land Law. Secondly, the project in Vung Tau has complete paperwork and is in the selling process.

Specifically, for the Aqua City project by Novaland, MB closely monitors information to complete the legal procedures. This process is progressing well, and it is one of the projects selected by the Government to address difficulties in the real estate sector. MB has no issues with Novaland’s debt repayment cash flow this year. Next year, the two projects in Phan Thiet and Vung Tau will finalize their business plans, while the Aqua project will undergo the necessary procedures this year for implementation.

Regarding the Sungroup, MB does not face challenges related to collateral asset balance or repayment sources. Currently, MB mainly focuses on tourism-related projects such as Fansipan and Ba Den, which have established designs, stable customer numbers, and consistent cash flow. Sungroup’s real estate projects with MB involvement have a low scale. MB maintains control over their quality.

As for Vingroup, MB closely monitors and only focuses on projects with complete legal documentation and final products. Most projects with Vingroup have been repaid quickly.

The collateral assets of these four business groups are three times their lending scale, so MB monitors progress according to each project. MB also continuously offers support to investors and customers and closely addresses each customer’s issues.

Ms. Nguyen Thi Thanh Nga, MB’s Chief Financial Officer, added that MB has maintained a credit limit for the real estate sector at a maximum of 10% of the Bank’s total loans for many years. The Bank consistently maintains this ratio between 8-19% and allocates a 1% margin for business opportunities in the market. In principle, MB does not refuse the real estate sector but focuses on finding customers with feasible loan proposals. The NPL ratio in the real estate sector is currently quite low.

Expecting to achieve a minimum profit target of VND 28,800 billion

Screen capture.

|

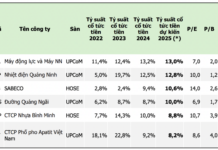

Ms. Nguyen Thi Thanh Nga shared that in the second quarter, MB’s profit growth was quite positive compared to the first quarter. However, the third quarter is expected to be more cautious, with credit growth estimated at around 12-13.x%. Since the end of April, operating expenses have started to increase, so a slight increase of 0.1-0.15% is expected in the third quarter. At the same time, provisioning expenses will also be higher.

Therefore, profit in the third quarter may fluctuate within a 6% range compared to the second quarter. The profit scenario for 2024 remains as presented to the Annual General Meeting of Shareholders, striving to maximize business revenue sources.

Chairman Luu Trung Thai further stated that in the last six months, MB would steadfastly focus on four critical issues: maintaining the lending NIM in the last six months, tightly controlling operating expenses, ensuring credit quality, and keeping NPLs in the last six months at least equal to the first six months. The target NPL ratio for the group is below 1.7%, and provisions will be made for 100% of NPLs.

Based on this, as credit demand returns, MB expects improvements in the third quarter in large business segments, fee collection scale, and, especially, the maintenance of bad debt recovery speed. The Bank expects to achieve a minimum profit target of VND 28,800 billion and potentially higher.

“Achieving the targeted profit for 2024 will be a victory, given the significant pressure on funding costs and provisioning for the banking industry this year,” emphasized Chairman Luu Trung Thai.

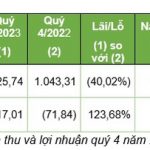

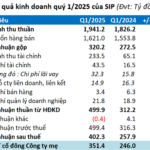

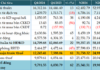

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.