In a panic-stricken turn of events for global stocks, the VN-Index once again plummeted below the 1,200-point mark. The index closed 48 points lower, sinking deep into the 1,188-point range, marking the second-largest drop since April’s 59-point freefall. At its most tense, the index wiped out 54 points.

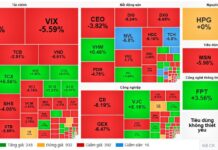

A staggering 845 codes flashed red across all three floors, with as many as 127 stocks closing at floor prices. The two groups with the largest capitalization on the floor, Real Estate and Banking, fell 3.51% and 3.54%, respectively. Raw materials, including steel, took the biggest hit with a 5% decline, followed by Securities at 4.94%. Groups dropping by 3-4% were commonplace, including Transportation at 4.06%, Consumer Goods at 4.3%, Information Technology at 3.91%, and Insurance at 3.89%.

Among the Banking group, VCB dropped 2%, shaving off 2.45 points from the market; BID erased another 2.29 points, while TCB and CTG, GVR, VHM, and FPT together wiped out 16 points from the VN-Index.

The widespread sell-off from start to finish pushed the three-floor liquidity above VND 26,000 billion. However, bottom-fishing demand remained cautious amid global turmoil.

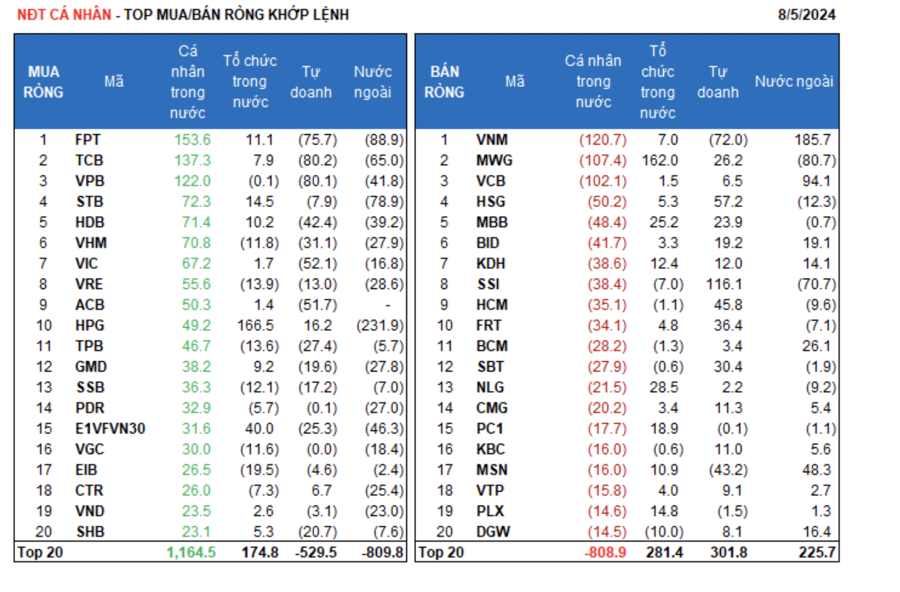

Foreign investors sold a net VND 757 billion, with a net sell of VND 789 billion in matched orders.

The main net buying sectors for foreign investors in matched orders were Food & Beverage and Oil & Gas. The top net bought stocks by foreign investors in matched orders included VNM, VCB, MSN, BCM, BID, DGC, DGW, KDH, and HVN.

On the net selling side, foreign investors offloaded Basic Resources. The top net sold stocks by foreign investors in matched orders were HPG, FPT, MWG, STB, SSI, E1VFVN30, VPB, HDB, and NKG.

Individual investors bought a net VND 585 billion, of which VND 570.8 billion was net bought in matched orders. In terms of matched orders, they net bought 9 out of 18 sectors, mainly in the Banking sector. The top net bought stocks by individual investors included FPT, TCB, VPB, STB, HDB, VHM, VIC, VRE, ACB, and HPG.

On the net selling side in matched orders, they sold 9 out of 18 sectors, mainly in Retail, Food & Beverage, and Real Estate. The top net sold stocks included VNM, MWG, VCB, VSG, MBB, BID, SSI, HCM, and FRT.

Proprietary trading sold a net VND 156.8 billion, with a net sell of VND 222.3 billion in matched orders.

In terms of matched orders, proprietary trading net bought 7 out of 18 sectors. The top net bought sectors were Financial Services and Basic Resources. The top net bought stocks by proprietary trading today included SSI, HSG, HCM, VCI, NKG, FRT, SBT, MWG, MBB, BID, and TCB.

The top net sold sector was Banking. The top net sold stocks included VPB, FPT, VNM, VIC, ACB, MSN, HDB, VHM, and TPB.

Domestic institutional investors bought a net VND 310 billion, with a net buy of VND 440.3 billion in matched orders.

In terms of matched orders, domestic institutions sold 5 out of 18 sectors, with the highest value in Construction and Materials. The top net sold stocks were VCI, EIB, DGC, VRE, TPB, MSB, SSB, VHM, VGC, and BAF.

The top net bought sector was Basic Resources. The top net bought stocks included HPG, MWG, E1VFVN30, NLG, MBB, PC1, LPB, PLX, STB, and KDH.

Today’s matched transactions totaled nearly VND 2,705 billion, up 118.8% from the previous week’s closing and contributing 10.2% of the total trading value.

Notable matched transactions today included those between individual investors in VIC (14.69 million units worth VND 619.6 billion) and EIB (17.55 million units worth VND 316.8 billion). Additionally, foreign institutions also transferred nearly 11.25 million ACB units at a price of VND 25,600 per share, approximately 9% higher than the average price during the session.

Money flow allocation increased significantly in Banking, Steel, Construction, Oil Equipment & Services, and Beer. It also saw a slight increase in Real Estate, Retail, and Gas, while decreasing in Food, Securities, Information Technology, Chemicals, Agro-Forestry-Fishery, and Oil Production.

In terms of matched orders, the money flow allocation increased in the mid-cap group (VNMID), remained almost unchanged in the large-cap group (VN30), and decreased in the small-cap group (VNSML).

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.