Halt Taxation

Speaking to Tien Phong , Ms. Tran Thi T. (from Cu Chi district, Ho Chi Minh City) shared that her family owns a plot of agricultural land measuring over 100 sq. m. Upon learning of the upcoming release of Ho Chi Minh City’s new land price framework, she proceeded to submit documents for land-use conversion.

Tax authorities in the city’s districts and Thu Duc city are calculating financial obligations only for dossiers transferred before July 31. Photo: U.P.

On August 2, Ms. T. went to the tax office to submit her documents but was rejected as they were awaiting instructions from the Ho Chi Minh City Tax Department on how to calculate financial obligations.

“Ho Chi Minh City has not yet issued a new land price framework. The current land price framework and adjustment coefficients remain legally valid. Is it in accordance with legal regulations for the tax authority to halt the determination of financial obligations for dossiers transferred from August 1 onwards?” Ms. T. questioned.

The suspension of financial obligation determination by multiple tax authorities in Ho Chi Minh City has caused confusion and concern among citizens with a need for land-use conversion.

Mr. H. (from Thu Duc city) expressed his uncertainty about the necessity of halting administrative procedures for citizens while awaiting instructions. He noted that other provinces and cities continue to apply the old land prices, unlike Ho Chi Minh City, despite not having the new framework in place.

“Ho Chi Minh City is expected to issue a new land price framework in mid-August or late August. For dossiers submitted before the effective date of the new framework, which land price will be used for calculation—the old or the new?” Mr. H. inquired. He further shared that he and many others were anxious about a potential increase in tax and had rushed to initiate the procedure, taking out loans for payment, only to be hindered by the tax office’s refusal to accept the dossiers, resulting in both inconvenience and loan interest expenses.

According to Tien Phong ‘s observations, since the beginning of August, tax authorities in the city’s districts and Thu Duc city have been calculating financial obligations only for dossiers transferred before July 31. For dossiers transferred from August 1 (the effective date of the 2024 Land Law), the tax offices are awaiting instructions from the Ho Chi Minh City Tax Department.

Many tax authorities are concerned about being held responsible for causing budget losses and are therefore reluctant to determine financial obligations for land-use conversions.

Posing as a citizen seeking guidance on procedures for land-use conversion from agricultural to residential, our reporter was directed by an employee of the Thu Duc City Tax Office to the Thu Duc City Branch of the Land Registration Office to initiate the dossier. Once the dossier is transferred to the tax office for financial calculation, subsequent steps can be taken. However, as there is no official announcement on whether to calculate taxes based on the draft land prices or the old method, the tax offices have temporarily halted their services, awaiting further instructions.

A leader of the Nha Be District Branch of the Land Registration Office also confirmed that the tax sector had discontinued processing tax calculation dossiers, awaiting the new land price framework and instructions from the Ho Chi Minh City Tax Department.

What Should Be Done?

According to several experts, Article 159 of the 2024 Land Law stipulates that the first land price framework, to be announced and applied from January 1, 2026, will be formulated based on market-based valuation methods.

Meanwhile, the Ho Chi Minh City Department of Natural Resources and Environment has stated that the draft land price framework (applicable until December 31, 2025) is based on market data and land price foundations provided by the Ho Chi Minh City Tax Department and the Ho Chi Minh City Land Registration Office.

Therefore, some experts argue that Ho Chi Minh City’s adjustment of land prices for the 2020–2025 framework based on market prices contradicts the spirit of the 2024 Land Law.

Currently, many provinces and cities have not implemented new land price frameworks. Hanoi has just adjusted the K coefficient, effective July 29. Thus, if the Ho Chi Minh City Department of Natural Resources and Environment adjusts the 2020–2025 framework, it must remain within the price range as it is constrained by the price framework. The price range can only be disregarded for the framework effective from January 1, 2026, onwards. If the market prices, which are higher than the range, are applied before that date, the regulation for the 2020–2025 framework, effective until December 31, 2025, becomes meaningless.

If Ho Chi Minh City issues a new land price framework in mid-August or late August, it will only take effect and be applicable from the date of issuance.

In a conversation with Tien Phong , Attorney Tran Duc Phuong (Ho Chi Minh City Bar Association) affirmed that Clause 3, Article 152 of the Law on the Issuance of Legal Documents prohibits retroactive application. Therefore, if Ho Chi Minh City issues a new land price framework in mid-August or late August, it will only take effect and be applicable from the date of issuance. As the city has not yet introduced a new framework to supersede the current one, the old framework should be applied, and the tax authority must facilitate administrative procedures for citizens. The suspension of land-use conversion dossiers by the tax authority is deemed inappropriate.

Attorney Tran Duc Phuong also confirmed that Clause 1, Article 257 of the 2024 Land Law allows localities to apply the old land prices until December 31, 2025, or adjust the land price framework according to their actual situation. Thus, with Ho Chi Minh City’s adjusted land price framework yet to be issued, the old framework remains valid until December 31, 2025.

“If the new framework isn’t in place yet, the old one should be applied according to Clause 1, Article 257 of the 2024 Land Law. There is no justification for halting administrative procedures and causing inconvenience to citizens,” Attorney Phuong stated.

The Ho Chi Minh City Department of Natural Resources and Environment asserted that adjusting the land price framework is necessary to address three shortcomings of the current framework. Additionally, the current framework has not been updated with approved resettlement prices and cannot serve as a basis for calculating land use fees for those eligible for resettlement under the 2024 Land Law.

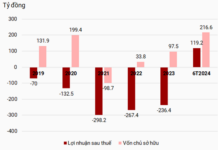

However, adopting the draft land price framework will significantly impact real estate prices and the city’s budget. Specifically, the investment capital required for the two projects along Xuyên Tâm Canal (in Binh Thanh and Go Vap districts) and the northern bank of Đôi Canal (in District 8) will increase by more than VND 10,000 billion for compensation and site clearance.

Previously, Ho Chi Minh City had approved an investment capital of nearly VND 5,000 billion for the Đôi Canal project and VND 9,600 billion for the Xuyên Tâm Canal project. However, if the new land prices are applied, District 8 will see a 254% increase, Go Vap District a 212% average increase, and Binh Thanh District a 167% increase, resulting in an additional cost of approximately VND 10,000 billion for site clearance, equivalent to a nearly 46% increase compared to the previous estimate.

Notably, this situation will not only affect these two projects but also other public investment projects, leading to increased capital for compensation and site clearance, which the budget will have to cover.