Personal Income Tax Settlement Notice for 2023

The General Department of Taxation recently issued a notice regarding the settlement of personal income tax for 2023.

Accordingly, for organizations and individuals paying income, the deadline is the last day of the third month from the end of the calendar year. However, as the last day of the third month from the end of calendar year 2023 is March 31, 2024 (a Sunday), the deadline for personal income tax settlement for organizations and income-paying individuals is April 1, 2024.

The General Department of Taxation notes the deadline for personal income tax settlement for 2023. Illustration.

For individuals directly settling personal income tax, the deadline is the last day of the fourth month from the end of the calendar year. However, as the last day of the fourth month from the end of the calendar year is April 30, 2024, and the following day is May 1, 2024 (a public holiday), the deadline for individuals to settle personal income tax directly is May 2, 2024.

Particularly, in recent times, many people have voiced concerns on social media about suddenly receiving personal income tax debt notices from tax authorities, leaving many wondering if they are in a similar situation.

So, is there a way to check and find out if you owe personal income tax? Especially for individuals who self-file their taxes with the tax authorities?

The tax authority encourages individual taxpayers to register for electronic tax transaction accounts without having to submit documents in person at the tax authority. Illustration.

Currently, the tax authority encourages individual taxpayers to register for electronic tax transaction accounts in order to file personal income tax settlement documents on the electronic tax service without having to submit documents in person at the tax authority.

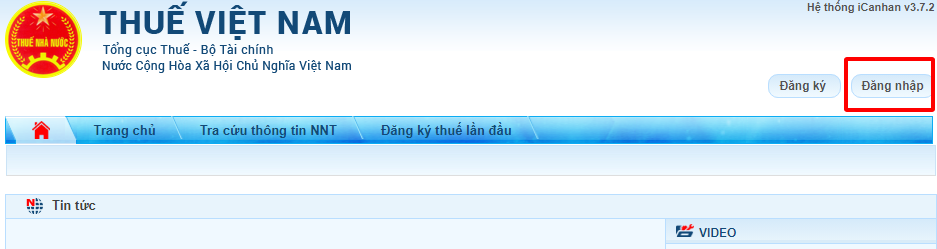

Inquiry on the General Department of Taxation’s Electronic Information Page

Step 1: Log in through the General Department of Taxation’s IT Portal

Taxpayers (TP) visit the **General Department of Taxation’s Electronic Information Page** https://thuedientu.gdt.gov.vn/.

Then select the **Individual** tab and click **Login**. TP can log in using the Ministry of Public Security’s National Digital Identity or an Electronic Tax account. If they do not have an account, TP register using their tax identification number and national identification number.

The General Department of Taxation encourages individual taxpayers to register for electronic tax transaction accounts

Step 2: Select Inquiry and then Tax Liability Inquiry

Here, the system displays two sections:

Section I – Amounts payable, paid, payable, overpaid, exempted, written off, refunded, refunded, refund pending.

Section II – Amounts payable, overpaid, and refund pending that have been recorded in the tax management application system.

At this step, TP can inquire information including the amount of paid tax (refunded), the amount of tax payable, etc.

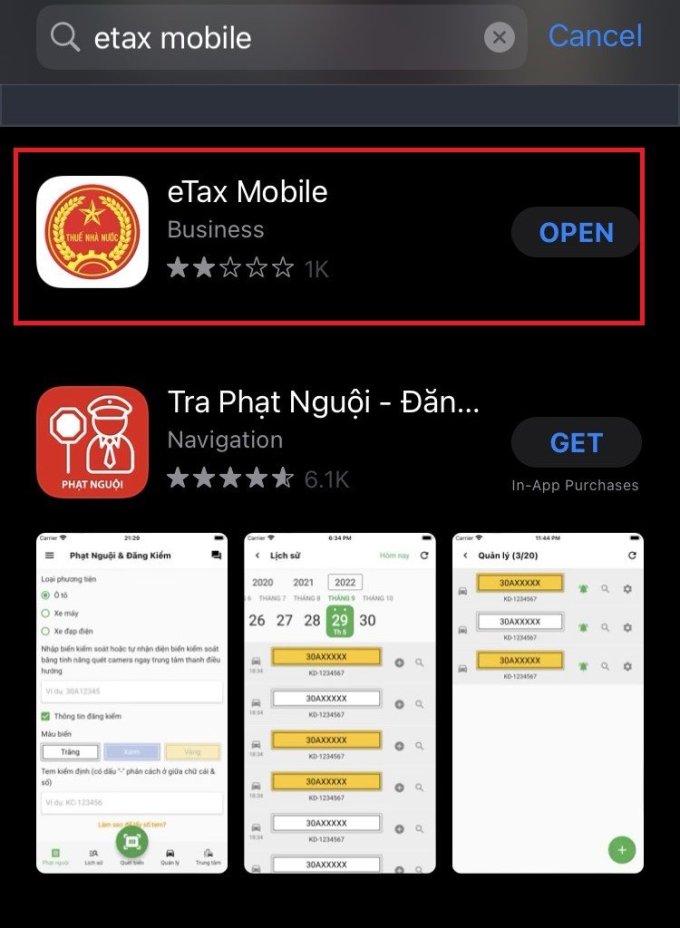

**Inquiry on the eTax Mobile Application**

Step 1: Log in with a registered account. If they do not have an account, TP register using their tax identification number and national identification number.