The Vietnamese stock market witnessed a bearish session with a sea of red on the screens. High selling pressure coupled with weak investor sentiment led to a sharp decline in various stocks, some even hitting their daily downward limit. At the close of August 5, the VN-Index plunged by 48.53 points or 3.92% to 1,188.07. Trading liquidity on HoSE improved, with the matched order value reaching VND 21,260 billion.

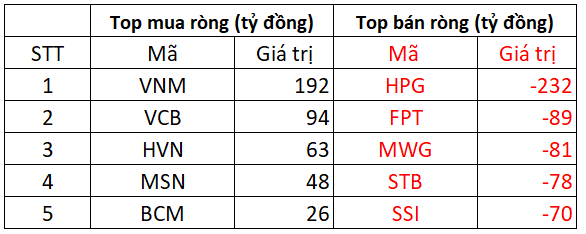

In terms of foreign trading, foreign investors offloaded Vietnamese stocks, recording a net sell value of VND 749 billion.

On the HoSE, foreign investors net sold VND 731 billion

Foreign investors heavily net sold HPG stocks, with a value of VND 232 billion. Several other Bluechip stocks also witnessed net selling by foreign investors: FPT (VND 89 billion), MWG (VND 81 billion), STB (VND 78 billion), SSI (VND 70 billion), etc.

On the buying side, VNM was the focus of foreign net buying with a value of VND 192 billion. This was followed by VCB, HVN, and MSN, which were net bought in the range of VND 48-94 billion.

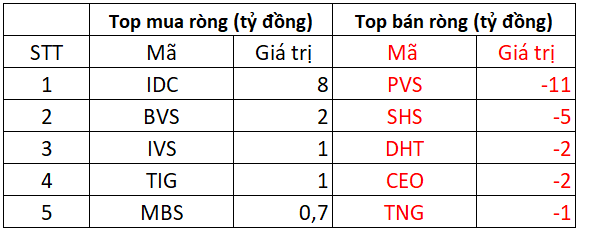

On the HNX, foreign investors net sold over VND 10 billion

On the buying side, IDC was net bought strongly with a value of VND 8 billion. BVS, IVS, and TIG were also net bought in the range of VND 1 to 2 billion each. Meanwhile, MBS was among the top net bought stocks on the HNX, but with a smaller value.

On the selling side, PVS faced the highest net selling pressure from foreign investors, with a value of nearly VND 11 billion. This was followed by SHS, DHT, and CEO, which were net sold in the range of a few billion VND each.

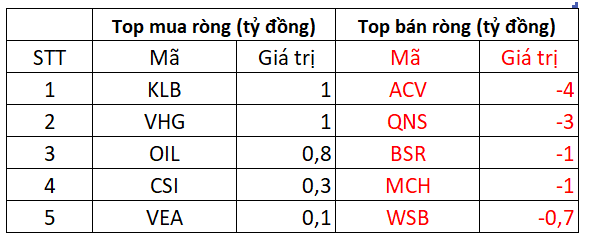

On the UPCOM, foreign investors net sold over VND 7 billion

On the other hand, ACV and QNS faced net selling pressure of around VND 3-4 billion each. Additionally, foreign investors also net sold BSR, MCH, WSB, and a few other stocks.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”