TPBank has announced an interest rate adjustment on its savings accounts, effective August 2nd. The bank has increased rates by 0.2% p.a. for terms ranging from 1 to 6 months for individual customers who opt for electronic savings accounts.

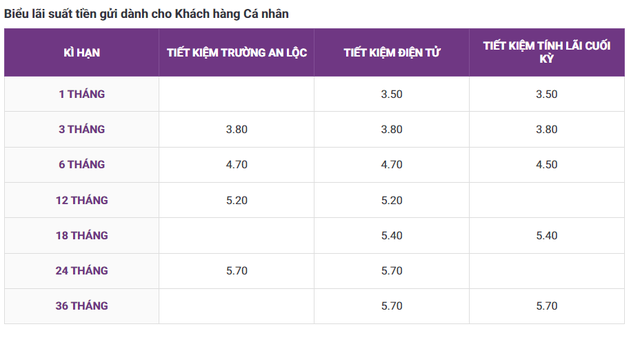

As a result, the 1-month term now offers an interest rate of 3.5% p.a., while the 3-month and 6-month terms stand at 3.8% p.a. and 4.7% p.a., respectively.

TPBank has maintained the interest rates for the remaining terms. The 12-month term earns an interest rate of 5.2% p.a., the 18-month term is at 5.4% p.a., and the 24- to 36-month term remains at 5.7% p.a.

Interest rates for individual customers.

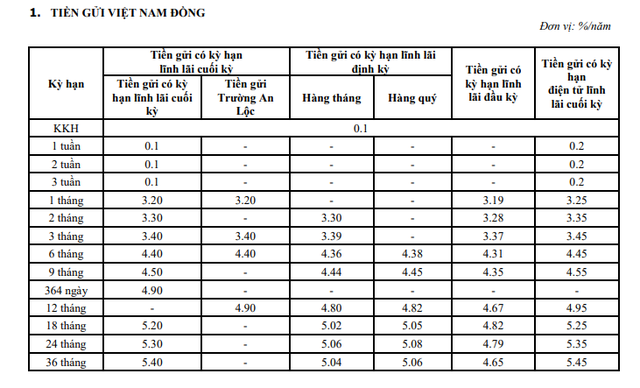

For business customers who choose to save online and receive interest at the end of the term, TPBank is offering an interest rate of 3.25% p.a. for the 1-month term, 4.45% p.a. for the 6-month term, and 4.95% p.a. for the 12-month term. The highest interest rate offered by the bank is 5.45% p.a. for the 36-month term.

Latest savings interest rates for business customers.

Latest TPBank Interest Rates for February 2024: Send via LiveBank for the highest interest rate

In February 2024, TPBank, a leading commercial bank in Vietnam, offers the highest deposit interest rates for individual customers. The interest rate is 5.2% per year for deposits made at TPBank’s counter and 5.25% per year for deposits made through LiveBank.