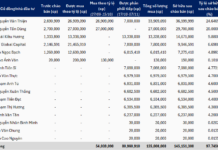

Technical Signals for VN-Index

During the morning trading session of August 7, 2024, the VN-Index witnessed a decline, accompanied by a significant drop in trading volume. This indicates a cautious sentiment among investors.

At present, the VN-Index is trending towards retesting the 200-day SMA as the Stochastic Oscillator continues its downward trajectory after previously signaling a sell-off. Should the sell signal be sustained and the index falls below this support level, the risk of a downward adjustment in the upcoming sessions heightens.

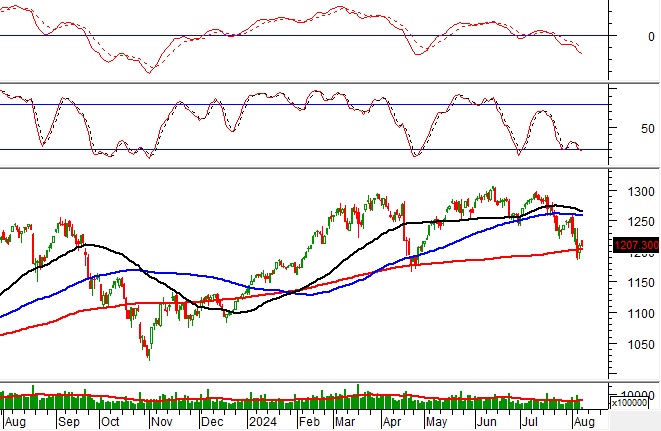

Technical Signals for HNX-Index

On August 7, 2024, the HNX-Index experienced a dip, along with a slight decrease in trading volume during the morning session, reflecting investors’ cautious attitude.

Additionally, the HNX-Index is retesting its June 2024 low (corresponding to the 219-225 point region) as the MACD indicator maintains its downward path after issuing a sell signal earlier. If the sell signal persists and the index breaks below this support area, the likelihood of a corrective phase intensifies in the forthcoming sessions.

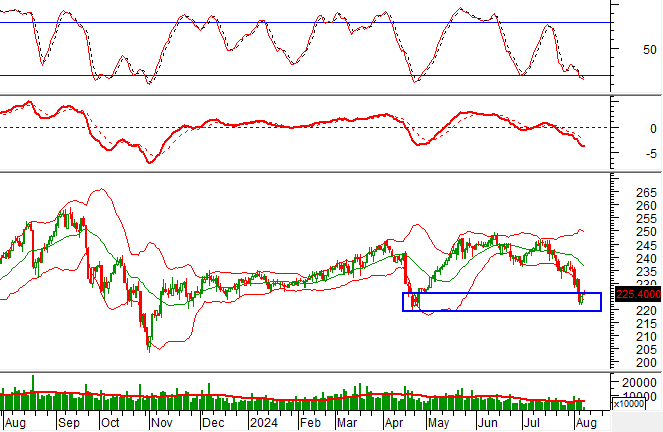

CTS – Vietnam Industrial and Commercial Bank Securities Joint Stock Company

On the morning of August 7, 2024, CTS witnessed a slight decrease in price alongside a notable surge in trading volume, indicating investors’ indecision.

Furthermore, the stock price is finding support from the 200-day SMA (equivalent to the 33,000-35,000 range) as the Stochastic Oscillator sustains its upward trajectory following a previous buy signal, suggesting that long-term optimism remains intact.

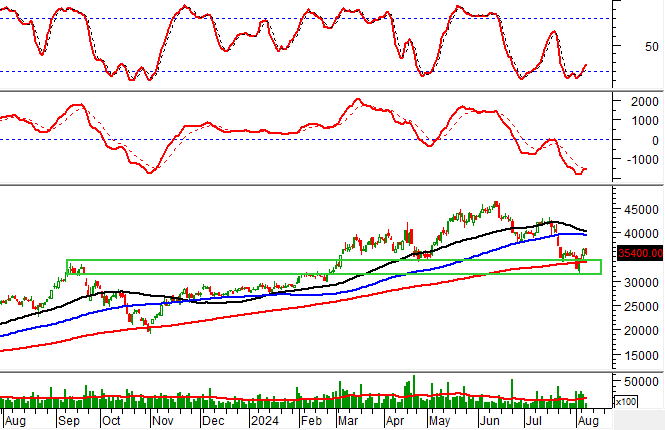

GAS – Vietnam National Gas Corporation – Joint Stock Company

During the morning session of August 7, 2024, GAS witnessed a price increase, accompanied by a substantial surge in trading volume, which is expected to surpass the 20-day average by the session’s end, reflecting investors’ optimism.

Additionally, the stock price has broken above the Middle line of the Bollinger Bands, and the MACD indicator is consistently widening the gap with the Signal line after providing an earlier buy signal. This suggests that the short-term recovery trend could resume in the upcoming sessions.

Technical Analysis Department, Vietstock Consulting