Joint Stock Commercial Bank for Foreign Trade of Vietnam, or Vietcombank, recently released a report on the management situation of FLC Group Joint Stock Company (stock code: FLC) for the first half of 2024. The report revealed that the company’s chartered capital stands at nearly VND 7,100 billion. As of June 30, 2024, Mr. Trinh Van Quyet held 215,436,257 FLC shares, accounting for 30.34% of the company’s charter capital. The report also disclosed that Mr. Trinh Van Quyet is related to an insider, Mr. Le Ba Nguyen, as Mr. Quyet is Mr. Nguyen’s brother-in-law.

Despite stepping down from his positions at FLC due to legal issues, Mr. Trinh Van Quyet remains the largest shareholder in the corporation.

Defendant Trinh Van Quyet has the final word. Photo: HP

According to the report, apart from Mr. Trinh Van Quyet, other individuals and organizations related to Mr. Le Ba Nguyen do not own any FLC shares. Neither Mr. Nguyen nor his sister, Ms. Le Thi Ngoc Diep (Mr. Quyet’s wife), hold any shares in the corporation.

In the first half of 2024, there were no transactions involving the transfer of FLC shares related to insiders or individuals related to insiders. Currently, FLC Group is still suspended from trading and there is no information about their plans to return to the UPCoM exchange. This suspension is due to FLC’s repeated violations of information disclosure obligations and failure to report, especially financial reports, to investors and the public.

FLC Experiences Changes in Senior Management

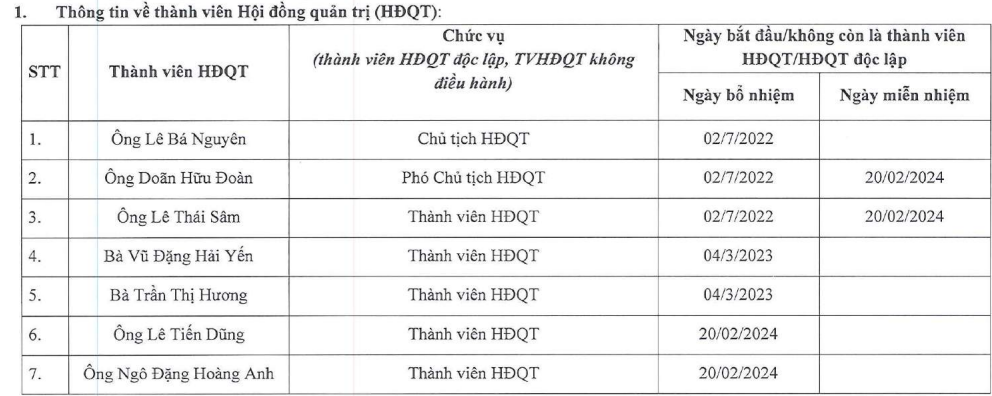

In the first half of this year, FLC made changes to its senior management team. As of now, the FLC Board of Directors consists of 5 members, including Mr. Le Ba Nguyen as Chairman, Ms. Vu Dang Hai Yen, Ms. Tran Thi Huong, Mr. Le Tien Dung, and Mr. Ngo Dang Hoang Anh. In the last 6 months, the FLC Board of Directors has issued 16 resolutions covering various matters, such as approving the resignation of Mr. Tran The Anh from his position as Deputy General Director and making changes to representatives in some companies where FLC has invested.

FLC Board Members (as of June 30, 2024). Photo: MH

Previously, the resolutions of the Annual General Meeting of Shareholders, issued in February 2024, approved the dismissal of 4 personnel, including the dismissal of Mr. Doan Huu Doan and Mr. Le Thai Sam from their positions as members of the Board of Directors effective February 20; and the dismissal of Mr. Nguyen Tri Thong and Mr. Nguyen Quang Thai from their positions as members of the Supervisory Board from the same date. Additionally, the resolutions approved the election of Mr. Le Tien Dung and Mr. Ngo Dang Hoang Anh as members of the Board of Directors for the term 2021 – 2026, and the election of Ms. Nguyen Thi Van Anh and Ms. Nguyen Thu Hien as members of the Supervisory Board for the same term.

Since the arrest of Mr. Trinh Van Quyet and several other leaders and officers of the FLC ecosystem in 2022, the corporation has faced challenges in its business operations and financial reporting.

The Hanoi People’s Court sentenced former FLC Chairman Trinh Van Quyet to 21 years in prison. Photo: VOV

Yesterday afternoon (August 5), after 14 days of trial and deliberation, the Hanoi People’s Court announced the verdict for former FLC Chairman Trinh Van Quyet and 49 other defendants in the case of “Fraudulent Appropriation of Property” and “Stock Market Manipulation”. Specifically, Mr. Trinh Van Quyet was sentenced to 3 years in prison for stock market manipulation and 18 years for fraud, resulting in a total sentence of 21 years in prison.

For the same charges, the defendants: Trinh Thi Minh Hue (accounting staff of FLC Group, Mr. Quyet’s sister) was sentenced to 14 years in prison; Trinh Thi Thuy Nga (Deputy General Director of BOS Securities Company, Mr. Quyet’s sister) was sentenced to 8 years in prison; Huong Tran Kieu Dung (Permanent Vice Chairman of FLC Group) was sentenced to 8 years and 6 months in prison; and Trinh Van Dai (Deputy General Director of FLC Faros Construction Joint Stock Company and Mr. Quyet’s cousin) was sentenced to 11 years in prison.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.

An HR member of the Big4 team with higher salary and bonus than the Chairman and CEO

Vietcombank, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, has recently released its financial report for the fourth quarter of 2023. In this report, the bank has disclosed the figures for the salaries, wages, and bonuses of the executives within the Board of Directors and the Executive Board.