“TAN BINH” AEON ENTERTAINMENT AND ITS PARTNERSHIP WITH BETA

AEON Entertainment and Beta Media have announced a joint venture with plans to invest 5,000 billion VND in 50 cinema complexes by 2035. The venture will focus on developing and operating 50 premium cinemas under the AEON Beta Cinema brand, with the first theater scheduled to open in 2025.

This partnership also includes domestic film production and distribution plans.

AEON Entertainment is a subsidiary of Japan’s AEON Group and is currently the largest cinema chain in the country, owning 96 theaters.

AEON’s entry into the film industry promises to intensify competition in an already competitive market. This “pie” is also very lucrative, as Vietnam has seen the emergence of “billion-dollar directors” such as Tran Thanh with his works Mai, Nha Ba Nu, Cua Lai Vo Bau, and more recently, Ly Hai with “Lat Mat 7.”

Tran Thanh’s film, Mai

While the global box office showed signs of decline in 2023, with significant decreases in the APAC region, North America, and South Korea, Vietnam was among the top-performing countries compared to prominent film markets worldwide.

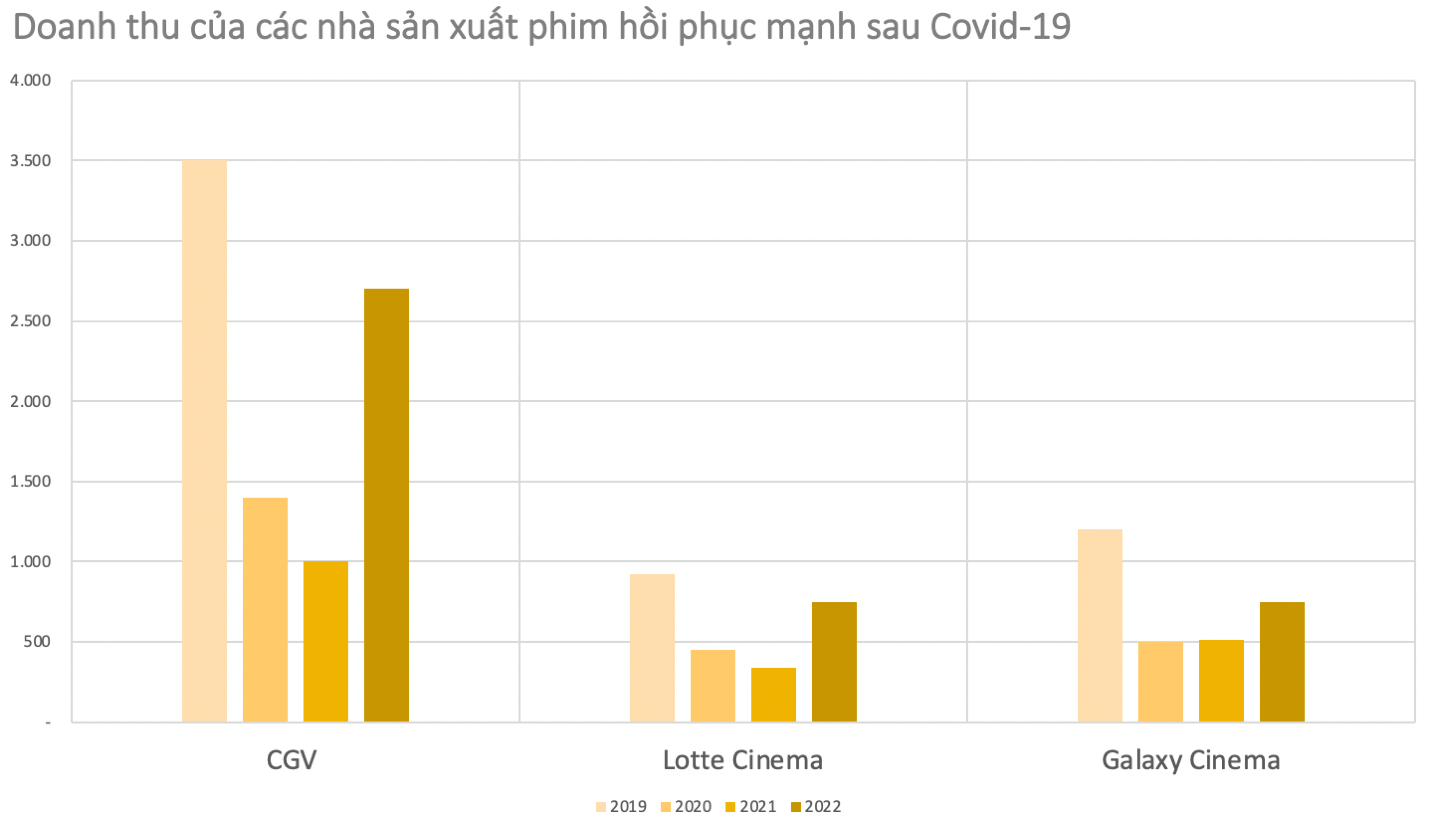

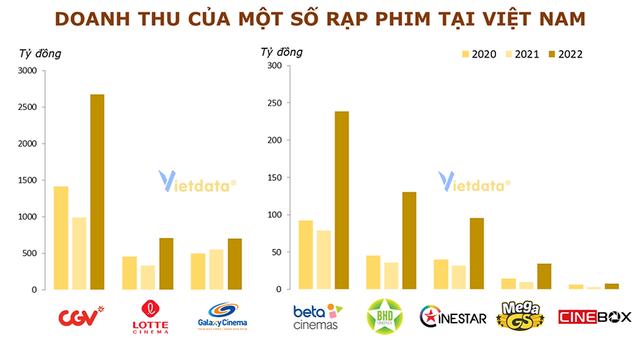

This recovery is also reflected in the business indices of film production units in Vietnam. Most companies recorded robust revenue growth in 2022, including CGV with nearly VND 2,700 billion, doubling that of 2021 and a 170% increase compared to 2020. Lotte Cinema and Galaxy also doubled their revenue to VND 800 billion.

Image: Revenue of the Top 3 film producers today.

MARKET SHARE DIVISION?

Beta Cinema has been positioned as a low-cost theater chain, but its partnership with the Japanese “giant” AEON elevates the brand into the premium segment currently dominated by CGV and Lotte.

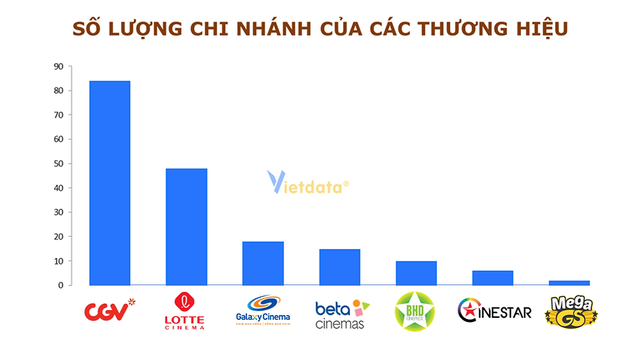

Not only the premium segment but, in reality, the majority of the market share of Vietnam’s cinema market is held by CGV and Lotte Cinema. According to the latest statistics from Statista in collaboration with Q&Me in 2022, CGV leads the market with a 45% share, followed by Lotte Cinema with 26%. Thus, these two Korean brands hold a combined 71% market share.

Data: VietData

CJ CGV is South Korea’s largest multiplex cinema chain, with branches in Vietnam, China, and the US. It is a subsidiary of CJ Group, one of South Korea’s most prominent economic conglomerates, with a presence in 21 countries worldwide.

Lotte Cinema, another leading brand in the Korean film industry, entered Vietnam in 2008. After nearly 15 years in the market, Lotte Cinema Vietnam has expanded to nearly 50 cinema complexes nationwide.

The remaining market share belongs to companies like Galaxy Cinema, BHD Star, Cineplex, Cinestar, and Beta Cinemas. Among these, two Vietnamese private companies, Galaxy, and BHD, hold 10% and 5.5% market share, respectively. Another Vietnamese cinema brand that has developed recently is Beta Cinema, with an 8% share. In contrast, state-owned cinemas hold only about 2% of the market.

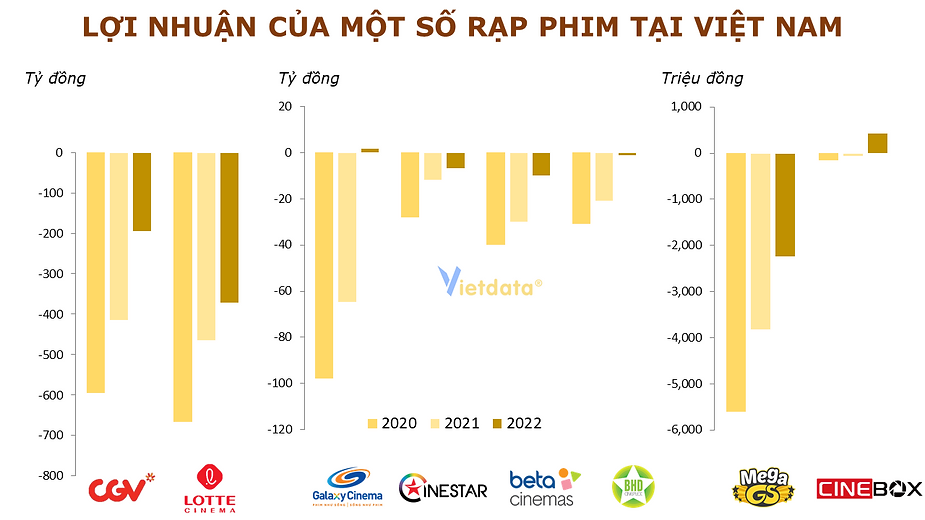

The expensive race to invest in cinemas has led to significant losses for these “giants.” From 2020 to 2022, CGV incurred a total net loss of VND 1,200 billion. Lotte Cinema lost more than VND 2,200 billion in the four years from 2019 to 2022. AEON’s partner, Beta Cinemas, has also suffered losses of hundreds of billions of VND in recent years.

Data: Vietdata

In 2023, thanks to the domestic film industry’s box office success, CGV Vietnam announced an operating profit of nearly VND 260 billion, a 38% increase from 2022’s figure of VND 188 billion. According to the business results report of CJ CGV Co., Ltd. (South Korea), revenue in the Vietnamese market in 2023 reached nearly KRW 185 billion (over VND 3,400 billion), a more than 23% increase compared to the previous year.

Present in Vietnam since 2009, as of July 10, 2023, AEON Vietnam has a charter capital of up to VND 192 million USD with 500 employees. The company has left its mark on the market with Aeon Mall Tan Phu (Ho Chi Minh City), Aeon Mall Binh Duong, Aeon Mall Ha Dong and Long Bien (Hanoi), and Aeon Mall Le Chan (Hai Phong). The total area of these hypermarkets can reach up to 10 hectares (Aeon Ha Dong), with rentable areas ranging from 49,000 sqm to 84,000 sqm.

In the first quarter of 2024, Vietnam was the region with the highest operating revenue growth among AEON’s overseas markets, accounting for approximately 48% of total operating revenue in the Southeast Asian market, while operating profit accounted for nearly 92%.

In a meeting with Prime Minister Pham Minh Chinh in May 2023, the Executive Chairman of the AEON Group stated that the company had invested over USD 1.18 billion in Vietnam and continues to choose the country as its second most important market (after Japan). AEON is also expanding its smaller supermarkets and specialty stores in major cities like Hanoi and Ho Chi Minh City.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.