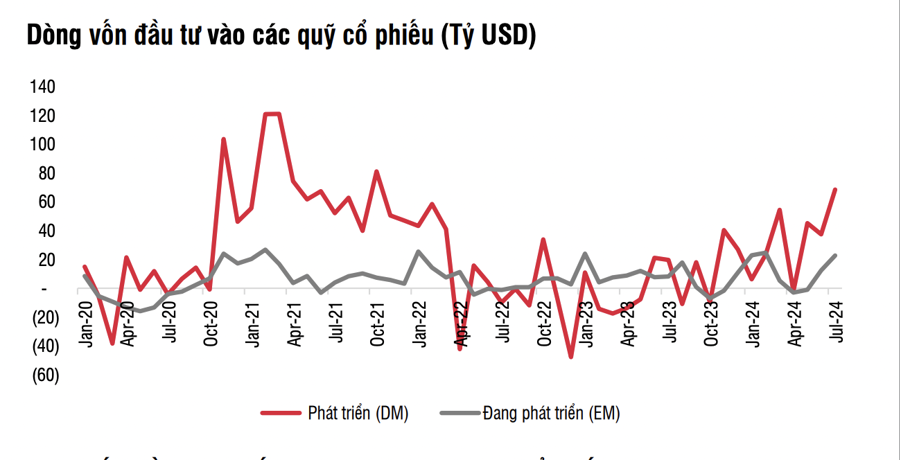

Global financial market flows, which had been positive for some time, began to show signs of reversal following political news, elections, and recession risks in the US.

COOLING GLOBAL MONEY FLOW IN EQUITY FUNDS

Inflows into equity funds in July continued to boom, with a net inflow of $91 billion, nearly double the previous month and the highest monthly net inflow since March 2021. The investment sentiment remained optimistic due to the monetary policy effect after moves by major central banks worldwide. Developed market funds attracted 68.4 billion dollars, far surpassing emerging market funds, which saw 22.7 billion dollars in inflows, according to new data from SSI Research.

Bond funds and money market funds continued to attract net inflows of 75 billion dollars and 58 billion dollars, respectively. Notably, inflows into bond funds reached their highest level since June 2020, driven by the US market.

Additionally, inflows into emerging market bond funds recorded a slight net inflow after 17 consecutive months of outflows, thanks to surging demand in the Chinese market and India’s recent inclusion in the JP Morgan emerging market bond index from July.

Overall, in the first seven months of 2024, financial asset inflows maintained a positive pace, with equity funds receiving 316.6 billion dollars, bond funds 366.8 billion dollars, and money market funds 285 billion dollars.

However, political and electoral uncertainties, along with recession risks in the US, began to surface towards the end of the month, causing capital flows to slow down in the final days of July. A survey by BofA also indicated a cooling in the optimism of fund managers in July, with cash allocations edging up to 4.1% from 4% in June.

In the developed markets, equity funds recorded net inflows of 68.4 billion dollars in July, the highest monthly net inflow since October 2021. Money continued to flow into the US market in July (+62.9 billion dollars), with expectations of interest rate cuts driving capital towards small-cap stocks and interest rate-sensitive stocks. July also saw the Russell 2000 index outperform the Nasdaq 100 significantly.

In the first seven months, developed market equity funds recorded net inflows of 233 billion dollars, mainly in the US market (195 billion dollars).

Emerging market equity funds benefited from positive investment sentiment and capital rotation in July, with net inflows of 22.7 billion dollars, nearly double the previous month’s inflows. This was mainly due to multi-country ETF inflows into the Chinese market (+19.9 billion dollars). The Indian market continued its 16th consecutive month of net inflows, attracting 2.6 billion dollars, not significantly different from previous months.

Among Southeast Asian countries, Malaysia stood out with inflows of 25 million dollars, while the other countries experienced significant outflows.

“After a volatile July, especially towards the end, equity fund inflows are likely to be more cautious in August as they assess recession risks in the US,” said SSI Research.

FOREIGN FUNDS EXPECTED TO RETURN IN Q4

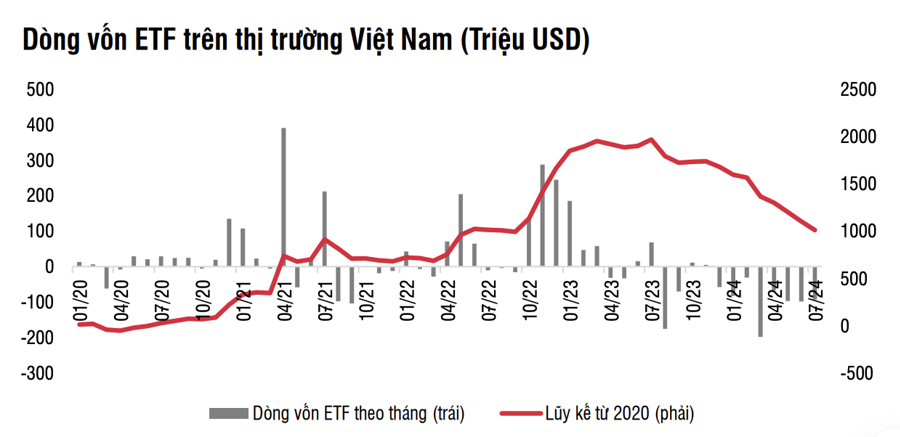

In Vietnam, capital flows were mixed, but the overall trend remained negative. ETFs continued to withdraw capital in July, with a total volume of -2.33 trillion VND, representing 3.5% of total assets. Since the beginning of the year, ETFs have withdrawn a net total of 18.5 trillion VND, equivalent to -24.4% of total assets at the end of 2023, bringing the total assets of ETFs to 59.9 trillion VND.

There was a divergence in capital flows among ETF groups, with the most significant withdrawal pressure observed in DCVFM VNDiamond (-1.48 trillion VND), Fubon (-925 billion VND), and Xtracker FTSE (-316 billion VND). On the other hand, KIM Growth VN30 (+132 billion VND) attracted capital for the fourth consecutive month, while DCVFM VN30 (+310 billion VND) saw a reversal of capital inflows this month.

SSI Research expressed caution as the liquidation of the iShares Frontier fund could temporarily hinder Vietnam’s ability to attract capital inflows into multi-country ETFs, along with the ongoing capital rotation. Additionally, Vietnam’s index fund options are not very diverse, mainly based on the VN30 and VN Diamond indices.

Active funds performed poorly in July, with capital outflows occurring evenly across funds investing solely in Vietnam and multi-country funds. Overall, approximately 1.4 trillion VND was withdrawn in July (compared to 1.6 trillion VND in June), bringing the total net outflows since the beginning of the year to about 7.7 trillion VND, or 2.2% of the total fund assets.

Specifically, funds investing solely in Vietnam withdrew about 350 billion VND, and only a small number of funds recorded net inflows in July. For multi-country funds, capital continued to flow out significantly in July (estimated at more than 1 trillion VND).

A positive development in July was the Ministry of Finance’s announcement of a draft circular highlighting the permission for foreign institutional investors to conduct margin trading within the T+2 period with the support of securities companies. It is expected that this circular will come into effect in Q4 2024, creating conditions for foreign investment funds to consider reinvesting in the Vietnamese market.