In a recent development, India Times reported on the statement made by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) regarding the complete shutdown of all garment manufacturing facilities, causing significant disruption to the country’s vital garment industry. This decision comes on the heels of the sudden resignation and departure of Prime Minister Sheikh Hasina.

The closure of garment factories in Bangladesh, a global manufacturing hub, will severely impact major brands such as H&M and Zara.

H&M sources apparel from over 1,000 factories in Bangladesh, while Zara heavily relies on domestic clusters.

Bangladesh’s export-oriented garment factories are impacted by political events.

Amid the ongoing political unrest, H&M has stated that they are closely monitoring the situation in Dhaka and will not request discounts from suppliers for any delays caused by the current circumstances.

“Based on the latest information, most factories are gradually reopening, and safety remains our top priority,” said an H&M spokesperson. “We have assured our suppliers that we will not request discounts due to delays in the current situation. We continue to assess the situation on a daily basis.”

The Confederation of Indian Textile Industry (CITI) has warned that many global brands relying on Bangladeshi suppliers will face disruptions.

Delays and reduced product availability could significantly impact inventory levels and sales in the global retail market.

The closure of garment factories in Bangladesh is expected to have a global impact.

Inditex, the parent company of Zara and Bershka, has significant production operations in Bangladesh, with 150 suppliers and 273 garment factories employing nearly a million workers.

The shutdown of garment factories in Bangladesh amid political turmoil poses a significant challenge to the global garment industry.

With major brands heavily reliant on Bangladeshi production, the disruption could lead to far-reaching consequences in the global retail market. As the situation evolves, stakeholders continue to closely monitor developments, hoping to find a resolution that restores stability and normalcy to this critical industry.

The Garment Industry’s Significance for Bangladesh’s Economy

The garment industry plays a crucial role in Bangladesh’s economy, accounting for approximately 83% of the country’s total revenue.

The political crisis in Bangladesh has caused significant instability. Reports of looting in Dhaka and other major cities have surfaced, with images of protesters ransacking the official residence of Prime Minister Sheikh Hasina circulating on social media. The country is currently in a transitional phase, awaiting the formation of an interim government.

In 2020, Bangladesh slipped to the third position as a garment exporter to Vietnam, earning $27.47 billion compared to Vietnam’s $29.80 billion, according to Textile Today.

Vietnam and Bangladesh consistently compete for positions in the global garment exports ranking.

Bangladesh regained its second position in 2021 with $35.81 billion in export earnings and maintained it in 2022. Additionally, Bangladesh’s market share in the global garment industry increased to 7.9%.

Bangladesh is the second-largest garment exporter, with garment exports totaling $45 billion in 2022. As usual, China remains in the top position. However, in this sector, Bangladesh consistently faces competition from another Asian country, Vietnam, which has also retained its third position.

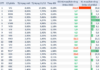

Meanwhile, the 2023 World Trade Statistical Review outlined the exports, market share, and growth rates of the top 10 garment-exporting countries.

It showed that China was the leading exporter of clothing in the global market in 2022, with conventional clothing exports worth $182 billion. However, China’s market share in global clothing exports decreased to 31.7% last year from 32.8% in 2021.

During the same period, Vietnam maintained its third position as a garment exporter with exports worth $35 billion and a market share of 6.1%. Turkey emerged as the fourth-largest garment exporter with a 3.5% global market share and garment exports worth about $20 billion in 2022. It was followed by India, with a 3.1% market share and garment exports worth $18 billion.