The Dragon Capital Vietnam Securities (VDSC) August 2024 strategic report revealed that the first few sessions of August witnessed a negative reaction, following the adjustment trend of global stock markets. The pace of the index adjustment was more rapid than the macroeconomic picture in the first half of 2024.

With a swift and significant adjustment, largely in tandem with global stock market movements rather than reflecting a bleak business performance of enterprises, the analysis team anticipates a swift market rebound.

VDSC also noted that alongside high economic growth in the first half, the six-month business results of listed companies tended to recover and grow in most sectors, especially since the beginning of Q2/2024, thanks to increased scale, improved asset turnover, and profit margins.

In 2024, market-wide EPS growth is expected to reach 14-18%, driven by the banking and real estate sectors, with a growth trend maintained in other sectors.

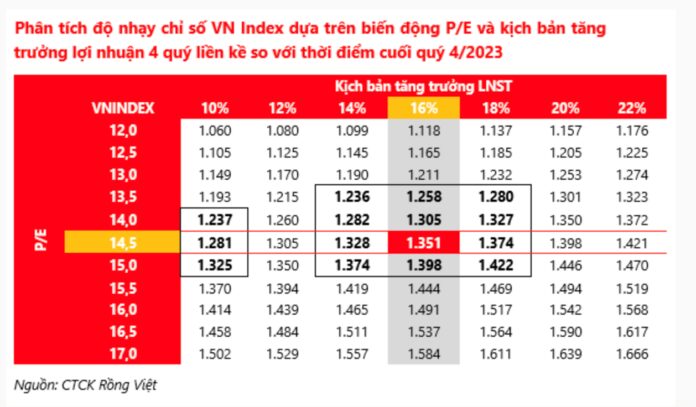

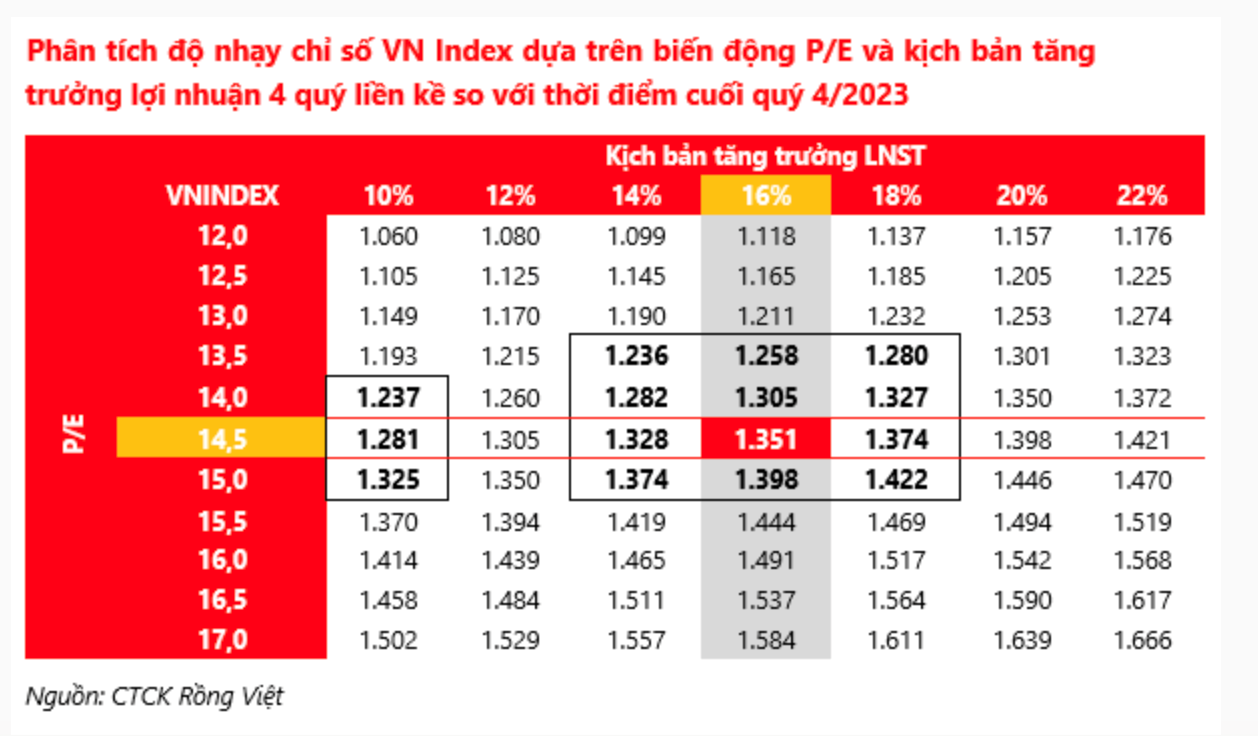

A yield gap of over 4% typically occurs when unexpected headwinds arise, which usually pass quickly, allowing the market to rebalance and recover. A reasonable P/E range for the index in Q3/2024 is expected to be 14x-15x, corresponding to a balanced trading range for the VN-Index of 1,237-1,325.

In the long run, based on profit growth prospects and a P/E trading scenario of 13.5-15 times, the reasonable range for the VN-Index is 1,236-1,420, reflecting the improved business results in 2024 compared to 2023.

However, VDSC pointed out that risks remain in the market, including the message and perspective on monetary policy management by the US Federal Reserve (Fed), geopolitical tensions, and the domestic corporate bond market.

“Although, in the end, headwinds will pass, the stock market often reacts strongly and negatively than reality. This could cause the VN-Index to fluctuate more negatively than the index’s fair valuation,” the VDSC report stated.

Selected investment opportunities for the second half of 2024, according to VDSC, include enterprises maintaining a recovery/profit growth trend in consumer goods, steel, banking, industrial park, and seafood sectors.