According to VDSC, the market has almost fully reflected the results of the fourth quarter of 2023. However, the spotlight is now shifting to the first quarter of 2024, with investors eagerly waiting for the upcoming earnings reports.

During most of the trading time in March, the market will not be heavily influenced by the first quarter earnings results. However, the macroeconomic data from February indicates a recovery trend in Vietnam’s production and investment during the initial two months of the year. This can be considered a fundamental factor that will support the expectations of listed companies’ earnings growth.

VDSC has highlighted a few events and factors to be aware of in March, including:

The monetary policy direction to be proposed during the March meetings of major central banks. The base scenario is that central banks, including the US and Western banks, will reverse their monetary policies in the second half of 2024, while the Bank of Japan may end its period of super-loose monetary policy earlier.

In the short term, the VN-Index’s P/E ratio approaching 15 times can put pressure on the market as foreign investors tend to sell when the valuation is higher than this threshold.

The positive net trading state of foreign investors is expected to return as capital flows from dollar-denominated assets begin to be reallocated following the reversal of monetary policy by Western countries. Additionally, the clearer prospects for Vietnam’s market upgrade after the resolution of bottlenecks will further strengthen investor confidence.

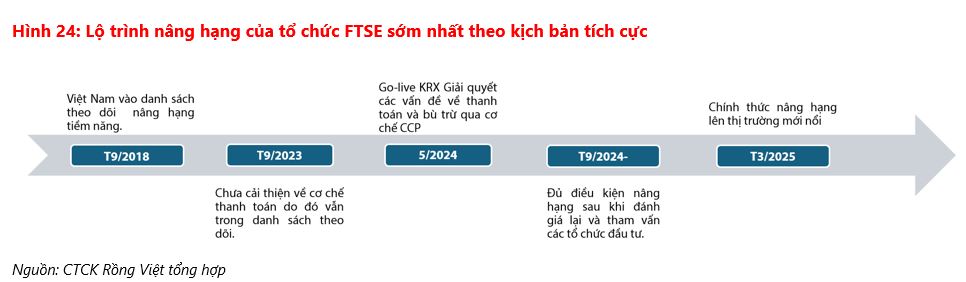

Furthermore, the market upgrade based on FTSE’s classification criteria is likely to be postponed until September instead of the upcoming review in March, as the criteria related to “Settlement and Clearing” have yet to be completed. However, positive results from the trial operation of the KRX system (a technical bottleneck for implementing the settlement and clearing mechanism) will reinforce the market’s belief in an official operation scenario in May.

In terms of performance, the VN-Index has experienced a four-month upward streak, accumulating a profit of 21.7% since the first point increase, and reaching the 7th highest level among 9 strong point increase streaks since 2009. The market may face profit-taking pressure from some investors, but positive data provide support for market income expectations. With balanced factors pushing and pulling, VDSC expects the VN-Index to fluctuate within a narrow range of 1,210-1,290 in March.

In this scenario, investors are encouraged to realize profits when their held stocks achieve a reasonable profit level for short- to medium-term investments. Portfolio status should avoid excessive leverage to avoid unexpected declines.

With expectations of steady money flow rather than market withdrawal, investors can focus on stocks and sectors with optimistic prospects in 2024, which have not seen corresponding price increases in the recent period.