In a recent report on the steel industry by VCBS, the securities firm gave a negative assessment of steel businesses, despite a recovery in domestic steel sales in the first half of 2024.

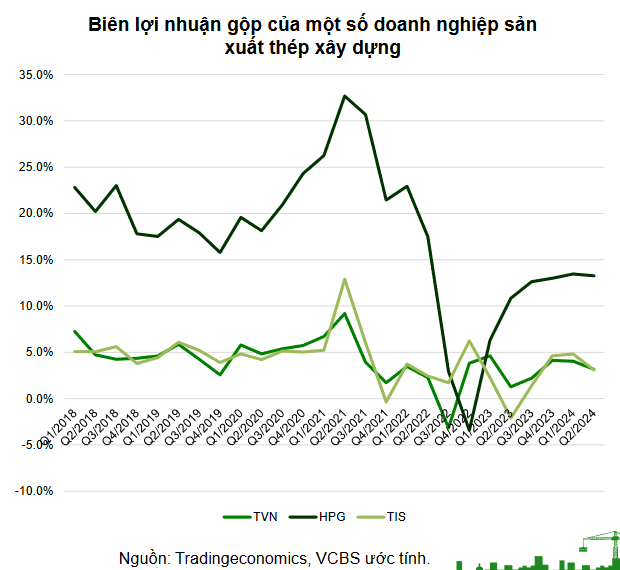

BUILDING CONSTRUCTION STEEL COMPANIES’ PROFIT MARGINS ARE HISTORICALLY LOW

Regarding building construction steel companies, VCBS stated that while there has been a recovery in profit margins for these businesses, they remain significantly lower than historical levels due to decreasing prices of domestic construction steel amid weak domestic construction demand and intense competition from lower-priced Chinese imported steel.

High input costs for raw materials such as iron ore and coke in Q4 2023 and Q1 2024, along with increased electricity prices, have put pressure on the steel industry (electricity costs account for about 10% of the cost of goods sold).

VCBS also noted that Hoa Phat is one of the few profitable steel producers in Vietnam, while other manufacturers are downsizing, liquidating assets, or selling stakes to foreign partners to raise capital.

Although business results have hit rock bottom, VCBS believes that the recovery process is slow and challenging.

On a positive note, profit margins for Vietnam’s coated steel exporters have rebounded strongly after a period of poor performance. This is mainly due to the strong recovery in imports from the EU and the US, coupled with a potential shortage of supply in these regions. Additionally, stable HRC prices in Q1 have helped companies avoid significant inventory adjustments in Q2 (coating steel companies usually import inventory three months in advance).

IMPACT OF ANTI-DUMPING TAX POLICIES

The implementation of temporary anti-dumping measures on HRC and coated steel products from China, India, and South Korea is expected to take effect as early as October or November 2024. VCBS assesses that these policies are feasible and will likely have the most impact on HRC products.

With Hoa Phat’s increased HRC capacity, the domestic market will be the main consumer, and the imposition of anti-dumping taxes will have a significant impact, as 60-70% of the industry’s consumption comes from imports.

Furthermore, VCBS believes that the impact of anti-dumping policies on coated steel products will be less significant than in the 2016-2017 period. This is because imports from China and South Korea account for only 30% of domestic consumption (a low figure compared to 100-110% in 2016-2017). China can also easily circumvent these taxes by redirecting exports through neighboring countries.

VCBS expects that after the application of anti-dumping taxes on coated steel products, domestic production may increase by about 10-15% from current levels (accounting for the loss of Chinese and South Korean steel production due to the taxes).

PROSPECTS FOR THE STEEL INDUSTRY

In the first half of 2024, domestic consumption of building construction steel reached 3.8 million tons (up 4% year-on-year), steel pipes increased by 3%, and coated steel rose by 22%.

This recovery is attributed to the rebound in the domestic real estate market in both the North and South, with the number of construction projects at a high level not seen in many years. This is thanks to improved legal environment and low-interest rates stimulating real estate demand.

Additionally, the market for residential construction has recovered as low construction material prices have encouraged people to build houses after waiting for a decrease in raw material prices and improved income following a challenging 2023.

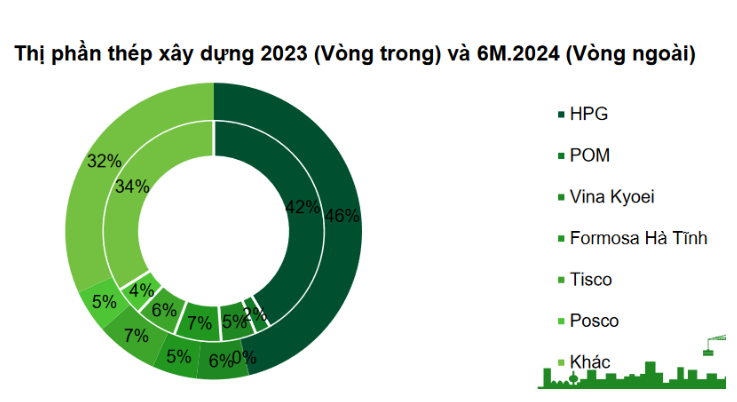

In terms of market share, Hoa Phat has continued to increase its dominance in the building construction steel sector by strengthening its position in the domestic market while other manufacturers struggle to maintain their operations. According to VCBS, Hoa Phat’s market share in the first half of 2024 was 46%.

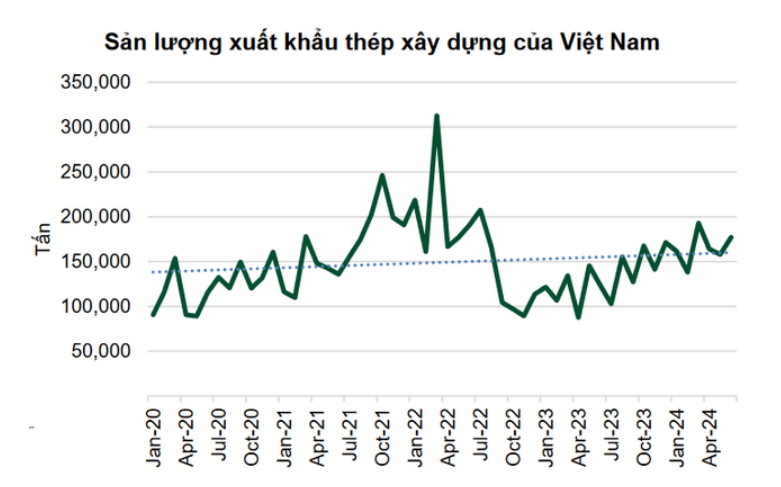

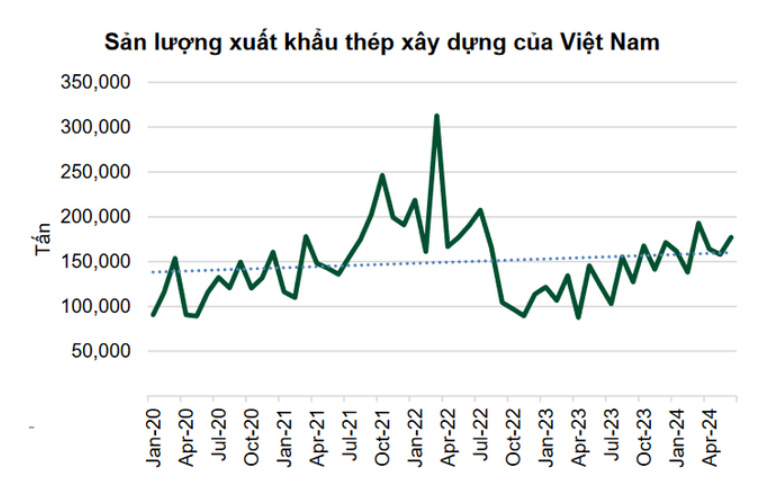

Export sales have also recovered, supporting consumption. While exports of building construction steel have recovered, they remain at low levels similar to the beginning of 2021 due to the global surplus of this type of steel.

Coated steel exports, though not yet at the high levels of 2021, continue to show a strong recovery. On the other hand, HRC exports surged in 2023 and Q1 2024 but declined in Q2 2024, which VCBS attributes to the resumption of production by domestic manufacturers in import markets and increased protectionism for HRC products in the EU.

Regarding the prospects for the steel industry, VCBS believes that import demand for steel in countries like the US and EU will remain robust as these countries lower interest rates and stimulate their economies. However, a point of risk is the potential for anti-dumping measures against Vietnamese steel to protect the recovering domestic industries in these countries, as well as reduced imports due to the resumption of operations of local factories.

Domestic consumption is expected to continue its strong recovery, driven by the rebound in Vietnam’s residential real estate market, with the number of projects remaining high in both the North and South. Moreover, increased public investment in the second half of the year is anticipated to boost growth for the entire industry.