The Hanoi Stock Exchange (HNX) has announced administrative sanctions for tax violations by the Hanoi Department of Taxation against Thang Long Investment Group Joint Stock Company (stock code: TIG), with a total fine of nearly VND 4.2 billion.

Specifically, the group was fined nearly VND 550 million for false declaration, resulting in an underpayment of taxes. They were required to pay the outstanding tax amount of nearly VND 2.8 billion and late payment charges of VND 847 million.

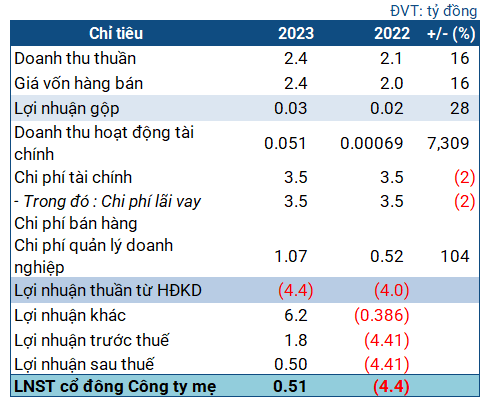

In the second quarter of 2024, Thang Long Investment Group reported a 25% year-on-year increase in net revenue, totaling VND 312 billion, and a 6% rise in after-tax profit, reaching VND 71 billion.

For the first six months of 2024, the group’s net revenue surged by 44% to over VND 718 billion. However, after deducting expenses, their after-tax profit decreased by nearly 7% compared to the previous year, amounting to VND 121.9 billion.

Hattoco 110 Tran Phu Ha Dong Mixed-use Building Project. Source: Thang Long Investment Group’s Website

As of the end of June 2024, the group’s payables remained unchanged from the beginning of the year at VND 1,558 billion. Of this, total loans and finance leases amounted to over VND 948 billion, accounting for nearly 61%. Inventory value slightly decreased from the beginning of the year to VND 342.7 billion.

Thang Long Investment Group operates in the fields of commerce, services, real estate investment, and financial investment.

According to their website, the group owns several real estate projects, including the Vuon Vua Resort & Villas project (Phu Tho province), the Viettronics – Ha Thanh Mixed-use Building project, and the Hattoco 110 Tran Phu Ha Dong Mixed-use Building project in Hanoi.

In the market, TIG shares are currently trading at VND 12,800 per share, a slight increase from the reference price and the beginning of 2024.