In its recently published financial results for the first half of 2024, the largest retailers in the market, spanning technology, electronics, fast-moving consumer goods, food, and pharmaceuticals, revealed that they had to close hundreds of stores to optimize profits.

A Wave of Openings and Closures

What came as a surprise was FPT Shop’s move to inaugurate ten electronics stores simultaneously in Ho Chi Minh City and various provinces, including Binh Duong, Dong Nai, and Tien Giang, at the beginning of August. This expansion signaled the emergence of a new electronics and home appliance chain in the market.

FPT Shop ventures into the electronics and home appliance market, competing with The Gioi Di Dong. (Photo: H. Anh)

FPT Shop’s electronics stores offer a diverse range of products, including televisions, refrigerators, air conditioners, washing machines, and home appliances from dozens of well-known brands familiar to consumers. Notably, these electronics stores also feature a small section selling phones, computers, and technology products, akin to The Gioi Di Dong’s Dien May Xanh stores.

Mr. Nguyen Viet Anh, Deputy General Director of FPT Retail, considers the simultaneous launch of ten electronics stores as a significant step in the company’s investment and development strategy for the electronics and home appliance sector. The company aims to continue expanding, targeting 50 electronics stores by the end of 2024.

Electronics and home appliances are entirely new product categories for FPT Shop, as the retailer only entered this market seven months ago, at the beginning of 2024.

At the 2024 Annual General Meeting of Shareholders held in April, FPT Retail’s Chairwoman, Ms. Pham Bach Diep, anticipated uncertainties in the ICT industry (phones and technology devices) for 2024, expecting stagnant or declining performance in the first half of the year. Consequently, the company decided to focus on high-growth sectors, including electronics, despite its novelty.

According to Ms. Diep, the electronics and home appliance segment currently contributes less than 5% to FPT Shop’s revenue but holds significant growth potential.

”

Our goal for 2024 is to boost the electronics business, increasing both its contribution and the scale of the chain, with an expected growth rate of 50-100%

,” Ms. Diep stated.

Notably, FPT Shop’s entry into the electronics market comes amid the closure of hundreds of its computer and phone stores. In its financial report for the first half of 2024, FPT Retail (FRT) disclosed that hundreds of FPT Shop stores had been shut down, with approximately 100 closures in the second quarter alone.

These closures are part of an effort to optimize the store network and “restructure” the FPT Shop chain.

The phone and technology sector continues to face challenges as consumers tighten their spending, leading to the closure of hundreds of stores selling these products each month. (Photo: P.M)

As of the end of June 2024, FPT Shop operated 642 phone and computer stores nationwide. The company’s revenue for the first half of 2024 decreased by 15% compared to the same period in 2023, reaching VND 6,923 billion. The average revenue per store was approximately VND 1.6 billion per month.

Following a similar strategy to FPT Shop, Bach Hoa Xanh has been actively expanding its presence, with its recruitment fan page regularly announcing new store openings. In July alone, Bach Hoa Xanh opened seven stores in Ho Chi Minh City, and it plans to open seven more in August in Ho Chi Minh City, Long An, Binh Duong, and Dong Nai. This pace is significantly faster than in May and June, when only 2-3 stores were opened each month.

For an extended period, starting in 2022, Bach Hoa Xanh refrained from opening new stores and instead focused on closing underperforming ones. The resumption of store openings is attributed to the rebound in retail performance in the first half of this year.

According to its financial report for the first half of 2024, Bach Hoa Xanh recorded revenue of VND 19,400 billion, a 42% increase compared to the same period last year. Notably, the chain turned a profit for the first time since its launch in 2015, with earnings of nearly VND 7 billion.

This year, Bach Hoa Xanh aims to open 100 new stores, expanding into the Central and Northern regions. Currently, the chain operates more than 1,700 stores.

However, Dien May Xanh, with a similar model to FPT Shop’s electronics stores, had to close 91 stores in the first half of this year, leaving 2,093 outlets. Similarly, The Gioi Di Dong closed 25 phone stores, and An Khang Pharmacy shut down 45 outlets, leaving 481 pharmacies in operation.

Offline Stores Remain Indispensable

Masan Group, a powerhouse in producing and supplying essential food and consumer goods, is also accelerating its store openings, aiming for at least one new store per day.

Businesses continue to invest in traditional stores despite shifts in shopping trends. (Photo: T. Tan)

According to recent information from Nikkei Asia, Ms. Nguyen Thi Phuong, CEO of WinCommerce, which operates the WiN and VinMart+ chains, shared the company’s ambitious goal of reaching 10,000 stores by 2030.

As of the end of June 2024, the WinCommerce system had 3,673 outlets. To achieve the target of 10,000 stores, Masan would need to open approximately 1,000 new stores each year.

In its financial report for the first half of 2024, billionaire Nguyen Dang Quang announced plans to accelerate store openings in the second half. The goal is to open approximately 100 new stores per quarter, equivalent to more than one store per day. Masan is not only focusing on large cities but also expanding into rural areas.

In the second quarter of 2024, WinCommerce recorded revenue of VND 7,844 billion. The company’s success is partly attributed to the recovery in consumer spending, and for the first time since its acquisition by Masan in 2019, the stores turned a profit. This year, 80% of the stores are expected to be profitable.

According to statistics, Vietnam’s retail and service market grew by 10% in 2023, reaching VND 62.3 quadrillion, and is projected to continue growing by nearly 8% annually. Retail remains attractive, even amid economic challenges and restrained consumer spending.

Masan aggressively expands its retail presence, aiming for 10,000 WiN and Vinmart+ stores by 2030. (Photo: H. Hanh)

Notably, while shopping trends have evolved, with consumers shifting from traditional stores to online platforms, market researchers emphasize the enduring importance of offline stores.

Ms. Ngoc Dung, Head of SMB Vietnam at Nielsen IQ, points out that Vietnamese consumers still prefer traditional shopping for fast-moving consumer goods, especially food, beverages, and essential goods, as well as experiential products. The offline shopping channel will undergo a transformation in terms of store models, but it cannot be replaced. Consumers are increasingly opting for smaller supermarkets and convenience stores over large supermarkets.

On the other hand, the online channel primarily caters to personal health and wellness products. Additionally, traditional stores hold a unique advantage that online platforms cannot replicate: they serve as a platform for brands to build their presence and establish themselves in the market. Only when a brand becomes well-known can it succeed in the online space. This dynamic explains why, despite the rise of online shopping, chains continue to invest in traditional stores.

Familiar Chinese Partner Seeking to Acquire Stake in Bach Hoa Xanh, Valued at $1.7 Billion?

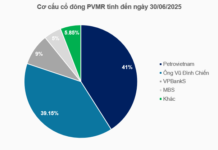

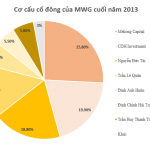

According to Reuters’ report on February 28, 2024, CDH Investments, an asset management company from China, is in talks to acquire a minority stake in the Bach Hoa Xanh chain owned by Mobile World Investment Corporation (HOSE: MWG).