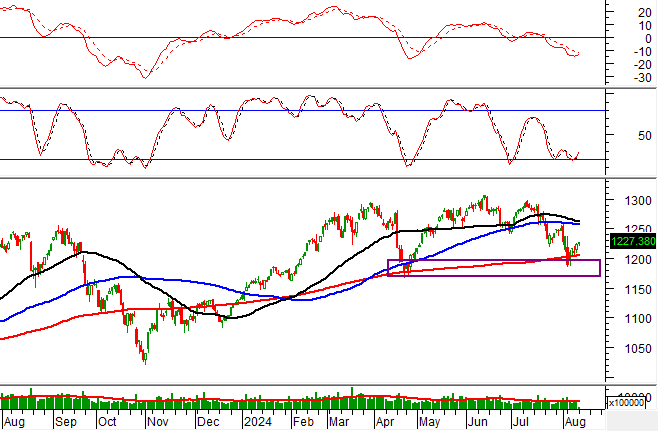

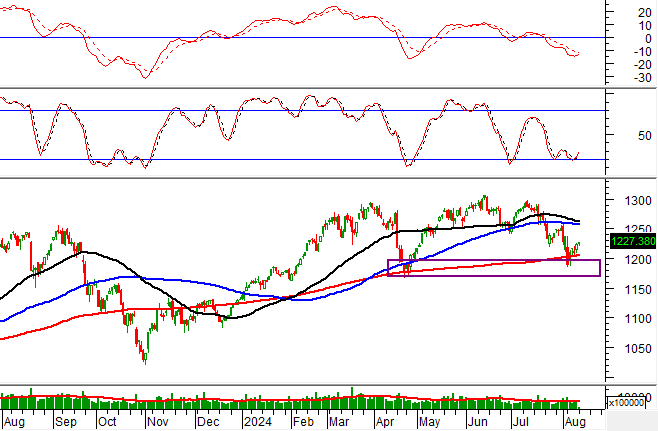

Technical Signals for VN-Index

In the morning trading session of August 12, 2024, the VN-Index witnessed a rise in points, accompanied by a slight increase in trading volume. This indicates that investor sentiment has become less pessimistic.

Currently, the VN-Index is finding good support from the 200-day SMA line, while the Stochastic Oscillator continues to trend upwards after previously giving a buy signal, suggesting that long-term optimism remains intact.

Technical Signals for HNX-Index

On August 12, 2024, the HNX-Index witnessed a price increase, along with a slight decrease in trading volume during the morning session, indicating investor indecision.

Additionally, the HNX-Index is retesting the Fibonacci Projection 23.6% threshold (equivalent to the 221-226 point region) as the MACD indicator narrows its gap with the signal line following a previous sell signal. If a buy signal reappears, the short-term recovery scenario could be back on the table in upcoming sessions.

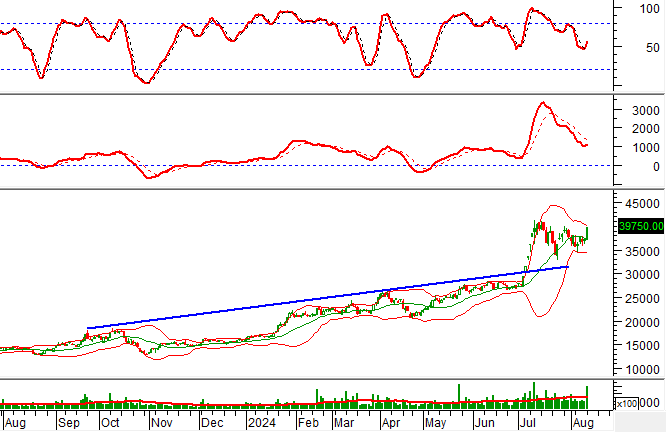

CSV – Southern Basic Chemicals JSC

During the morning session of August 12, 2024, CSV hit the daily limit-up and formed a White Marubozu candlestick pattern, accompanied by above-average trading volume. This indicates active participation from investors.

Furthermore, the stock price surged and broke above the Fibonacci Projection 23.6% threshold (equivalent to the 36,500-38,500 range) as the Stochastic Oscillator generated a buy signal again, reinforcing the bullish momentum in the short term.

HHV – Deo Ca Transport Infrastructure Investment JSC

On the morning of August 12, 2024, HHV witnessed a significant price increase, along with a substantial rise in trading volume, surpassing the average of the last 20 sessions. This reflects the optimism among investors.

Additionally, the stock price broke above the Middle line of the Bollinger Bands as the MACD indicator triggered a buy signal. This suggests that a short-term recovery scenario is likely to unfold in the upcoming sessions.

Analysis by the Technical Analysis Department, Vietstock Consulting