VN-Index Resilient Amid Positive Signals

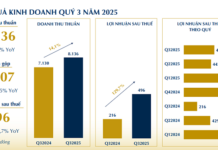

The Q2 2024 financial reporting season concluded with notable results, as the overall market grew by an impressive 14.5%. Following this season’s strong profit growth, coupled with the recent dip in the VN-Index, the VN-Index’s PE now stands at approximately 12.9 times, a relatively low figure compared to the five-year average of 14.74 times. Additionally, the potential for the Fed to cut interest rates in September or, at the latest, December, bodes well for the market, allaying fears related to unfavorable interest rate and exchange rate dynamics.

Vietnam Bank Securities Company (NHSV) also asserts that the market has witnessed a significant decline over the past month. Notably, on August 5, the index dropped by 48.53 points (-3.92%) to 1,188.07 points, marking the second-largest decline for the VN-Index since the beginning of the year, following a nearly -60 point (-4.7%) drop in mid-April. However, the VN-Index has been trading sideways within a large range, from around 1,220 to nearly 1,300 points. The worst-case scenario would be a drop to 1,170 points, but the likelihood of this happening is low. Global and Vietnamese stock markets are currently facing some negative psychological impacts due to the Iran-Israel conflict and a few worrying signs from the US stock market. Nonetheless, these are initial indications that have not yet led to any clear signals of an impending recession.

According to experts from NHSV, while caution is advised, investors can take advantage of these dips to buy. As the factors influencing market sentiment subside, investor sentiment tends to stabilize, and the market recovers. The NHSV specialist emphasizes that, regardless of the conditions, enhancing knowledge about the market and investing is paramount. Investors should stay informed through reliable sources and consider participating in stock investment competitions to gain practical experience.

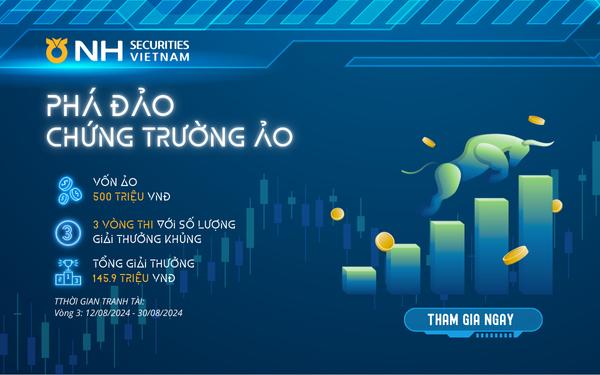

“Conquer the Virtual Stock Market” at NHSV Securities and Win Exciting Prizes

In the context of a volatile market, joining investment competitions, especially virtual ones, is an effective way for investors to hone their skills in a simulated environment. This not only helps build their confidence but also enhances their ability to react swiftly to real-market fluctuations. One notable competition is “Conquer the Virtual Stock Market” hosted by Vietnam Bank Securities Company, offering attractive prizes worth a total of VND 146 million. To participate, investors simply need to open a securities account with NHSV and compete using a virtual account on the NHSV Pro trading application. In each round, participants are provided with a virtual account funded with VND 500 million to trade stocks, mirroring real-market conditions.

“Conquer the Virtual Stock Market” has already completed two successful rounds, each presenting unique challenges and fostering intense competition among investors. In the first two rounds, the champions achieved remarkable returns, with the winner of Round 1 attaining a profit rate of 73%, and the runner-up securing a profit rate of 44.31%. This competition not only serves as a platform for investors to test their mettle in the market but also provides an opportunity to validate their current investment strategies or experiment with new approaches.

The third round will officially commence from August 12 to August 30, 2024. Investors with the highest profit rates on their virtual accounts, as ranked on the leaderboard for each virtual round, will emerge as the winners.

The most enticing aspect of Round 3 is the substantial increase in prize money compared to previous rounds, including a first prize of VND 20,000,000, a second prize of VND 12,000,000, and a third prize of VND 4,000,000. Additionally, there are numerous consolation prizes and “Lucky Investment” awards. The competition boasts a total of 180 prizes worth VND 145,900,000, making it a highly competitive yet captivating event.

Investors can find more information and register here.