The market experienced significant volatility, with a rapid sell-off in the final 30 minutes of continuous matching that saw the VN-Index drop by 7.3 points. However, it quickly rebounded and closed above the reference level. This was caused by a group of large-cap stocks that created a strong ripple effect across the market before bottom-fishers stepped in.

The VN-Index hit its intraday low at 2:13 PM, falling to 1223.01 points, a 0.59% decrease from the reference level. However, within just 17 minutes, the index surged back above the reference level and ended the ATC period with a 0.14-point gain.

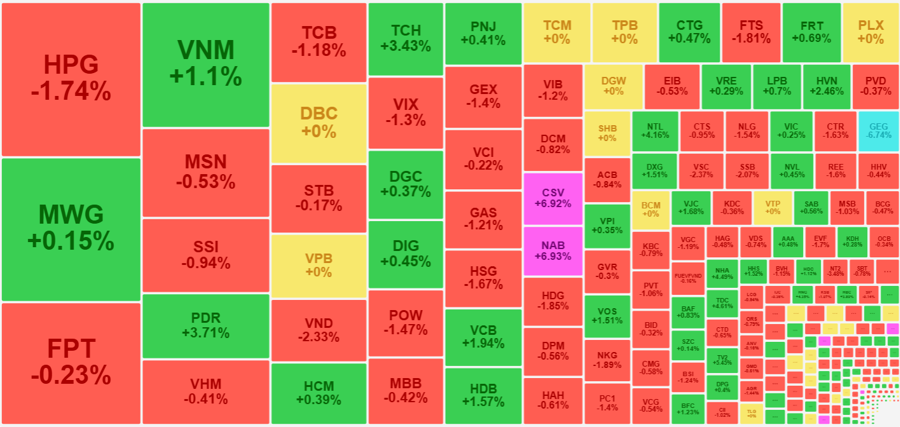

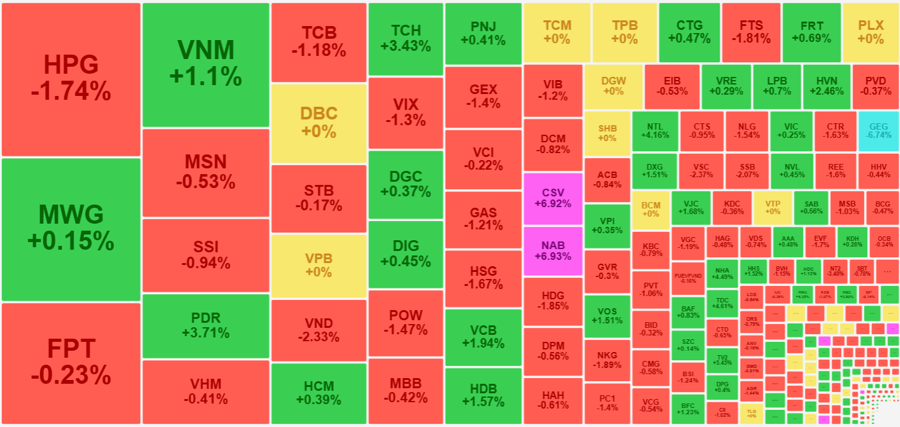

The biggest impact during this brief shakeout was felt by a group of leading blue-chip stocks: VHM tumbled by as much as 1.78% from the reference level before recovering to close 0.41% lower, regaining nearly 1.4%. HPG was pressured to a 2.51% loss but managed to trim its decline to 1.74% by the close. CTG fell by 1.1% before reversing course to end 0.47% higher. FPT also experienced a pullback of around 0.7% during the VN-Index’s downturn, while GAS slipped by 0.9%. MSN touched an intraday low of 1.86% before paring its loss to 0.53%…

This shakeout in leading stocks was evident and caused some panic: The VN-Index recovered to its intraday high at 1:45 PM, with 136 gainers and 266 losers. When it hit its low at 2:13 PM, there were only 111 gainers and 302 losers. At the close, the HoSE had 162 gainers and 234 losers. This change indicates that many stocks plunged along with the VN-Index and then rebounded in tandem with the index’s recovery.

The shakeout did not significantly increase liquidity. The HoSE’s trading value in the afternoon session was only about 16% higher than in the morning and 4% lower than the previous afternoon – when the market also experienced similar volatility. Considering this liquidity level, along with the change in breadth, selling pressure was not substantial. This can be viewed as a positive signal, indicating that stocks recovered relatively easily.

Large-cap stocks played a crucial role in maintaining stability. VCB witnessed minimal fluctuations during the VN-Index’s decline and subsequently led the recovery, contributing over 2.3 points to the index. CTG, after its initial slip, rebounded strongly, closing 0.47% higher, but its intraday recovery reached 1.59%. According to statistics, 14 stocks in the VN30 basket exhibited recovery ranges of more than 1% from their daily lows. The VN30-Index ended the day down 0.21% with 9 gainers and 16 losers.

Mid-cap and small-cap stocks witnessed more substantial rebounds. Approximately 90 stocks on the HoSE recovered by 2% or more from their daily lows, with only 4 stocks from the VN30 basket: HDB, POW, VCB, and VJC contributing to this group. Several small-caps were actively traded and highly volatile, swinging by 7-8% intraday, including DLG, SAV, QCG, NAB, and BMC.

At the close, the HoSE had 63 stocks rising over 1% from the reference level, but their liquidity accounted for only about 17.1% of the total matched volume on the exchange. Aside from a few blue-chips like VNM, VCB, and HDB, most stocks in this group had relatively low liquidity. PDR and TCH stood out in the mid-cap range with trading values exceeding VND 100 billion, while others mostly matched in the tens of billions. HVN, CSV, NAB, VOS, NTL, DXG, BFC, NHA, and TDC were among the stocks with average liquidity and notable price increases.

On the downside, there were also many stocks in terms of quantity and liquidity. Among the 85 stocks that fell by more than 1%, 10 had trading values exceeding VND 100 billion: Blue-chips included HPG, down 1.74%; TCB, down 1.18%; POW, down 1.47%; GAS, down 1.21%; and VIB, down 1.2%. Mid-cap and small-cap stocks with substantial declines were VND, down 2.33%; VIX, down 1.3%; GEX, down 1.4%; HSG, down 1.67%; and FTS, down 1.81%. These stocks faced intense selling pressure, with sell-side volume dominating. The positive sign is that, except for VIB, all the others managed to recover from their intraday lows to varying degrees.