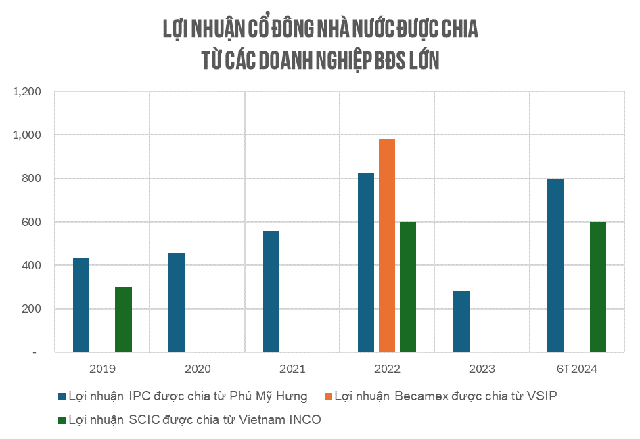

According to SCIC’s report on enterprise governance and organizational structure for the first half of 2024, the company received VND 600 billion in dividends from Vietnam INCO, a consulting and investment company. This is not the first year that SCIC has received dividends from this company.

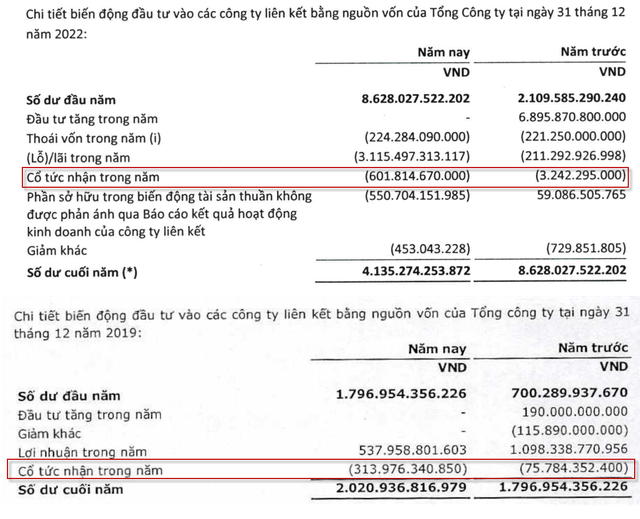

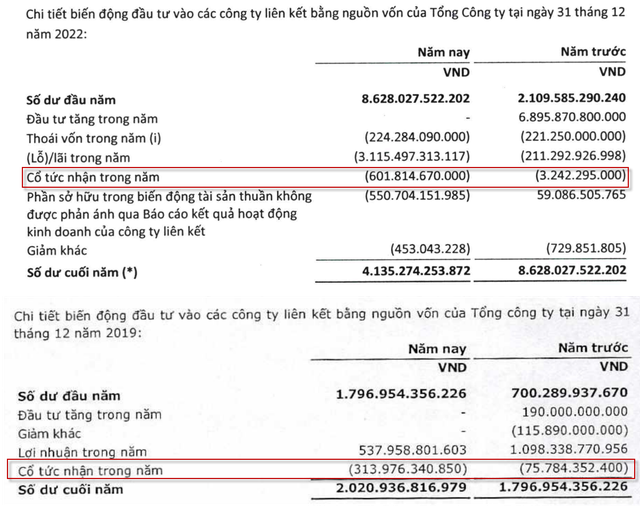

Specifically, in 2019 and 2022, SCIC’s reports showed that they received VND 314 billion and VND 602 billion in dividends, respectively, from affiliated companies, using the corporation’s own capital. Among the affiliated companies directly invested by SCIC (excluding companies that received capital transfer from the state), only Vietnam INCO has significant profits and is able to pay large dividends.

Thus, the dividend item in 2019 and 2022 from affiliated companies using SCIC’s capital is mostly from Vietnam INCO. Adding the amount in the first half of 2024, it is estimated that Vietnam INCO has paid a total of VND 1,500 billion in dividends to SCIC.

Not only SCIC, but a series of state-owned enterprises also received large dividends from real estate companies. For example, MWV Tan Thuan Industrial Development Co., Ltd. (IPC) has received hundreds of billions of VND in profit sharing from Phu My Hung. According to our calculations, since 2019, IPC has received a total of more than VND 3,300 billion in dividends from Phu My Hung.

Another case worth mentioning is Becamex IDC, which received VND 980 billion from VSIP joint venture in 2022.

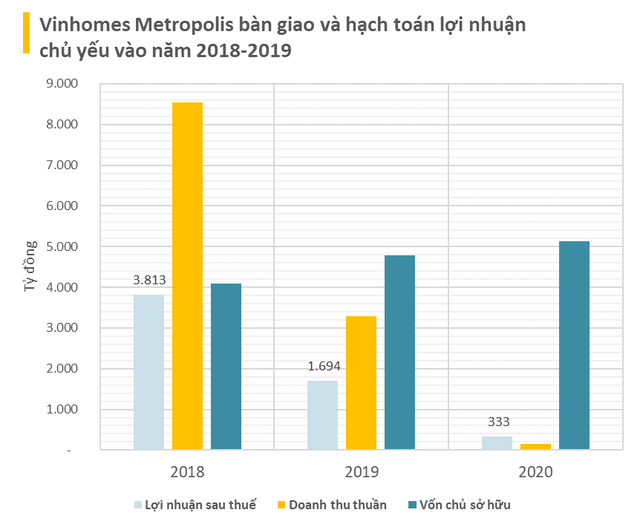

Currently, SCIC holds 30% of Vietnam INCO’s capital. Thus, the total amount that this enterprise paid out in 2024 amounts to VND 2,000 billion – 33 times higher than its charter capital of VND 60 billion. In 2019 and 2022, if we calculate based on the amount SCIC received, Vietnam INCO paid out approximately VND 1,050 billion and VND 2,000 billion, respectively. Therefore, the total amount that the investor of Vinhomes Metropolis project has paid out in dividends over the years is about VND 5,000 billion, equal to the owner’s equity in 2020.

With 30% of Vietnam INCO’s capital, SCIC’s capital contribution to this enterprise is only “meager” VND 18 billion, but it has received VND 1,500 billion in dividends, 83 times the initial amount.

Regarding the business performance of Vietnam INCO, the company delivered apartments in the period of 2018-2019. Therefore, these two years also witnessed the company’s profits in the thousands of billions of VND.

The reason SCIC holds 30% of Vietnam INCO’s capital is that initially, this unit was assigned to manage a 3.5-hectare land lot at 29 Lieu Giai, Ba Dinh District, after taking over from the Russian Embassy.

After that, the Hanoi People’s Committee assigned the land lot to Vietnam INCO to implement the project and requested Vietnam INCO to coordinate with SCIC to determine the value of the State’s capital contribution owned by SCIC in this project.