Starting as a mobile phone-related sales and repair business 20 years ago, The Gioi Di Dong (MWG) has become a retail “giant” with thousands of stores nationwide. Leading in ICT&CE, Nguyen Duc Tai’s retail business is also aiming for the same with Bach Hoa Xanh (BHX) and the ambition to “go global” with EraBlue.

Anticipating billions in profits with the grocery chain

BHX was established in 2015 during MWG’s search for new growth drivers as the ICT&CE retail market showed signs of saturation. After eight years of waiting, MWG’s “darling” turned a profit for the first time in the second quarter. Net profit was about VND 7 billion, a small number but a positive sign that this strategic move is heading in the right direction.

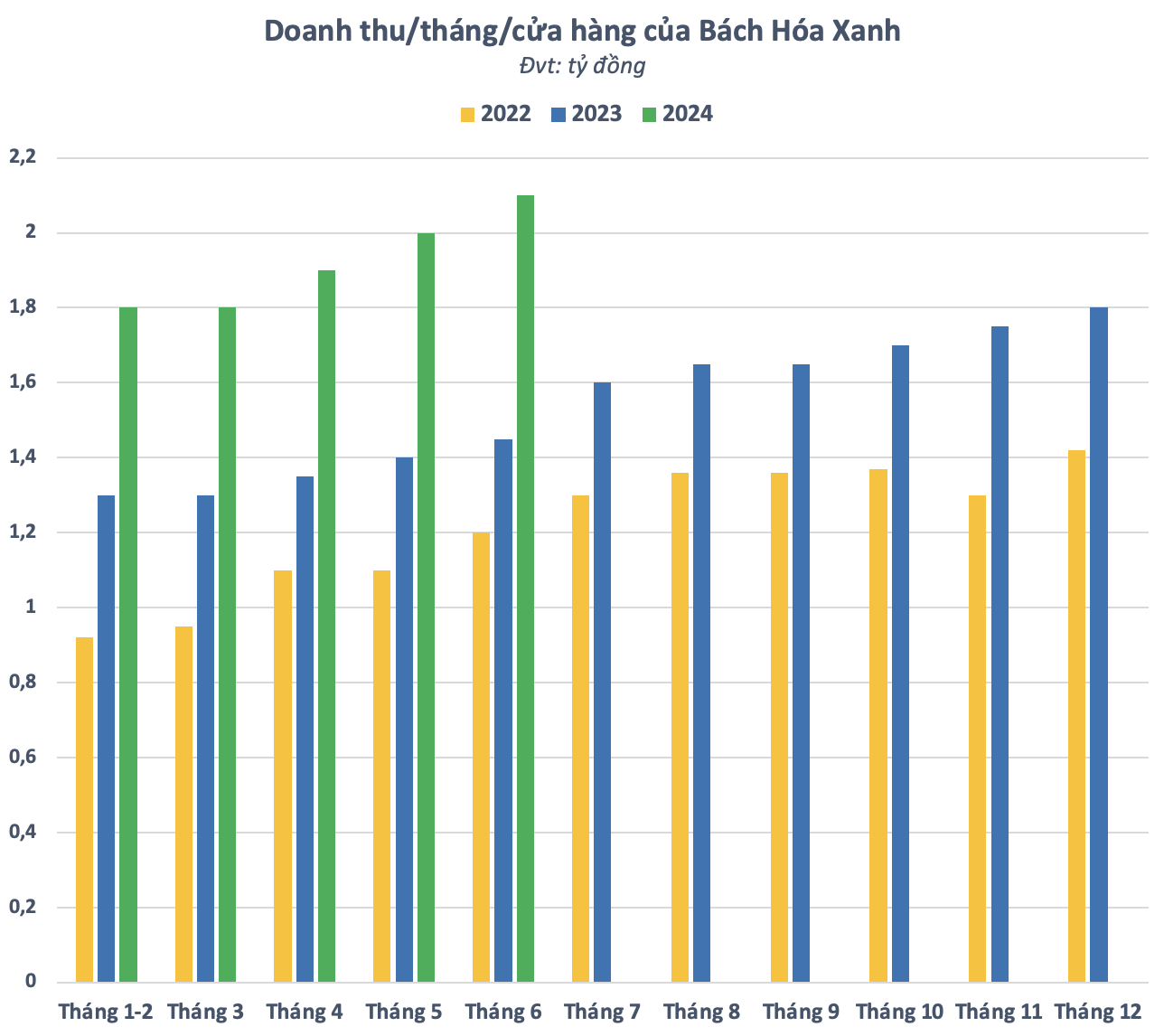

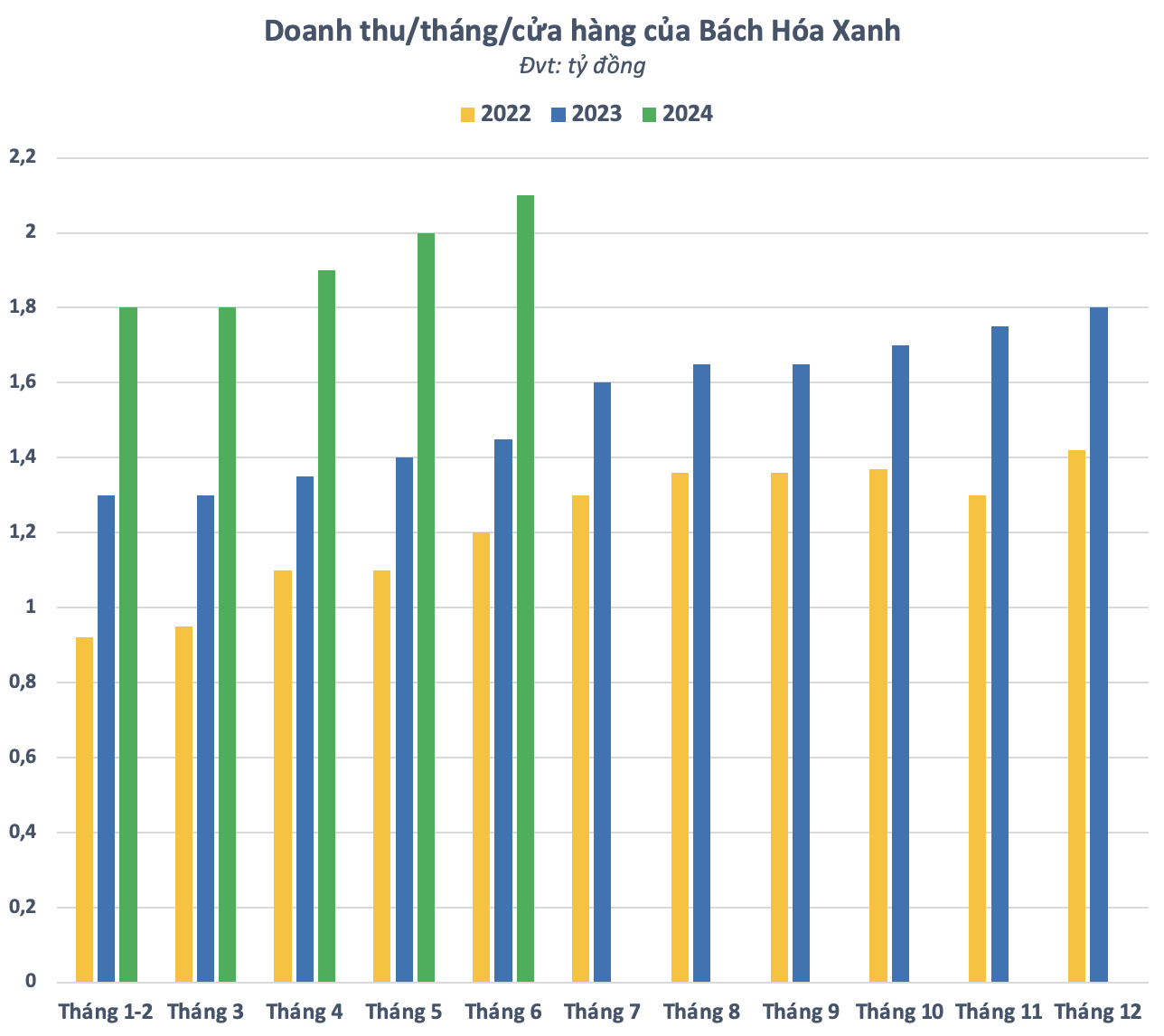

Over the years, although it has not made a profit, this MWG grocery chain has recorded very high and promising revenue growth. In June 2024, Bach Hoa Xanh’s revenue exceeded VND 3,600 billion, the highest in three years. Notably, the average revenue reached VND 2.1 billion/store/month, the highest ever, equivalent to the period of July 2021 when revenue surged due to the Covid pandemic’s essential goods demand.

Bach Hoa Xanh’s management said that the chain had a strategy from the beginning of the year to grow revenue and focus on cost optimization, including two major areas: store operating costs and logistics operating costs. Although consumer spending is assessed as not increasing or increasing weakly, the advantage of the grocery chain is the continuing trend of shifting from traditional to modern channels.

According to FPTS’s assessment, compared to other mini-supermarket chains (WinMart+, Satrafoods, Co.op Food), Bach Hoa Xanh’s product portfolio is more diverse in both fresh and fast-moving consumer goods (FMCG). This competitive advantage helps Bach Hoa Xanh attract new customers and increase the purchase frequency of existing customers. In addition, fresh produce also plays a leading role in channeling customers to buy more FMCG products with higher gross margins.

FPTS believes that Bach Hoa Xanh is oriented to open dense instead of wide to optimize the operating capacity of the distribution center. The projection is that MWG’s food retail chain will increase the number of stores to 1,740 by the end of 2024, before opening 100 new stores/year in the 2025-2029 period. Average revenue/store can reach VND 2.65 billion/month in 2029.

Bringing the successful model in Vietnam to Indonesia

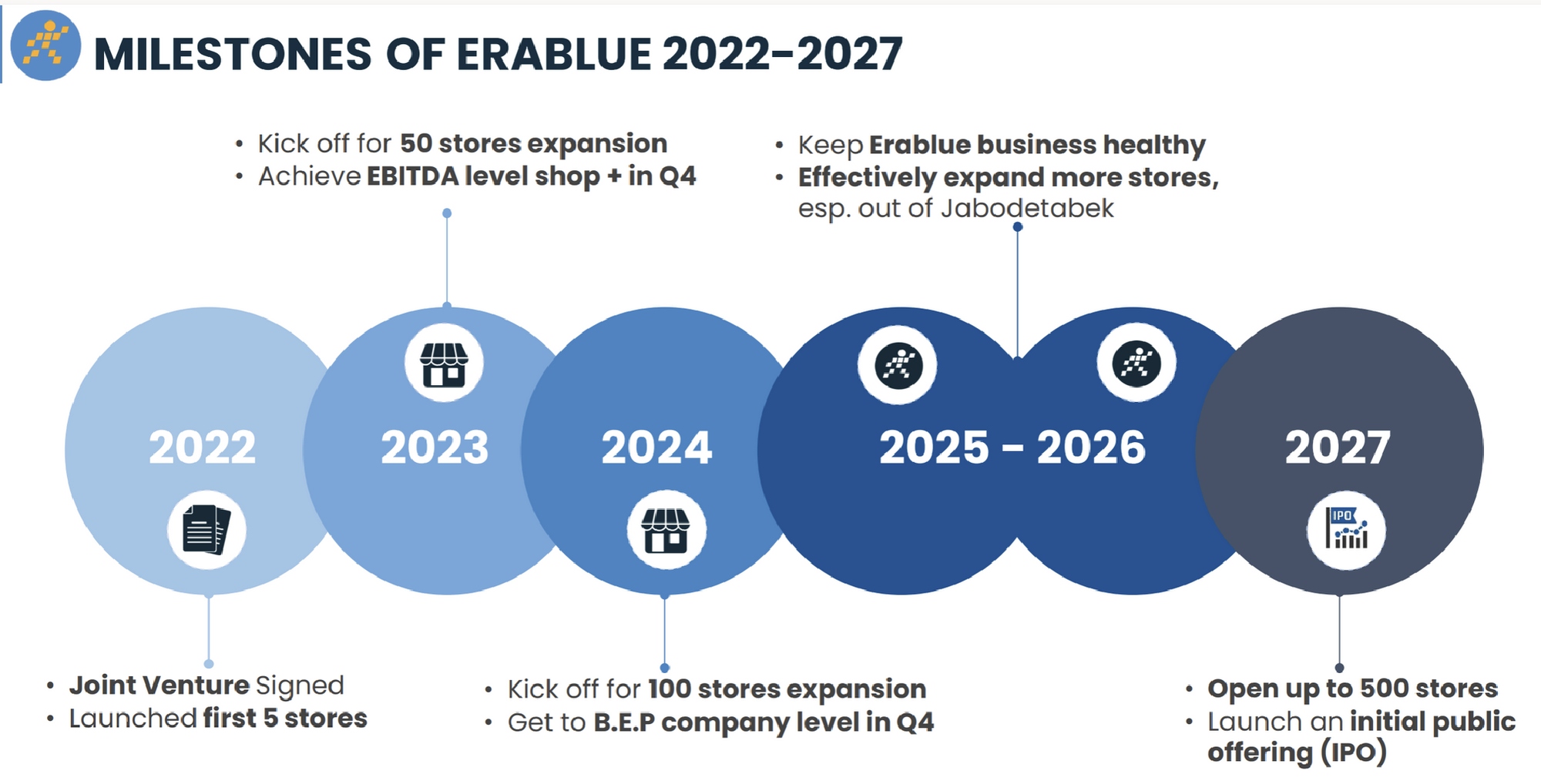

EraBlue is another direction of MWG to realize its “go global” ambition, starting by applying the Dien May Xanh (DMX) model, which has succeeded in Vietnam, in Indonesia. Just two years after its appearance, EraBlue has become the largest modern retail chain in the “archipelago” country. There are many reasons why the MWG management has high confidence in EraBlue’s future.

First, the electronics and appliance retail market in Indonesia is still fragmented, with the largest retail chain having only about 60 stores, while the demand is very high.

Second, although Indonesia has similar traffic conditions to Vietnam, with customers mainly moving by motorbike, all modern retail chains are located in shopping centers. In contrast, the EraBlue model is quite friendly, located on busy traffic roads, making it convenient for customers to identify and easily access the stores everywhere.

Third, delivery and installation services for electronic appliances are quite rudimentary. It takes 7-10 days to buy a washing machine, while EraBlue’s service takes only four hours. The culture of serving and dedication, MWG’s strength, applied to EraBlue, has won the hearts of Indonesian customers.

Finally but no less important is the price. Although the service quality is equivalent to the modern model, EraBlue’s price is only equivalent to the traditional model.

As of July 2024, the chain had 65 stores in the satellite areas of the capital, Jakarta, including 37 mini-size stores (size M, area of about 280 – 320m2) and 28 Supermini-size stores (size S, area of 180 – 220m2). Notably, EraBlue stores’ revenue (VND 4 billion/month for size M and VND 2.2 billion/month for size S) is almost double that of a DMX store of the same size in Vietnam.

At the beginning of August, the two sides in the EraBlue joint venture between MWG and Erajaya met with the goal of aiming for new milestones. Accordingly, the two sides agreed on the target of making a profit at the company level before the fourth quarter of 2024, and the increasingly clear signals from the business results are the basis for promoting the process of strongly expanding EraBlue this year and in the following years.

Promising to become a “blockbuster” IPO

Making a profit at the company level will be a stepping stone for EraBlue to expand its system. The number of stores is expected to increase to nearly 100 by the end of 2024 and 500 by 2027. Thus, on average, in the period from 2025 – 2027, at least ten EraBlue stores will be inaugurated each month. When reaching the target of 500 stores, both sides do not rule out the possibility of an IPO and listing on the Indonesian stock exchange after 2027.

Regarding Bach Hoa Xanh, Nguyen Duc Tai shared that this chain of stores would develop to a large enough scale and be listed on the stock exchange as committed to investors and the expectations of shareholders. “When the scale is large enough, the figure of billions of profits will emerge, which is when BHX will be ready to go public,” emphasized the Chairman of MWG.

Bach Hoa Xanh’s CEO, Pham Van Trong, also confidently said that he believes that in one or two years, a four-digit profit (billions of profits) is feasible. If the company’s “timing” is accurate, the time when Bach Hoa Xanh IPOs and goes public will likely fall in 2027. When these two “blockbusters” may create a strong re-rating activity for MWG.

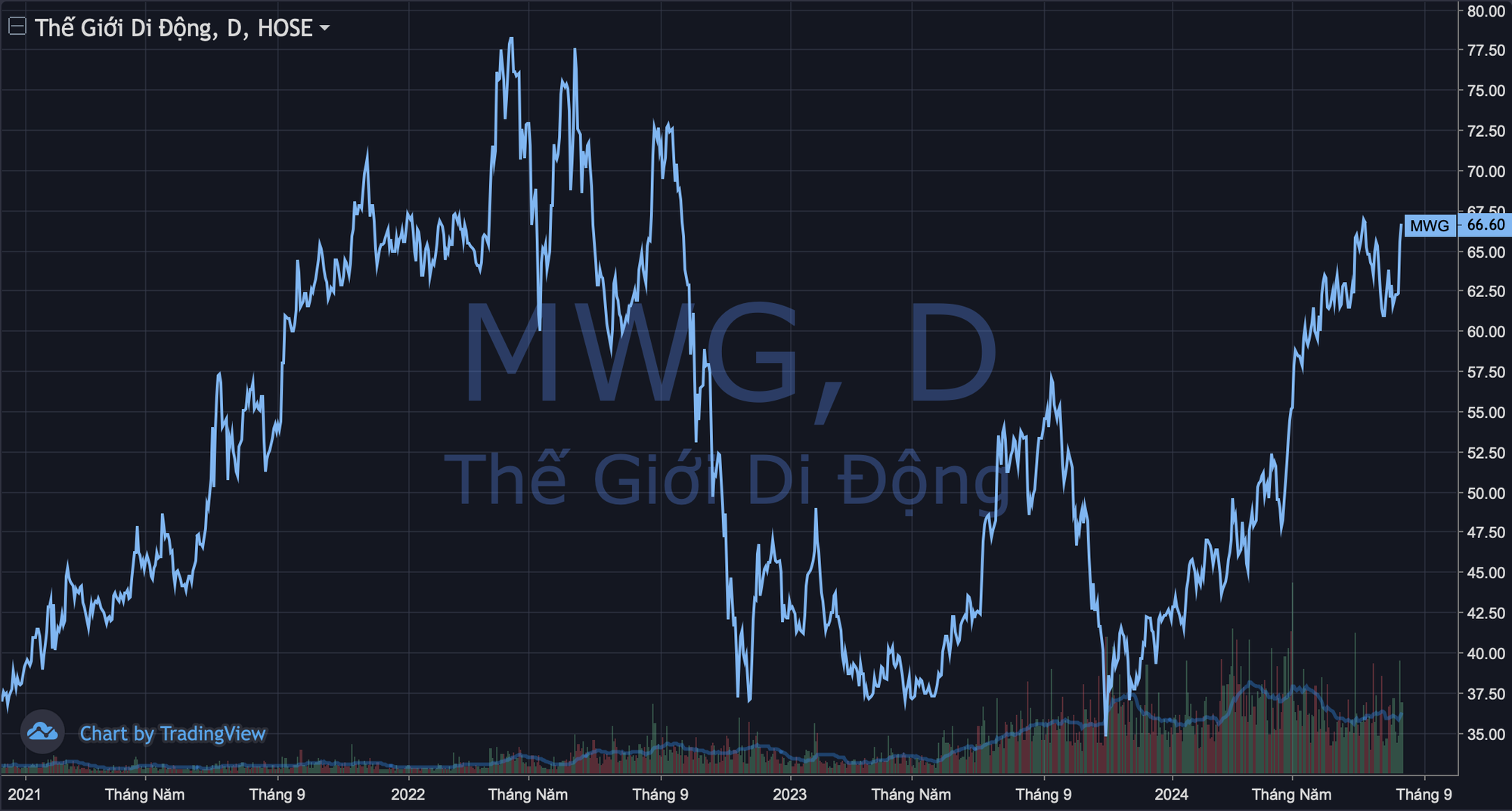

With much supportive information, MWG’s stock on the market has recovered strongly with an upward trend almost preserved throughout the past nine months. The retail stock is currently trading at VND 66,600/share, a 22-month high. The market capitalization corresponds to more than VND 97,000 billion (~USD 4 billion), up 57% from the beginning of the year but still lower than about 15% compared to the peak in mid-April 2022.